Music royalties platforms offer investors the opportunity to earn passive income by purchasing rights to songs, often providing steady cash flow linked to the music's performance across streaming, radio, and licensing. Real estate crowdfunding enables fractional ownership in property projects, combining asset appreciation potential with income from rental yields, accessible through online investment platforms. Explore the unique advantages and risks of both investment types to determine which aligns best with your financial goals.

Why it is important

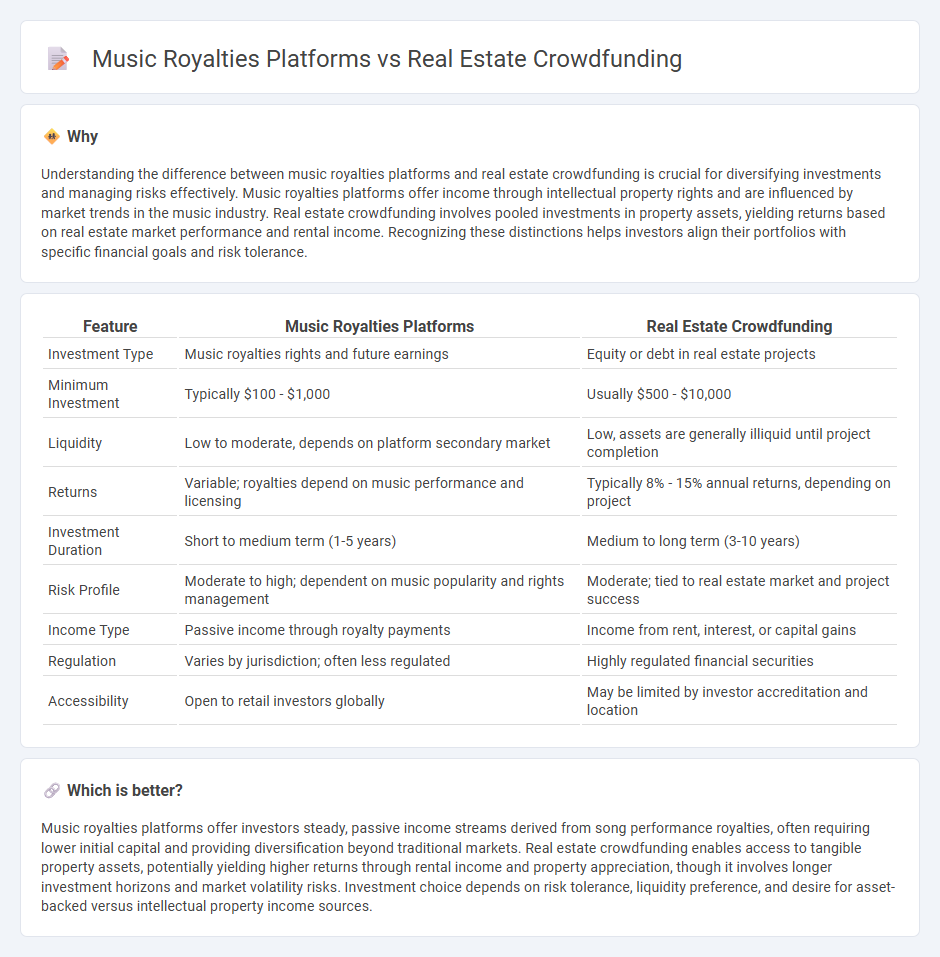

Understanding the difference between music royalties platforms and real estate crowdfunding is crucial for diversifying investments and managing risks effectively. Music royalties platforms offer income through intellectual property rights and are influenced by market trends in the music industry. Real estate crowdfunding involves pooled investments in property assets, yielding returns based on real estate market performance and rental income. Recognizing these distinctions helps investors align their portfolios with specific financial goals and risk tolerance.

Comparison Table

| Feature | Music Royalties Platforms | Real Estate Crowdfunding |

|---|---|---|

| Investment Type | Music royalties rights and future earnings | Equity or debt in real estate projects |

| Minimum Investment | Typically $100 - $1,000 | Usually $500 - $10,000 |

| Liquidity | Low to moderate, depends on platform secondary market | Low, assets are generally illiquid until project completion |

| Returns | Variable; royalties depend on music performance and licensing | Typically 8% - 15% annual returns, depending on project |

| Investment Duration | Short to medium term (1-5 years) | Medium to long term (3-10 years) |

| Risk Profile | Moderate to high; dependent on music popularity and rights management | Moderate; tied to real estate market and project success |

| Income Type | Passive income through royalty payments | Income from rent, interest, or capital gains |

| Regulation | Varies by jurisdiction; often less regulated | Highly regulated financial securities |

| Accessibility | Open to retail investors globally | May be limited by investor accreditation and location |

Which is better?

Music royalties platforms offer investors steady, passive income streams derived from song performance royalties, often requiring lower initial capital and providing diversification beyond traditional markets. Real estate crowdfunding enables access to tangible property assets, potentially yielding higher returns through rental income and property appreciation, though it involves longer investment horizons and market volatility risks. Investment choice depends on risk tolerance, liquidity preference, and desire for asset-backed versus intellectual property income sources.

Connection

Music royalties platforms and real estate crowdfunding both leverage digital investment models to democratize access to traditionally exclusive asset classes. These platforms utilize blockchain and smart contract technologies to enhance transparency, secure transactions, and enable fractional ownership, attracting diverse investors seeking alternative income streams. By offering predictable cash flows from music royalties and property rents, they provide complementary passive income opportunities within diversified investment portfolios.

Key Terms

**Real Estate Crowdfunding:**

Real estate crowdfunding platforms allow investors to pool funds and invest in diverse property projects, offering access to commercial and residential real estate with lower capital requirements compared to traditional methods. These platforms typically provide detailed property analysis, projected returns, and risk assessments to help investors make informed decisions. Explore how real estate crowdfunding can diversify your portfolio and generate passive income.

Equity Shares

Real estate crowdfunding platforms offer investors equity shares in property ventures, enabling partial ownership and potential rental income or capital gains. Music royalty platforms provide equity shares in artists' future earnings, allowing investors to benefit from streaming revenue and licensing fees. Explore more about how equity shares function in these innovative investment avenues.

Property Appreciation

Real estate crowdfunding platforms offer investors the potential for property appreciation by pooling resources to invest in diverse real estate assets, which can increase in value over time. In contrast, music royalties platforms generate returns based on the ongoing income from song performance and licensing rather than asset value growth. Explore how these investment models compare to identify opportunities that match your financial goals.

Source and External Links

Crowdfunding real estate: What to know - Real estate crowdfunding allows investors to pool money online to buy shares in residential or commercial properties they couldn't afford individually, offering a way to diversify portfolios with less effort than traditional real estate investing.

Crowdfunding - Crowdfunding is a method where investors collectively fund real estate projects through online platforms, earning passive income without the responsibilities of direct property management.

Arrived | Easily Invest in Real Estate - Arrived is a platform that lets investors start investing in pre-vetted rental properties for as little as $100, with the platform handling property management so investors can earn rental income and potential appreciation passively.

dowidth.com

dowidth.com