Carbon credit trading allows companies to offset their emissions by buying and selling certificates representing a ton of CO2 reduced or removed, creating a market-driven approach to sustainability. Impact investing directs capital toward projects and companies that generate measurable social and environmental benefits alongside financial returns, focusing on long-term positive change. Explore the distinctions between these investment strategies to understand their roles in driving environmental progress.

Why it is important

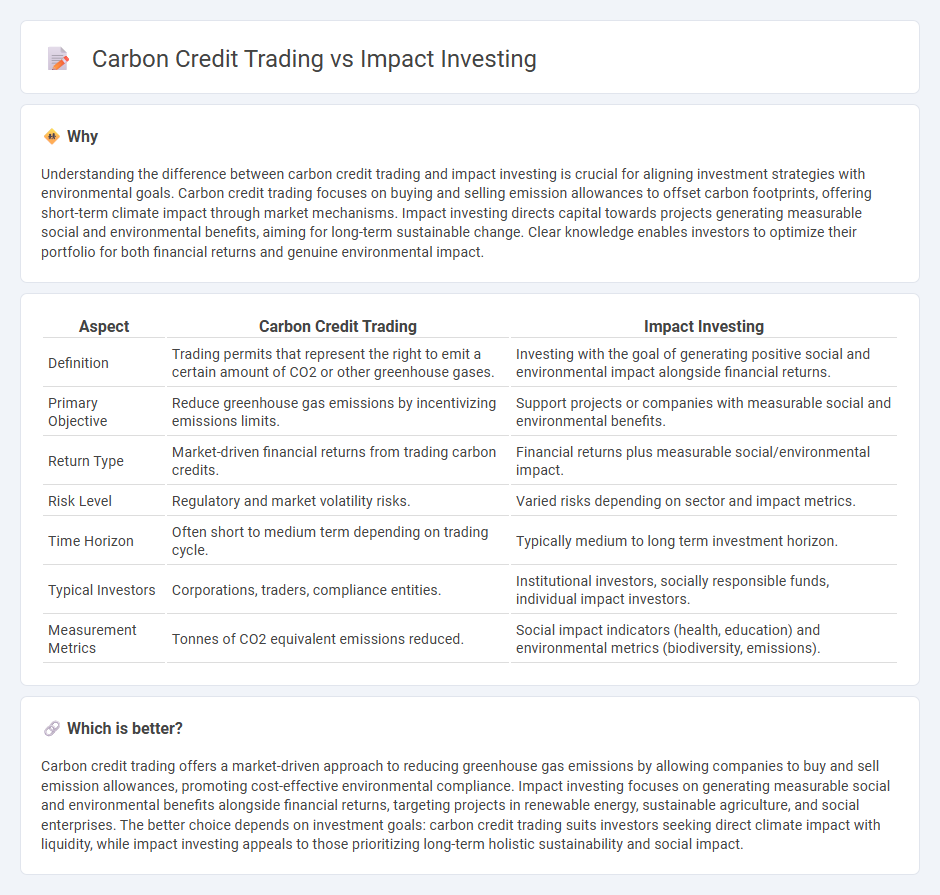

Understanding the difference between carbon credit trading and impact investing is crucial for aligning investment strategies with environmental goals. Carbon credit trading focuses on buying and selling emission allowances to offset carbon footprints, offering short-term climate impact through market mechanisms. Impact investing directs capital towards projects generating measurable social and environmental benefits, aiming for long-term sustainable change. Clear knowledge enables investors to optimize their portfolio for both financial returns and genuine environmental impact.

Comparison Table

| Aspect | Carbon Credit Trading | Impact Investing |

|---|---|---|

| Definition | Trading permits that represent the right to emit a certain amount of CO2 or other greenhouse gases. | Investing with the goal of generating positive social and environmental impact alongside financial returns. |

| Primary Objective | Reduce greenhouse gas emissions by incentivizing emissions limits. | Support projects or companies with measurable social and environmental benefits. |

| Return Type | Market-driven financial returns from trading carbon credits. | Financial returns plus measurable social/environmental impact. |

| Risk Level | Regulatory and market volatility risks. | Varied risks depending on sector and impact metrics. |

| Time Horizon | Often short to medium term depending on trading cycle. | Typically medium to long term investment horizon. |

| Typical Investors | Corporations, traders, compliance entities. | Institutional investors, socially responsible funds, individual impact investors. |

| Measurement Metrics | Tonnes of CO2 equivalent emissions reduced. | Social impact indicators (health, education) and environmental metrics (biodiversity, emissions). |

Which is better?

Carbon credit trading offers a market-driven approach to reducing greenhouse gas emissions by allowing companies to buy and sell emission allowances, promoting cost-effective environmental compliance. Impact investing focuses on generating measurable social and environmental benefits alongside financial returns, targeting projects in renewable energy, sustainable agriculture, and social enterprises. The better choice depends on investment goals: carbon credit trading suits investors seeking direct climate impact with liquidity, while impact investing appeals to those prioritizing long-term holistic sustainability and social impact.

Connection

Carbon credit trading enables investors to support projects that reduce greenhouse gas emissions, aligning with the goals of impact investing focused on environmental sustainability. Impact investing directs capital towards initiatives generating measurable social and environmental benefits, often utilizing carbon markets to finance clean energy, reforestation, and sustainable agriculture. Both mechanisms leverage market-driven solutions to drive positive environmental change while offering potential financial returns.

Key Terms

**Impact investing:**

Impact investing directs capital towards projects and companies that generate measurable social and environmental benefits alongside financial returns, emphasizing sustainable development goals such as renewable energy, affordable housing, and clean water access. This approach integrates Environmental, Social, and Governance (ESG) criteria into investment decisions, enhancing positive societal impact while managing risk. Explore further to understand how impact investing drives long-term change and supports global sustainability efforts.

Social Return on Investment (SROI)

Impact investing emphasizes generating measurable social and environmental benefits alongside financial returns, often quantified through Social Return on Investment (SROI) metrics to assess long-term value creation. Carbon credit trading primarily targets emissions reductions by allowing organizations to offset their carbon footprints, with less direct focus on broader social impact or SROI outcomes. Explore how integrating SROI into carbon markets can enhance the socio-environmental effectiveness of climate finance strategies.

ESG (Environmental, Social, Governance)

Impact investing directly channels capital into companies or projects that generate measurable environmental and social benefits while promoting strong governance practices, aligning closely with ESG criteria. Carbon credit trading, on the other hand, allows organizations to offset their carbon emissions by purchasing credits from projects that reduce or sequester greenhouse gases, thus addressing the environmental aspect of ESG. Explore the differences further to understand how each approach contributes uniquely to sustainable development goals.

Source and External Links

What you need to know about impact investing - The GIIN - Impact investing involves making investments with the intention to generate positive, measurable social or environmental outcomes alongside financial returns, and it spans sectors like energy, healthcare, and sustainable agriculture.

What is Impact Investing? | Fidelity Charitable - Impact investing aligns financial investments with personal or philanthropic values to achieve social or environmental benefits while generating financial returns, with growing adoption among younger generations and institutional investors.

Impact Investing | United Nations Development Programme - Impact investing deploys capital into ventures that produce measurable social or environmental benefits alongside financial returns, supporting sustainable development and private sector growth globally.

dowidth.com

dowidth.com