Crypto staking offers higher potential returns by earning rewards through validating blockchain transactions, compared to traditional savings accounts that provide fixed interest rates with lower risk. While savings accounts guarantee principal protection and liquidity insured by institutions, crypto staking involves market volatility and platform security considerations. Explore the nuances of crypto staking and savings accounts to optimize your investment strategy.

Why it is important

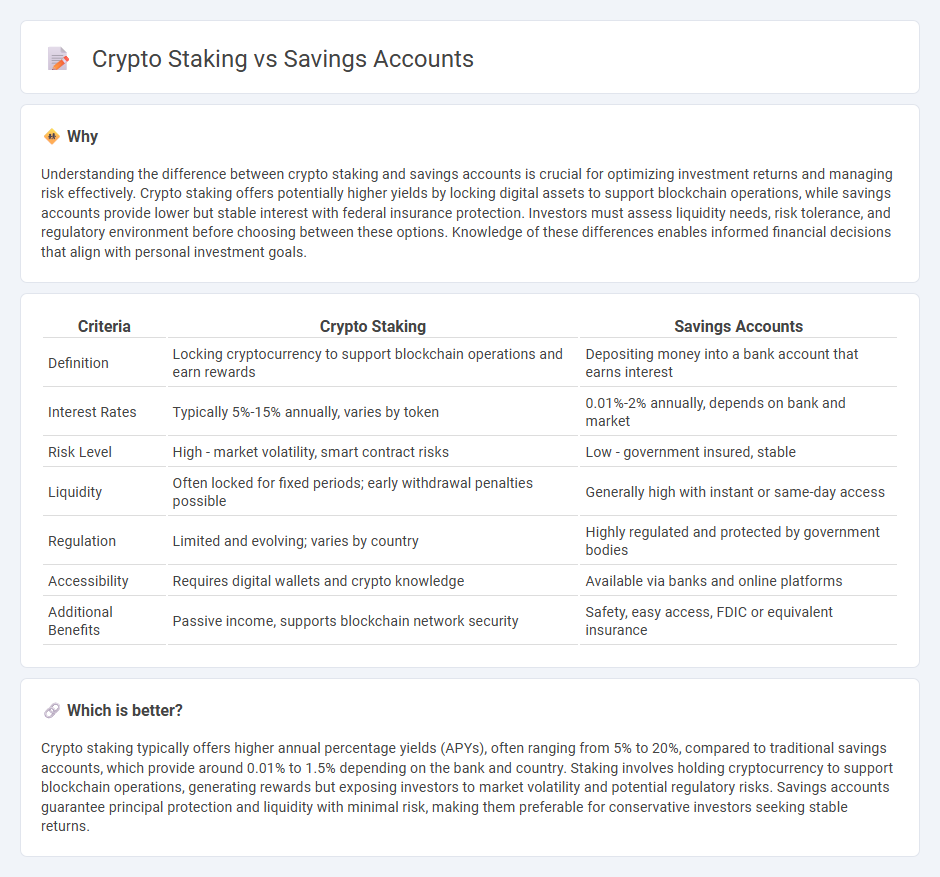

Understanding the difference between crypto staking and savings accounts is crucial for optimizing investment returns and managing risk effectively. Crypto staking offers potentially higher yields by locking digital assets to support blockchain operations, while savings accounts provide lower but stable interest with federal insurance protection. Investors must assess liquidity needs, risk tolerance, and regulatory environment before choosing between these options. Knowledge of these differences enables informed financial decisions that align with personal investment goals.

Comparison Table

| Criteria | Crypto Staking | Savings Accounts |

|---|---|---|

| Definition | Locking cryptocurrency to support blockchain operations and earn rewards | Depositing money into a bank account that earns interest |

| Interest Rates | Typically 5%-15% annually, varies by token | 0.01%-2% annually, depends on bank and market |

| Risk Level | High - market volatility, smart contract risks | Low - government insured, stable |

| Liquidity | Often locked for fixed periods; early withdrawal penalties possible | Generally high with instant or same-day access |

| Regulation | Limited and evolving; varies by country | Highly regulated and protected by government bodies |

| Accessibility | Requires digital wallets and crypto knowledge | Available via banks and online platforms |

| Additional Benefits | Passive income, supports blockchain network security | Safety, easy access, FDIC or equivalent insurance |

Which is better?

Crypto staking typically offers higher annual percentage yields (APYs), often ranging from 5% to 20%, compared to traditional savings accounts, which provide around 0.01% to 1.5% depending on the bank and country. Staking involves holding cryptocurrency to support blockchain operations, generating rewards but exposing investors to market volatility and potential regulatory risks. Savings accounts guarantee principal protection and liquidity with minimal risk, making them preferable for conservative investors seeking stable returns.

Connection

Crypto staking and savings accounts both generate passive income by allowing users to earn interest on their held assets. Staking involves locking cryptocurrency in a blockchain network to support operations, receiving rewards akin to interest in savings accounts. Both methods offer opportunities for portfolio growth through compounding returns, blending traditional financial principles with blockchain technology.

Key Terms

Interest Rate

Savings accounts typically offer fixed interest rates ranging from 0.01% to 2% annually, providing a low-risk return backed by federal insurance like FDIC protection. Crypto staking yields vary widely, often between 5% and 20% APY, depending on the blockchain network and token, but carry higher volatility and risk due to market fluctuations. Explore detailed comparisons and risk assessments to determine the best strategy for maximizing your interest income.

Risk Level

Savings accounts offer low risk with government-backed insurance such as FDIC protection, ensuring principal safety and steady interest income. Crypto staking involves higher risk due to market volatility, potential loss of staked assets, and unregulated platforms, but can yield significantly higher returns. Explore the detailed risk comparisons between savings accounts and crypto staking to make informed financial decisions.

Liquidity

Savings accounts offer high liquidity with instant access to funds and minimal withdrawal restrictions, making them ideal for emergency savings. Crypto staking often involves lock-up periods ranging from days to months, reducing liquidity but potentially providing higher yields. Explore the comparative benefits and risks of liquidity in these options to make informed financial decisions.

Source and External Links

Savings Accounts - View our best rates | Open online - U.S. Bank - U.S. Bank offers up to 3.50% APY on savings accounts with a minimum $25 opening deposit and a $5 monthly maintenance fee, with higher rates requiring a large qualifying balance or a new/existing Elite Money Market Account with at least $50,000 deposited.

6 Best Savings Accounts of July 2025: Up to 4.66% - NerdWallet - NerdWallet lists several high-yield savings accounts with APYs ranging from 3.65% to 4.66%, including options with no minimum opening deposit and FDIC insurance.

Open a Savings Account Online | Wells Fargo - Wells Fargo provides interest-bearing savings accounts and CDs, allowing online account opening for adults with a U.S. address, SSN/ITIN, and mobile number, with joint accounts available in-branch.

dowidth.com

dowidth.com