Private credit funds directly lend to middle-market companies, offering investors diversification and higher yield potential compared to traditional fixed-income assets. Collateralized Loan Obligations (CLOs) bundle syndicated leveraged loans into tranches with varying risk-return profiles, providing liquidity and capital structure exposure. Explore the differences in risk, return, and structure to decide which suits your investment strategy best.

Why it is important

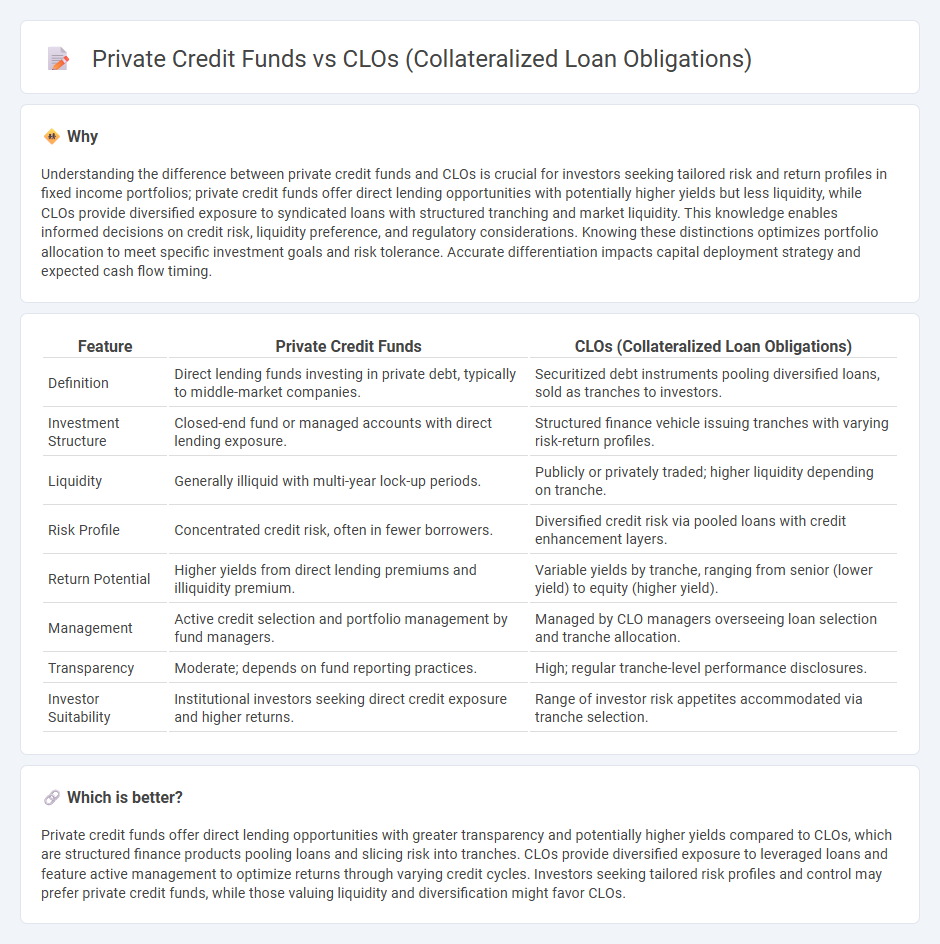

Understanding the difference between private credit funds and CLOs is crucial for investors seeking tailored risk and return profiles in fixed income portfolios; private credit funds offer direct lending opportunities with potentially higher yields but less liquidity, while CLOs provide diversified exposure to syndicated loans with structured tranching and market liquidity. This knowledge enables informed decisions on credit risk, liquidity preference, and regulatory considerations. Knowing these distinctions optimizes portfolio allocation to meet specific investment goals and risk tolerance. Accurate differentiation impacts capital deployment strategy and expected cash flow timing.

