Livestock investment platforms offer opportunities to invest in animal agriculture, focusing on cattle, poultry, and other farm animals, providing investors with exposure to meat, dairy, and egg production markets. Farmland investment platforms allow individuals to invest in agricultural land, benefiting from crop production, land appreciation, and rental income, often appealing to those seeking long-term asset growth and diversification. Explore the differences between these platforms to determine which aligns best with your investment goals.

Why it is important

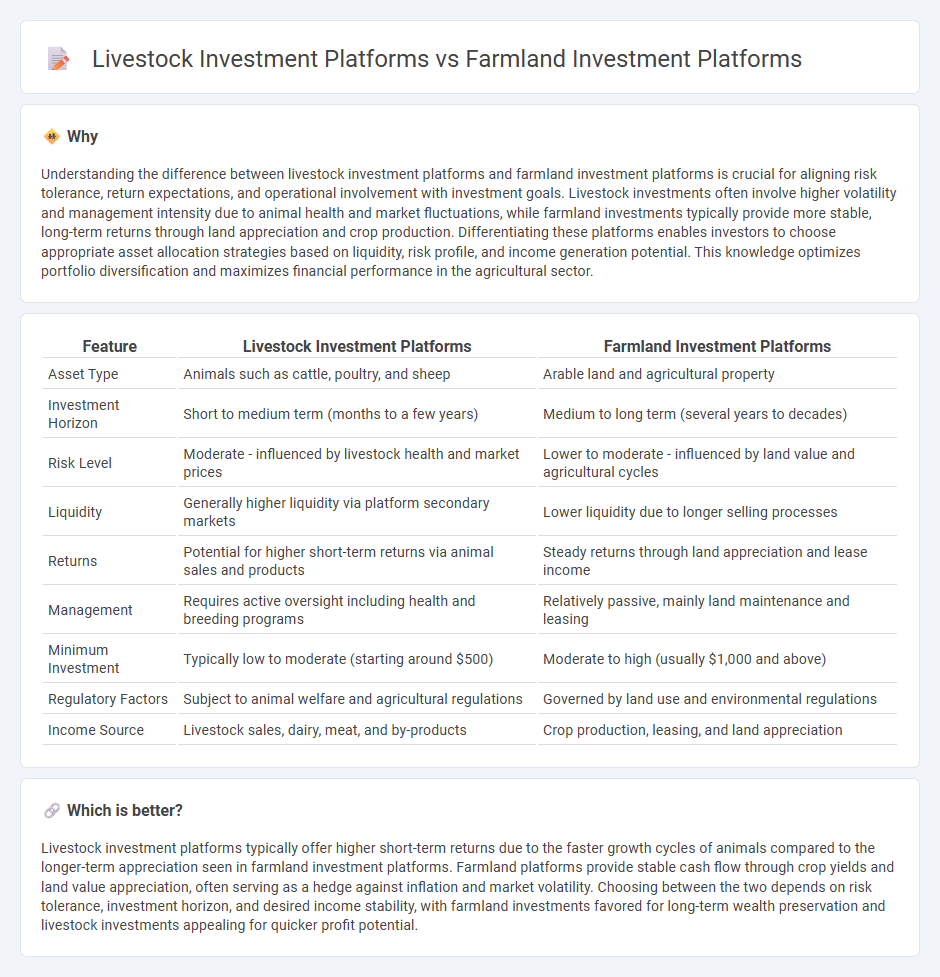

Understanding the difference between livestock investment platforms and farmland investment platforms is crucial for aligning risk tolerance, return expectations, and operational involvement with investment goals. Livestock investments often involve higher volatility and management intensity due to animal health and market fluctuations, while farmland investments typically provide more stable, long-term returns through land appreciation and crop production. Differentiating these platforms enables investors to choose appropriate asset allocation strategies based on liquidity, risk profile, and income generation potential. This knowledge optimizes portfolio diversification and maximizes financial performance in the agricultural sector.

