Carbon offset investing focuses on funding projects that reduce or capture greenhouse gas emissions to balance out carbon footprints, often through reforestation or renewable energy initiatives. Climate tech venture capital targets innovative startups developing advanced technologies aimed at mitigating climate change, such as energy storage, carbon capture, or sustainable agriculture. Explore the distinct strategies and impacts of these investment approaches to understand their potential in driving environmental change.

Why it is important

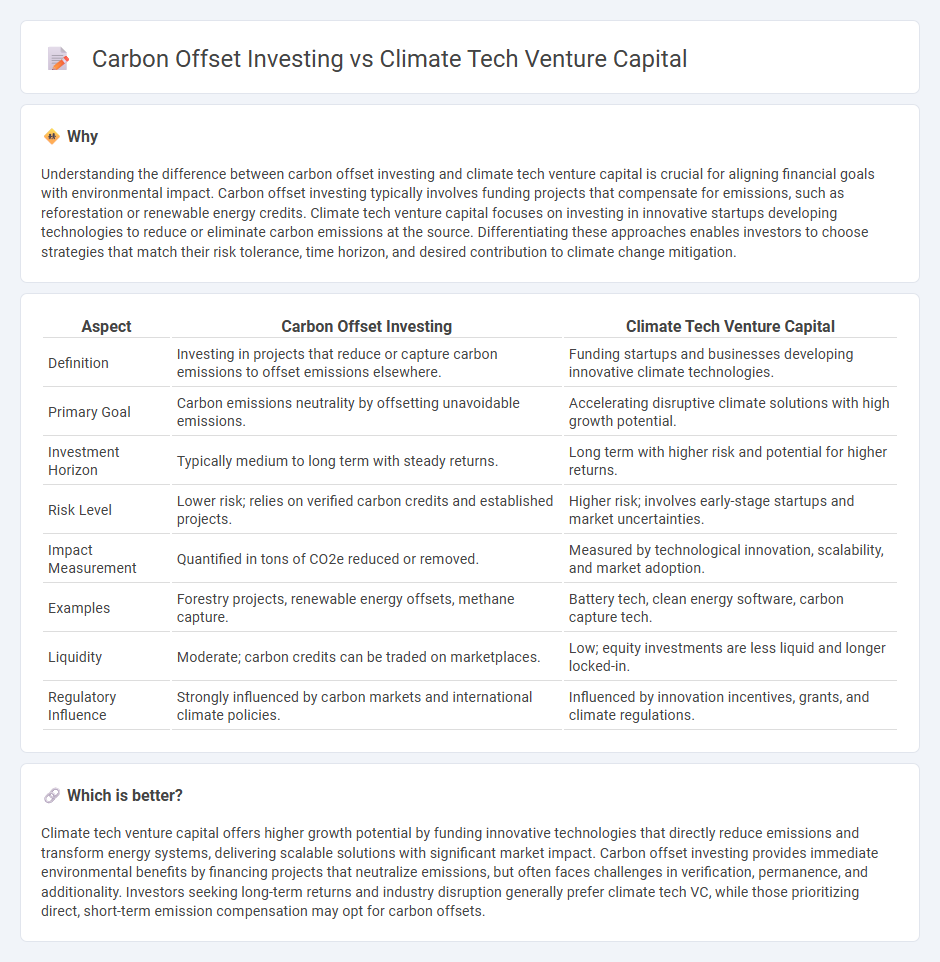

Understanding the difference between carbon offset investing and climate tech venture capital is crucial for aligning financial goals with environmental impact. Carbon offset investing typically involves funding projects that compensate for emissions, such as reforestation or renewable energy credits. Climate tech venture capital focuses on investing in innovative startups developing technologies to reduce or eliminate carbon emissions at the source. Differentiating these approaches enables investors to choose strategies that match their risk tolerance, time horizon, and desired contribution to climate change mitigation.