Comparison Table

| Feature | Private Credit Funds | CLOs (Collateralized Loan Obligations) |

|---|---|---|

| Definition | Direct lending funds investing in private debt, typically to middle-market companies. | Securitized debt instruments pooling diversified loans, sold as tranches to investors. |

| Investment Structure | Closed-end fund or managed accounts with direct lending exposure. | Structured finance vehicle issuing tranches with varying risk-return profiles. |

| Liquidity | Generally illiquid with multi-year lock-up periods. | Publicly or privately traded; higher liquidity depending on tranche. |

| Risk Profile | Concentrated credit risk, often in fewer borrowers. | Diversified credit risk via pooled loans with credit enhancement layers. |

| Return Potential | Higher yields from direct lending premiums and illiquidity premium. | Variable yields by tranche, ranging from senior (lower yield) to equity (higher yield). |

| Management | Active credit selection and portfolio management by fund managers. | Managed by CLO managers overseeing loan selection and tranche allocation. |

| Transparency | Moderate; depends on fund reporting practices. | High; regular tranche-level performance disclosures. |

| Investor Suitability | Institutional investors seeking direct credit exposure and higher returns. | Range of investor risk appetites accommodated via tranche selection. |

Which is better?

Private credit funds offer direct lending opportunities with greater transparency and potentially higher yields compared to CLOs, which are structured finance products pooling loans and slicing risk into tranches. CLOs provide diversified exposure to leveraged loans and feature active management to optimize returns through varying credit cycles. Investors seeking tailored risk profiles and control may prefer private credit funds, while those valuing liquidity and diversification might favor CLOs.

Connection

Private credit funds often invest in loans that are packaged into Collateralized Loan Obligations (CLOs), creating a direct connection between these two investment vehicles. CLOs aggregate diversified pools of leveraged loans, many of which originate from private credit funds focusing on middle-market companies. This relationship enhances liquidity for private credit funds while providing CLO investors exposure to a wide range of credit assets with varying risk and return profiles.

Key Terms

Securitization

Collateralized Loan Obligations (CLOs) are securitized financial instruments that pool together various loans, primarily leveraged loans, and issue tranches of different risk levels to investors, enabling liquidity and risk diversification. Private credit funds directly invest in loans and private debt instruments without securitizing these assets, offering more bespoke lending solutions but less immediate liquidity compared to CLOs. Explore deeper insights into the differences in structure, risk management, and investor benefits between CLOs and private credit funds.

Direct Lending

Collateralized Loan Obligations (CLOs) pool diversified loans and issue tranches to investors, providing liquidity and risk distribution in direct lending markets. Private credit funds specialize in direct lending by offering tailored, often illiquid loans to mid-market companies, capturing higher yields through selective credit analysis. Explore comprehensive insights into how CLOs and private credit funds structure direct lending to optimize risk and returns.

Tranches

Collateralized Loan Obligations (CLOs) structure debt into multiple tranches with varying risk and return profiles, offering investors tailored exposure from senior secured loans to high-yield equity interests. Private credit funds often invest directly in loans without tranching, providing more straightforward but less segmented risk exposure compared to CLOs' layered capital structure. Explore how tranche dynamics influence risk, returns, and investor strategy in both CLOs and private credit funds.

Source and External Links

Collateralized Loan Obligations (CLO) - Definition, Pro, Cons - CLOs are securities backed by a pool of loans, repackaged and sold to investors in various tranches with differing risk and return profiles, where higher-rated tranches offer lower risk and lower returns, while lower-rated (equity) tranches face higher risk but higher potential returns.

What are collateralized loan obligations (CLOs)? - CLOs are structured investment vehicles holding pools of below-investment-grade, floating-rate loans, issuing tranched securities that range from low-risk, senior (e.g., AAA-rated) tranches to high-risk, unrated equity tranches that absorb first losses if defaults occur.

CLO Equity: How It Works - and Why It's Compelling Now - A CLO raises capital to purchase a large pool of leveraged loans (typically 150-350), which serve as collateral, then distributes cash flows and losses according to the priority of each tranche, with the equity tranche bearing the most risk but potentially the highest returns.

dowidth.com

dowidth.com