Watch investment communities focus on passionate collectors and enthusiasts leveraging market knowledge to trade and appreciate luxury timepieces, emphasizing authenticity and rarity. Private equity firms approach watch investments with a strategic financial perspective, targeting portfolio diversification and long-term capital gains through acquisitions and brand partnerships. Discover how these distinct approaches shape the world of watch investing and which strategy suits your portfolio best.

Why it is important

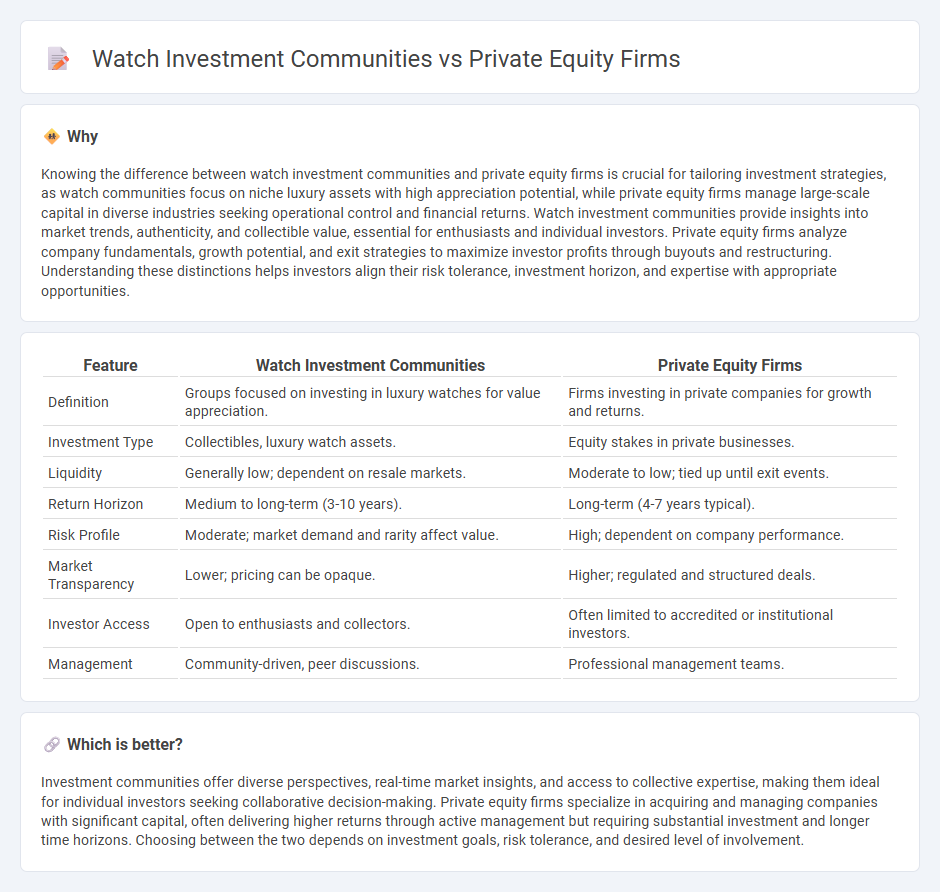

Knowing the difference between watch investment communities and private equity firms is crucial for tailoring investment strategies, as watch communities focus on niche luxury assets with high appreciation potential, while private equity firms manage large-scale capital in diverse industries seeking operational control and financial returns. Watch investment communities provide insights into market trends, authenticity, and collectible value, essential for enthusiasts and individual investors. Private equity firms analyze company fundamentals, growth potential, and exit strategies to maximize investor profits through buyouts and restructuring. Understanding these distinctions helps investors align their risk tolerance, investment horizon, and expertise with appropriate opportunities.

Comparison Table

| Feature | Watch Investment Communities | Private Equity Firms |

|---|---|---|

| Definition | Groups focused on investing in luxury watches for value appreciation. | Firms investing in private companies for growth and returns. |

| Investment Type | Collectibles, luxury watch assets. | Equity stakes in private businesses. |

| Liquidity | Generally low; dependent on resale markets. | Moderate to low; tied up until exit events. |

| Return Horizon | Medium to long-term (3-10 years). | Long-term (4-7 years typical). |

| Risk Profile | Moderate; market demand and rarity affect value. | High; dependent on company performance. |

| Market Transparency | Lower; pricing can be opaque. | Higher; regulated and structured deals. |

| Investor Access | Open to enthusiasts and collectors. | Often limited to accredited or institutional investors. |

| Management | Community-driven, peer discussions. | Professional management teams. |

Which is better?

Investment communities offer diverse perspectives, real-time market insights, and access to collective expertise, making them ideal for individual investors seeking collaborative decision-making. Private equity firms specialize in acquiring and managing companies with significant capital, often delivering higher returns through active management but requiring substantial investment and longer time horizons. Choosing between the two depends on investment goals, risk tolerance, and desired level of involvement.

Connection

Investment communities and private equity firms are closely connected as private equity firms rely on investment communities to source capital and identify promising opportunities. Investment communities provide a network of individual and institutional investors who contribute funds that private equity firms deploy into portfolio companies. This symbiotic relationship enhances deal flow, funding capabilities, and value creation for both investors and private equity firms.

Key Terms

Private Equity Firms:

Private equity firms specialize in acquiring significant stakes in private companies, driving growth through strategic management improvements and operational efficiencies to enhance value before exit. These firms typically raise capital from institutional investors and high-net-worth individuals, focusing on long-term investments across sectors such as technology, healthcare, and manufacturing. Discover more about how private equity firms influence market dynamics and investment strategies.

Leveraged Buyout (LBO)

Private equity firms specialize in leveraged buyouts (LBOs) by acquiring companies using significant debt to enhance returns, leveraging operational improvements and strategic management. Watch investment communities focus on monitoring LBO trends, analyzing market shifts, and sharing insights on successful exits to guide investment decisions. Explore more to understand how LBO dynamics influence private equity strategies and community intelligence.

Fund Management

Private equity firms specialize in active fund management by acquiring and restructuring companies to generate high returns, leveraging deep industry expertise and operational improvements. Watch investment communities typically focus on monitoring market trends and sharing insights to inform retail or institutional investment decisions without direct fund control. Explore the key differences in fund management strategies and performance metrics to better understand investment approaches.

Source and External Links

Private equity firm (Wikipedia) - Private equity firms are investment management companies that provide financial backing and make investments primarily in privately owned companies, with the goal of realizing a profit, often through strategies like leveraged buyouts, venture capital, or growth capital.

Top Private Equity Firms: The Ultimate Guide (2025) - Private equity firms manage pooled funds from institutional investors to invest directly in private companies or buy out public ones, aiming to increase the companies' value through active management before selling their stakes.

What is Private Equity? (BVCA) - Private equity is medium to long-term finance provided for a stake in high-growth unquoted companies, typically involving close collaboration between the private equity firm and company management to drive growth and operational improvements.

dowidth.com

dowidth.com