Carbon credits trading enables businesses to offset carbon emissions through verified market transactions, offering a flexible mechanism for reducing environmental impact. Nature-based solutions funds focus on investing in projects like reforestation and ecosystem restoration to achieve long-term climate resilience and biodiversity benefits. Explore how these distinct investment approaches contribute to sustainable development and climate action.

Why it is important

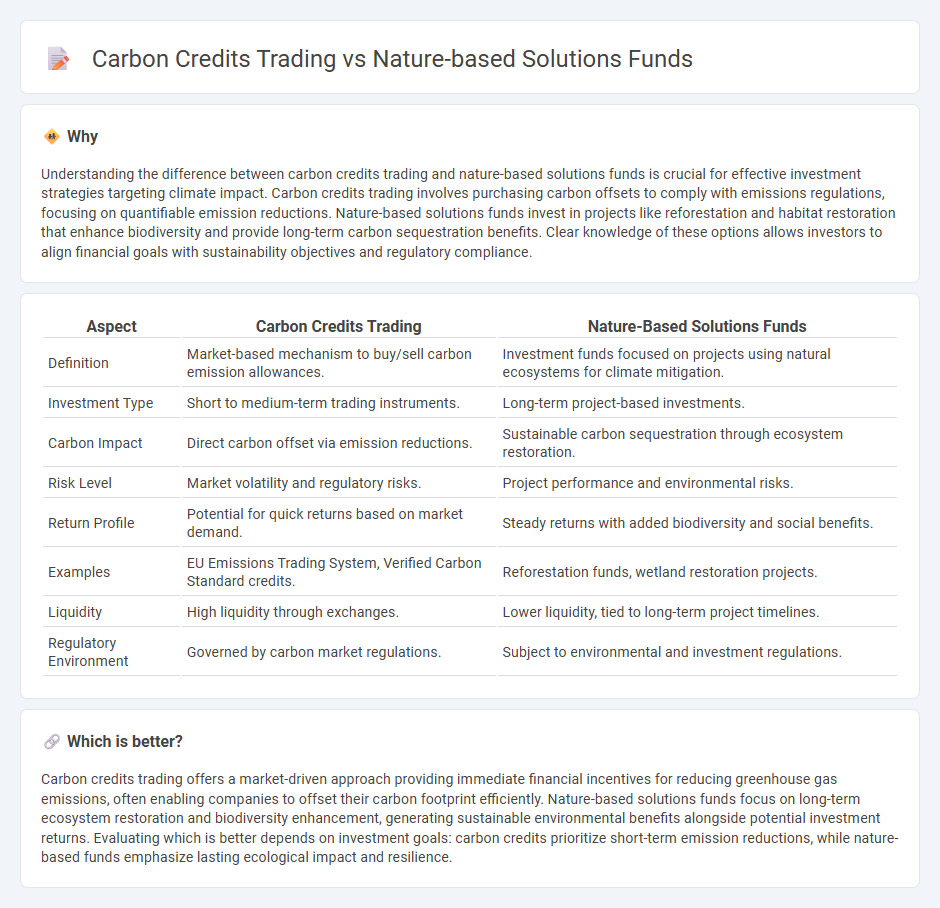

Understanding the difference between carbon credits trading and nature-based solutions funds is crucial for effective investment strategies targeting climate impact. Carbon credits trading involves purchasing carbon offsets to comply with emissions regulations, focusing on quantifiable emission reductions. Nature-based solutions funds invest in projects like reforestation and habitat restoration that enhance biodiversity and provide long-term carbon sequestration benefits. Clear knowledge of these options allows investors to align financial goals with sustainability objectives and regulatory compliance.

Comparison Table

| Aspect | Carbon Credits Trading | Nature-Based Solutions Funds |

|---|---|---|

| Definition | Market-based mechanism to buy/sell carbon emission allowances. | Investment funds focused on projects using natural ecosystems for climate mitigation. |

| Investment Type | Short to medium-term trading instruments. | Long-term project-based investments. |

| Carbon Impact | Direct carbon offset via emission reductions. | Sustainable carbon sequestration through ecosystem restoration. |

| Risk Level | Market volatility and regulatory risks. | Project performance and environmental risks. |

| Return Profile | Potential for quick returns based on market demand. | Steady returns with added biodiversity and social benefits. |

| Examples | EU Emissions Trading System, Verified Carbon Standard credits. | Reforestation funds, wetland restoration projects. |

| Liquidity | High liquidity through exchanges. | Lower liquidity, tied to long-term project timelines. |

| Regulatory Environment | Governed by carbon market regulations. | Subject to environmental and investment regulations. |

Which is better?

Carbon credits trading offers a market-driven approach providing immediate financial incentives for reducing greenhouse gas emissions, often enabling companies to offset their carbon footprint efficiently. Nature-based solutions funds focus on long-term ecosystem restoration and biodiversity enhancement, generating sustainable environmental benefits alongside potential investment returns. Evaluating which is better depends on investment goals: carbon credits prioritize short-term emission reductions, while nature-based funds emphasize lasting ecological impact and resilience.

Connection

Carbon credits trading incentivizes the reduction of greenhouse gas emissions by assigning monetary value to emission reductions, directly aligning with the goals of nature-based solutions funds, which invest in projects like reforestation and wetland restoration to capture carbon naturally. These funds channel capital into ecosystem-based initiatives that generate verifiable carbon credits, creating a financial mechanism that supports biodiversity, climate mitigation, and sustainable development. The synergy between carbon credits markets and nature-based funds drives environmental impact investment, promoting scalable, profitable pathways for carbon sequestration and ecosystem preservation.

Key Terms

Ecosystem Services

Nature-based solutions funds primarily invest in projects that restore and conserve ecosystems to provide ecosystem services such as carbon sequestration, biodiversity enhancement, and water regulation. Carbon credits trading involves buying and selling verified emission reductions or removals, often generated through nature-based projects, enabling firms to offset their carbon footprint. Explore how integrating ecosystem services in these financial mechanisms drives sustainable environmental impact and market innovation.

Additionality

Nature-based solutions funds prioritize projects that generate measurable environmental benefits beyond existing regulations, ensuring true additionality by restoring ecosystems and enhancing biodiversity. Carbon credits trading often faces challenges in verifying additionality, as some credits may represent emissions reductions that would have occurred without financial incentives. Explore the critical differences and implications of additionality in these approaches to environmental financing.

Market Mechanisms

Nature-based solutions funds mobilize capital for projects like reforestation and wetland restoration, aiming to enhance ecosystems while generating carbon sequestration benefits. Carbon credits trading involves buying and selling verified emission reductions, providing a market-driven incentive for reducing greenhouse gases. Explore the differences and synergies between these market mechanisms to optimize climate finance strategies.

Source and External Links

NBS Invest: Accelerating Nature Based Solutions in Least Developed Countries - This World Bank initiative aims to increase funding and mainstream nature-based solutions (NBS) for climate mitigation, adaptation, biodiversity conservation, and livelihood development, particularly focusing on the world's poorest countries where ecosystem services are declining rapidly.

Leading investors in nature-based solutions | illuminem - A curated list of prominent funds such as Silvania, Terra Bella NbS Fund, and Terra Natural Capital that provide substantial capital (ranging from $5 million to over $100 million) for projects including reforestation, mangrove restoration, peatland restoration, and agroforestry, aimed at scaling nature-based solutions globally.

The Fund for Nature - CrossBoundary Group - This fund focuses on scaling nature-based solutions in emerging markets by investing in projects that restore critical ecosystems and promote sustainable land management, supporting climate resilience and community benefits in underserved areas.

dowidth.com

dowidth.com