Tangible asset tokenization enables fractional ownership of physical assets such as real estate, art, or commodities through blockchain technology, enhancing liquidity and accessibility for investors. Private equity involves direct investment in private companies, typically requiring significant capital and longer holding periods, with potential for high returns through company growth and value creation. Explore the advantages and differences of these innovative investment strategies to optimize your portfolio.

Why it is important

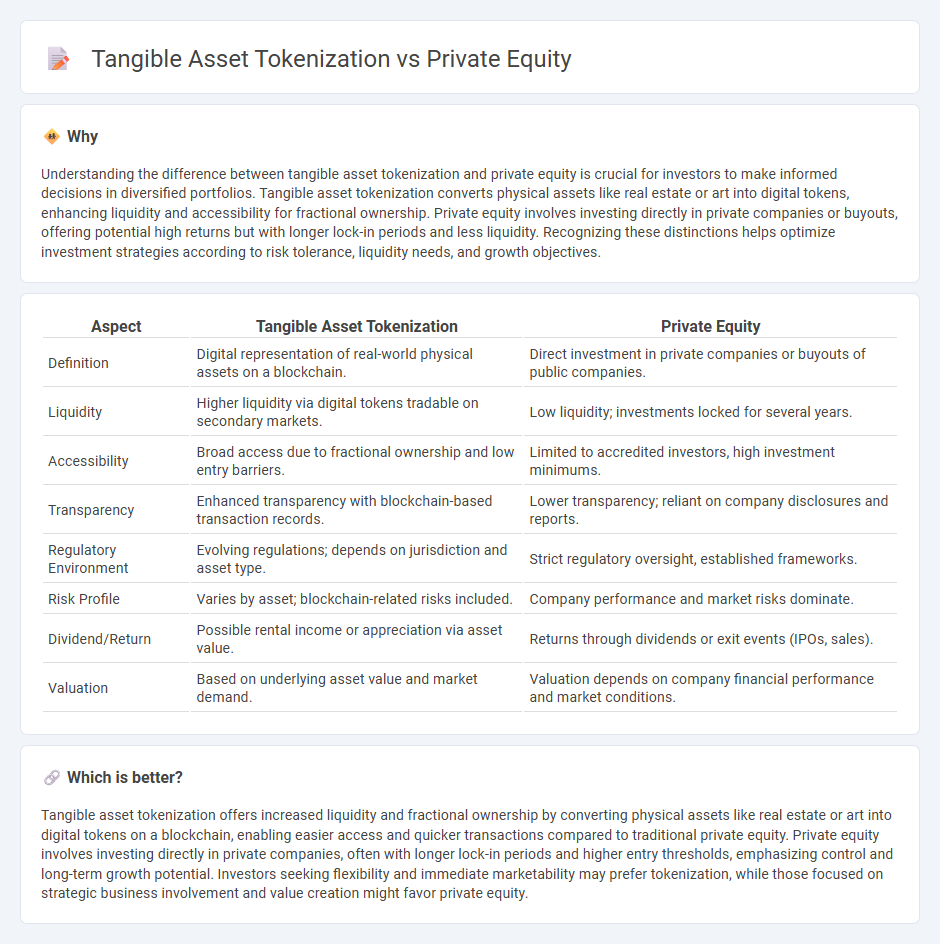

Understanding the difference between tangible asset tokenization and private equity is crucial for investors to make informed decisions in diversified portfolios. Tangible asset tokenization converts physical assets like real estate or art into digital tokens, enhancing liquidity and accessibility for fractional ownership. Private equity involves investing directly in private companies or buyouts, offering potential high returns but with longer lock-in periods and less liquidity. Recognizing these distinctions helps optimize investment strategies according to risk tolerance, liquidity needs, and growth objectives.

Comparison Table

| Aspect | Tangible Asset Tokenization | Private Equity |

|---|---|---|

| Definition | Digital representation of real-world physical assets on a blockchain. | Direct investment in private companies or buyouts of public companies. |

| Liquidity | Higher liquidity via digital tokens tradable on secondary markets. | Low liquidity; investments locked for several years. |

| Accessibility | Broad access due to fractional ownership and low entry barriers. | Limited to accredited investors, high investment minimums. |

| Transparency | Enhanced transparency with blockchain-based transaction records. | Lower transparency; reliant on company disclosures and reports. |

| Regulatory Environment | Evolving regulations; depends on jurisdiction and asset type. | Strict regulatory oversight, established frameworks. |

| Risk Profile | Varies by asset; blockchain-related risks included. | Company performance and market risks dominate. |

| Dividend/Return | Possible rental income or appreciation via asset value. | Returns through dividends or exit events (IPOs, sales). |

| Valuation | Based on underlying asset value and market demand. | Valuation depends on company financial performance and market conditions. |

Which is better?

Tangible asset tokenization offers increased liquidity and fractional ownership by converting physical assets like real estate or art into digital tokens on a blockchain, enabling easier access and quicker transactions compared to traditional private equity. Private equity involves investing directly in private companies, often with longer lock-in periods and higher entry thresholds, emphasizing control and long-term growth potential. Investors seeking flexibility and immediate marketability may prefer tokenization, while those focused on strategic business involvement and value creation might favor private equity.

Connection

Tangible asset tokenization transforms physical assets into digital tokens on a blockchain, enhancing liquidity and accessibility in private equity markets. This innovation allows fractional ownership and easier transfer of stakes in private companies, broadening investment opportunities and increasing market efficiency. Tokenization bridges the gap between traditional private equity and modern digital finance, fostering transparency and expanding investor participation.

Key Terms

Ownership Structure

Private equity typically involves direct ownership of shares in a company, granting investors equity stakes with voting rights and profit participation. Tangible asset tokenization converts physical assets into digital tokens on a blockchain, enabling fractional ownership and enhancing liquidity while maintaining transparent and immutable records. Explore how these ownership structures impact control, liquidity, and investor accessibility to understand which suits your investment goals best.

Liquidity

Private equity investments traditionally face liquidity constraints due to long lock-up periods and limited secondary market options, making it challenging for investors to access their capital quickly. In contrast, tangible asset tokenization leverages blockchain technology to fractionalize physical assets, enabling faster, more flexible trading and enhanced liquidity through digital marketplaces. Explore the advantages of tokenization in transforming asset liquidity and investor accessibility.

Regulation

Private equity investments are heavily regulated by securities laws such as the SEC's Regulation D and the Investment Company Act of 1940, ensuring investor protection and transparency. Tangible asset tokenization operates within emerging regulatory frameworks that address both asset-backed securities and digital tokens, often involving compliance with AML/KYC requirements and evolving guidelines from agencies like the SEC and FinCEN. To explore how regulation shapes opportunities and risks in these innovative investment vehicles, discover more about the latest legal developments.

Source and External Links

Private equity - Private equity is investment in private companies (not publicly traded) through funds raised from institutional investors, with strategies focused on value creation through revenue growth, margin expansion, cash flow, and valuation multiple expansion, typically over a 4-7 year horizon.

What is Private Equity? - Private equity provides medium to long-term finance to unquoted companies, working closely with management to increase business value through active ownership, operational improvement, and governance, often holding investments for 4-7 years before exit.

Private Equity Funds - Private equity funds are pooled investment vehicles managed by firms that take controlling or minority stakes in companies, focusing on long-term investment horizons of typically 10+ years, and are less regulated than public funds with limited disclosure requirements.

dowidth.com

dowidth.com