Investing in music royalties offers a steady income stream derived from established artists' earnings, providing lower risk and consistent cash flow compared to startup crowdfunding, which involves backing early-stage companies with higher growth potential but increased uncertainty and volatility. Music royalties investment benefits from royalty payments, licensing fees, and streaming revenues, while startup crowdfunding relies on equity appreciation or exit events that may never materialize. Explore the unique advantages and risks of both investment avenues to make informed financial decisions.

Why it is important

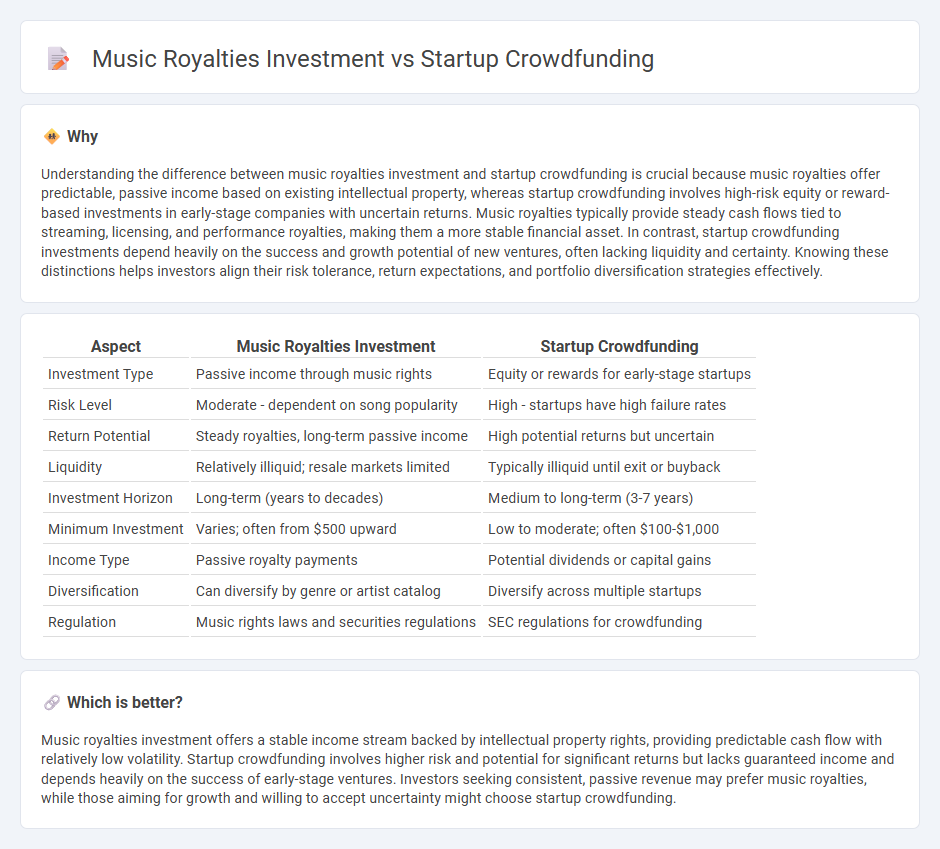

Understanding the difference between music royalties investment and startup crowdfunding is crucial because music royalties offer predictable, passive income based on existing intellectual property, whereas startup crowdfunding involves high-risk equity or reward-based investments in early-stage companies with uncertain returns. Music royalties typically provide steady cash flows tied to streaming, licensing, and performance royalties, making them a more stable financial asset. In contrast, startup crowdfunding investments depend heavily on the success and growth potential of new ventures, often lacking liquidity and certainty. Knowing these distinctions helps investors align their risk tolerance, return expectations, and portfolio diversification strategies effectively.

Comparison Table

| Aspect | Music Royalties Investment | Startup Crowdfunding |

|---|---|---|

| Investment Type | Passive income through music rights | Equity or rewards for early-stage startups |

| Risk Level | Moderate - dependent on song popularity | High - startups have high failure rates |

| Return Potential | Steady royalties, long-term passive income | High potential returns but uncertain |

| Liquidity | Relatively illiquid; resale markets limited | Typically illiquid until exit or buyback |

| Investment Horizon | Long-term (years to decades) | Medium to long-term (3-7 years) |

| Minimum Investment | Varies; often from $500 upward | Low to moderate; often $100-$1,000 |

| Income Type | Passive royalty payments | Potential dividends or capital gains |

| Diversification | Can diversify by genre or artist catalog | Diversify across multiple startups |

| Regulation | Music rights laws and securities regulations | SEC regulations for crowdfunding |

Which is better?

Music royalties investment offers a stable income stream backed by intellectual property rights, providing predictable cash flow with relatively low volatility. Startup crowdfunding involves higher risk and potential for significant returns but lacks guaranteed income and depends heavily on the success of early-stage ventures. Investors seeking consistent, passive revenue may prefer music royalties, while those aiming for growth and willing to accept uncertainty might choose startup crowdfunding.

Connection

Music royalties investment and startup crowdfunding intersect through innovative financial models that allow investors to fund creative projects while securing potential revenue streams. Both leverage platforms that democratize access to investment opportunities, enabling individuals to support emerging talent or startups in exchange for future financial returns. This synergy incorporates the monetization of intellectual property and business equity, expanding diversification strategies within alternative investment portfolios.

Key Terms

**Startup Crowdfunding:**

Investing in startup crowdfunding offers access to early-stage companies with high growth potential and opportunities for equity ownership, although it carries significant risk and typically lacks liquidity. Platforms like SeedInvest and Republic provide diverse startup options, allowing investors to diversify and potentially benefit from future exits or acquisitions. Explore comprehensive insights to understand how startup crowdfunding can fit into your investment strategy.

Equity

Equity crowdfunding in startups allows investors to acquire ownership stakes with potential high returns linked to company success, whereas music royalties investment provides a share of future revenue without equity dilution. Startup equity investments often carry higher risk but offer possible control or influence over business direction, contrasting with the more passive income flow from royalty rights. Explore detailed comparisons and strategies to optimize your portfolio with equity-focused approaches.

Valuation

Startup crowdfunding valuation often depends on projected market growth, revenue potential, and competitive analysis, resulting in higher volatility and risk. Music royalties investment valuation is based on historical royalty income, artist popularity, and catalog lifespan, offering more predictable, income-driven returns. Discover detailed insights on how these valuation methods impact your investment decisions.

Source and External Links

12 Best Crowdfunding Sites for Startups 2025 - Startup crowdfunding mainly involves three types: equity crowdfunding (offering shares in the company), rewards crowdfunding (offering non-monetary rewards), and debt crowdfunding (raising loans to be repaid with interest), with platforms like StartEngine, Indiegogo, and Kickstarter being popular choices depending on the fundraising method.

Crowdfunding a Startup: Types, Strategies and Benefits - Two key crowdfunding strategies for startups are product crowdfunding, which uses reward-based incentives for early sales and community building, and equity crowdfunding, which gives investors ownership stakes and is suitable for raising larger sums up to $5 million annually.

What is crowdfunding? Here are four types to know - Crowdfunding democratizes startup financing, with primary types including reward-based, equity-based, debt-based, and donation-based crowdfunding, each offering distinct benefits such as market validation, early customer engagement, and alternative capital sources compared to traditional funding.

dowidth.com

dowidth.com