Comparison Table

| Aspect | Carbon Offset Investing | Climate Tech Venture Capital |

|---|---|---|

| Definition | Investing in projects that reduce or capture carbon emissions to offset emissions elsewhere. | Funding startups and businesses developing innovative climate technologies. |

| Primary Goal | Carbon emissions neutrality by offsetting unavoidable emissions. | Accelerating disruptive climate solutions with high growth potential. |

| Investment Horizon | Typically medium to long term with steady returns. | Long term with higher risk and potential for higher returns. |

| Risk Level | Lower risk; relies on verified carbon credits and established projects. | Higher risk; involves early-stage startups and market uncertainties. |

| Impact Measurement | Quantified in tons of CO2e reduced or removed. | Measured by technological innovation, scalability, and market adoption. |

| Examples | Forestry projects, renewable energy offsets, methane capture. | Battery tech, clean energy software, carbon capture tech. |

| Liquidity | Moderate; carbon credits can be traded on marketplaces. | Low; equity investments are less liquid and longer locked-in. |

| Regulatory Influence | Strongly influenced by carbon markets and international climate policies. | Influenced by innovation incentives, grants, and climate regulations. |

Which is better?

Climate tech venture capital offers higher growth potential by funding innovative technologies that directly reduce emissions and transform energy systems, delivering scalable solutions with significant market impact. Carbon offset investing provides immediate environmental benefits by financing projects that neutralize emissions, but often faces challenges in verification, permanence, and additionality. Investors seeking long-term returns and industry disruption generally prefer climate tech VC, while those prioritizing direct, short-term emission compensation may opt for carbon offsets.

Connection

Carbon offset investing and climate tech venture capital are interconnected through their shared goal of mitigating climate change by funding projects that reduce greenhouse gas emissions. Carbon offset investing supports initiatives like reforestation and renewable energy, creating market demand for innovative climate technologies developed and scaled by climate tech venture capital funds. This symbiotic relationship accelerates the deployment of sustainable solutions, driving both environmental impact and financial returns in the growing green economy.

Key Terms

**Climate tech venture capital:**

Climate tech venture capital targets innovative startups developing breakthrough technologies for clean energy, carbon capture, and sustainable materials, aiming to reduce greenhouse gas emissions at the source. It provides strategic funding for scalable solutions that can disrupt traditional industries and drive long-term environmental and economic impact. Explore the transformative potential of climate tech venture capital to understand its role in accelerating the green transition.

Equity financing

Climate tech venture capital targets equity financing in innovative startups developing clean energy, carbon capture, and sustainable materials, providing high growth potential and direct impact on emissions reduction. Carbon offset investing often involves purchasing credits from projects that reduce or sequester carbon, focusing more on tradable assets than equity stakes. Explore further to understand the strategic benefits and risks associated with equity financing in climate-focused investments.

Startup innovation

Climate tech venture capital drives startup innovation by providing early-stage funding focused on breakthrough solutions in renewable energy, carbon capture, and sustainable materials. Carbon offset investing, while supporting environmental impact, often finances established projects like reforestation or methane reduction rather than cutting-edge technology development. Explore the evolving dynamics between these two investment approaches to understand their distinct impacts on climate change mitigation.

Source and External Links

Top 5 Climate Tech VCs & Investors in 2025 - Highlights leading climate tech venture capital firms focusing entirely on the sector, including Breakthrough Energy Ventures founded by Bill Gates, focusing on net-zero greenhouse gases by 2050, with $3.5 billion invested in over 110 companies, and Pale Blue Dot, a Swedish VC investing mainly in American and European pre-seed and seed startups.

Clean Energy Ventures | Climate Tech Venture Capital - Clean Energy Ventures invests in early-stage climate tech startups with scalable technologies aimed at mitigating 2.5 gigatons of CO2 emissions by 2050, combining deep technical evaluation with hands-on mentorship to help companies achieve significant climate impact.

Climate Tech VC | Pre-Seed and Seed Startup Funding - Speedinvest focuses on funding climate tech startups across sectors such as manufacturing, construction, real estate, energy, mobility, and agriculture, providing access to a broad network of industry players and investors to scale impactful climate tech companies, with over 25 successful investments so far.

dowidth.com

dowidth.com