Wine funds and collectibles funds represent alternative investment vehicles that focus on tangible assets with potential for value appreciation. Wine funds invest in fine and rare wines, leveraging market trends and historical data to optimize returns, while collectibles funds target items such as art, coins, and rare memorabilia, relying on rarity and demand dynamics. Explore more to understand which fund aligns better with your portfolio strategy and risk tolerance.

Why it is important

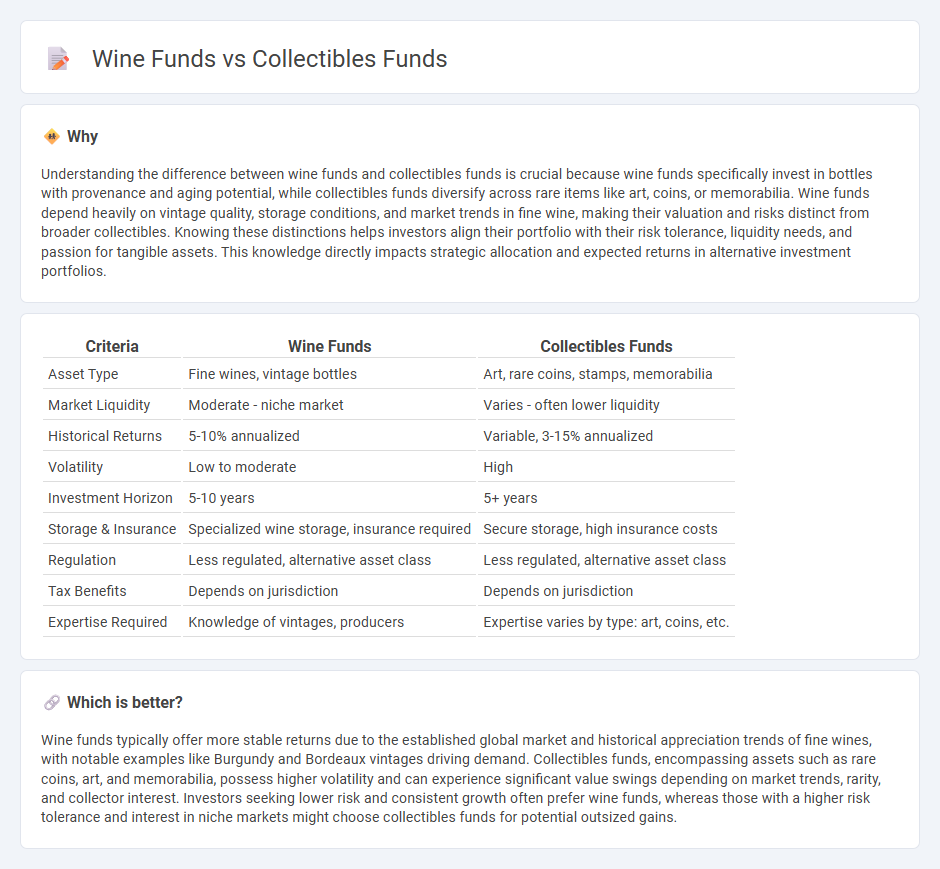

Understanding the difference between wine funds and collectibles funds is crucial because wine funds specifically invest in bottles with provenance and aging potential, while collectibles funds diversify across rare items like art, coins, or memorabilia. Wine funds depend heavily on vintage quality, storage conditions, and market trends in fine wine, making their valuation and risks distinct from broader collectibles. Knowing these distinctions helps investors align their portfolio with their risk tolerance, liquidity needs, and passion for tangible assets. This knowledge directly impacts strategic allocation and expected returns in alternative investment portfolios.

Comparison Table

| Criteria | Wine Funds | Collectibles Funds |

|---|---|---|

| Asset Type | Fine wines, vintage bottles | Art, rare coins, stamps, memorabilia |

| Market Liquidity | Moderate - niche market | Varies - often lower liquidity |

| Historical Returns | 5-10% annualized | Variable, 3-15% annualized |

| Volatility | Low to moderate | High |

| Investment Horizon | 5-10 years | 5+ years |

| Storage & Insurance | Specialized wine storage, insurance required | Secure storage, high insurance costs |

| Regulation | Less regulated, alternative asset class | Less regulated, alternative asset class |

| Tax Benefits | Depends on jurisdiction | Depends on jurisdiction |

| Expertise Required | Knowledge of vintages, producers | Expertise varies by type: art, coins, etc. |

Which is better?

Wine funds typically offer more stable returns due to the established global market and historical appreciation trends of fine wines, with notable examples like Burgundy and Bordeaux vintages driving demand. Collectibles funds, encompassing assets such as rare coins, art, and memorabilia, possess higher volatility and can experience significant value swings depending on market trends, rarity, and collector interest. Investors seeking lower risk and consistent growth often prefer wine funds, whereas those with a higher risk tolerance and interest in niche markets might choose collectibles funds for potential outsized gains.

Connection

Wine funds and collectibles funds both serve as alternative investment vehicles that diversify portfolios beyond traditional stocks and bonds. These funds capitalize on the appreciation potential of rare assets, with wine funds focusing on fine and rare wines, while collectibles funds invest in items such as art, antiques, and memorabilia. Both types of funds leverage the limited supply and unique market dynamics of tangible assets to generate returns and hedge against inflation.

Key Terms

Asset Valuation

Collectibles funds often rely on expert appraisals and historical auction data to determine asset valuation, reflecting rarity and market demand, whereas wine funds use provenance, vintage, and storage conditions combined with market trends to assess worth. Both asset classes face challenges in liquidity and price volatility, but wine funds benefit from standardized grading and global consumption patterns, providing a more quantifiable valuation framework. Explore the detailed comparisons of asset valuation methodologies and market dynamics in collectibles versus wine funds for deeper insights.

Liquidity

Collectibles funds generally offer higher liquidity compared to wine funds due to more frequent trading opportunities and established secondary markets for assets like art and rare coins. Wine funds often face challenges with liquidity as the market relies heavily on wine auctions and private sales, which can be less predictable and slower. Explore our detailed analysis to better understand liquidity dynamics in these alternative investment options.

Authentication

Collectibles funds emphasize rigorous authentication methods involving expert appraisals, provenance research, and digital certification to ensure asset legitimacy and value stability. Wine funds rely on authentication processes such as vintage verification, producer validation, and storage condition monitoring to maintain investment quality and prevent fraud. Explore detailed insights into authentication techniques in collectibles and wine funds to understand their impact on investment security.

Source and External Links

Investing In The $500 Billion Collectibles Market: How To Get Started - This article outlines what counts as collectibles (art, NFTs, coins, rugs, wine, etc.) and highlights both their potential profitability and risks due to changing market trends and tastes.

How to Invest in Collectibles | Nasdaq - Investing in collectibles can offer portfolio diversification and substantial returns with items ranging from rare coins and fine art to vintage toys, but it requires careful research and knowing the market complexities.

Stocks, Bonds and Wine: For Some Investors, Collectibles Provide ... - Collectibles are an alternative investment class favored especially by ultra-high-net-worth individuals, representing around 2% of their wealth and showing price appreciation due to limited supply and growing demand.

dowidth.com

dowidth.com