Comparison Table

| Feature | Livestock Investment Platforms | Farmland Investment Platforms |

|---|---|---|

| Asset Type | Animals such as cattle, poultry, and sheep | Arable land and agricultural property |

| Investment Horizon | Short to medium term (months to a few years) | Medium to long term (several years to decades) |

| Risk Level | Moderate - influenced by livestock health and market prices | Lower to moderate - influenced by land value and agricultural cycles |

| Liquidity | Generally higher liquidity via platform secondary markets | Lower liquidity due to longer selling processes |

| Returns | Potential for higher short-term returns via animal sales and products | Steady returns through land appreciation and lease income |

| Management | Requires active oversight including health and breeding programs | Relatively passive, mainly land maintenance and leasing |

| Minimum Investment | Typically low to moderate (starting around $500) | Moderate to high (usually $1,000 and above) |

| Regulatory Factors | Subject to animal welfare and agricultural regulations | Governed by land use and environmental regulations |

| Income Source | Livestock sales, dairy, meat, and by-products | Crop production, leasing, and land appreciation |

Which is better?

Livestock investment platforms typically offer higher short-term returns due to the faster growth cycles of animals compared to the longer-term appreciation seen in farmland investment platforms. Farmland platforms provide stable cash flow through crop yields and land value appreciation, often serving as a hedge against inflation and market volatility. Choosing between the two depends on risk tolerance, investment horizon, and desired income stability, with farmland investments favored for long-term wealth preservation and livestock investments appealing for quicker profit potential.

Connection

Livestock investment platforms and farmland investment platforms are interconnected through their shared reliance on agricultural assets that generate steady income streams. Both platforms leverage the value of natural resources--livestock and arable land--allowing investors to capitalize on rising global food demand and sustainable farming practices. The synergy between these platforms enhances portfolio diversification by combining the growth potential of animal agriculture with the long-term appreciation of farmland.

Key Terms

Asset Type (Crops vs. Animals)

Farmland investment platforms primarily focus on crop production assets such as wheat, corn, and soybeans, offering investors exposure to agricultural land and seasonal harvest yields. Livestock investment platforms specialize in animal assets including cattle, poultry, and sheep, providing opportunities tied to animal husbandry and meat production cycles. Explore detailed comparisons and performance metrics to determine which asset type aligns best with your investment goals.

Yield Measurement (Harvest vs. Weight Gain/Breeding)

Farmland investment platforms primarily measure yield through crop harvest volume and quality, directly correlating with market prices and seasonal outputs, whereas livestock investment platforms focus on weight gain, breeding success rates, and animal health metrics as key indicators of profitability. Crop yield data often uses satellite imagery and sensor technology for precision agriculture insights, while livestock investments rely on biometric tracking and veterinary assessments to evaluate growth and reproductive efficiency. Explore how these distinct yield measurement approaches impact investment strategies and risk management in agricultural finance.

Risk Factors (Weather/Climate vs. Disease/Biosecurity)

Farmland investment platforms primarily face risks related to weather variability and climate change, which can impact crop yields and land value through droughts, floods, and temperature extremes. Livestock investment platforms contend with disease outbreaks and biosecurity challenges, including infections like avian influenza or foot-and-mouth disease that can decimate herds and disrupt supply chains. Explore these critical differences to make informed decisions in agricultural investments.

Source and External Links

Here Are 5 Interesting Farmland Investing Platforms For 2025 - Comparing platforms like AcreTrader and FarmTogether, which offer accessible farmland crowdfunding for accredited investors, plus Steward for regenerative agriculture loans open to all investors, and highlighting minimum investments and fee structures for each.

FarmFundr | Agriculture Crowdfunding Investment Farms - A farmer-owned, equity crowdfunding platform focused on U.S. specialty crops, offering fractional ownership with active farm management and annual profit distributions to investors.

Farmland Investing - Gold Leaf Farming - Explains both farmland REITs (publicly traded, liquid) and ag crowdfunding platforms (direct farm selection, less liquid), illustrating portfolio strategies for cash flow or appreciation-focused investors.

dowidth.com

dowidth.com