Sports memorabilia investment offers unique opportunities to capitalize on the growing market for rare collectibles like signed jerseys, trading cards, and game-used equipment, driven by passionate fan bases and increasing global interest. Antique investment focuses on acquiring valuable, historically significant items such as furniture, art, and artifacts with proven provenance and enduring cultural appeal. Explore the key differences between these investment types to make informed decisions tailored to your financial goals.

Why it is important

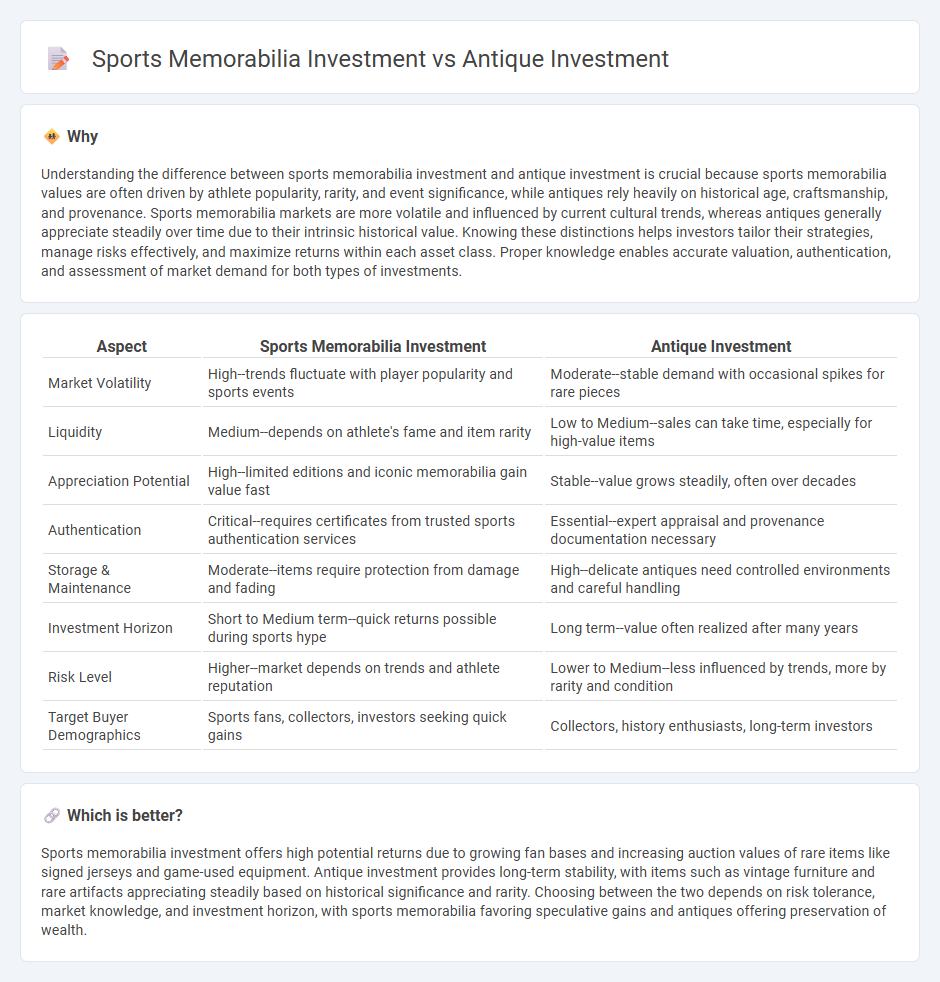

Understanding the difference between sports memorabilia investment and antique investment is crucial because sports memorabilia values are often driven by athlete popularity, rarity, and event significance, while antiques rely heavily on historical age, craftsmanship, and provenance. Sports memorabilia markets are more volatile and influenced by current cultural trends, whereas antiques generally appreciate steadily over time due to their intrinsic historical value. Knowing these distinctions helps investors tailor their strategies, manage risks effectively, and maximize returns within each asset class. Proper knowledge enables accurate valuation, authentication, and assessment of market demand for both types of investments.

Comparison Table

| Aspect | Sports Memorabilia Investment | Antique Investment |

|---|---|---|

| Market Volatility | High--trends fluctuate with player popularity and sports events | Moderate--stable demand with occasional spikes for rare pieces |

| Liquidity | Medium--depends on athlete's fame and item rarity | Low to Medium--sales can take time, especially for high-value items |

| Appreciation Potential | High--limited editions and iconic memorabilia gain value fast | Stable--value grows steadily, often over decades |

| Authentication | Critical--requires certificates from trusted sports authentication services | Essential--expert appraisal and provenance documentation necessary |

| Storage & Maintenance | Moderate--items require protection from damage and fading | High--delicate antiques need controlled environments and careful handling |

| Investment Horizon | Short to Medium term--quick returns possible during sports hype | Long term--value often realized after many years |

| Risk Level | Higher--market depends on trends and athlete reputation | Lower to Medium--less influenced by trends, more by rarity and condition |

| Target Buyer Demographics | Sports fans, collectors, investors seeking quick gains | Collectors, history enthusiasts, long-term investors |

Which is better?

Sports memorabilia investment offers high potential returns due to growing fan bases and increasing auction values of rare items like signed jerseys and game-used equipment. Antique investment provides long-term stability, with items such as vintage furniture and rare artifacts appreciating steadily based on historical significance and rarity. Choosing between the two depends on risk tolerance, market knowledge, and investment horizon, with sports memorabilia favoring speculative gains and antiques offering preservation of wealth.

Connection

Sports memorabilia investment and antique investment are interconnected through their shared reliance on historical value, rarity, and provenance to drive appreciation and demand. Both markets attract collectors who prioritize authenticity and condition, which directly impact the asset's worth over time. Understanding market trends and valuation techniques in antiques can enhance strategic decisions in sports memorabilia investments, making expertise transferable between the two domains.

Key Terms

Antique Investment:

Antique investment offers a unique blend of historical value and aesthetic appeal, often appreciating steadily due to rarity and cultural significance. Unlike sports memorabilia, antiques possess intrinsic craftsmanship and can include diverse categories such as furniture, art, and jewelry, making them a versatile asset class. Explore our detailed guide to uncover the benefits and strategies for successful antique investment.

Provenance

Provenance plays a critical role in both antique and sports memorabilia investments, as it authenticates the item's history and enhances its market value. Antiques often require documented lineage tracing centuries back, while sports memorabilia demand verifiable event or player association to ensure legitimacy. Explore how provenance impacts your investment strategy in these distinct collectible markets.

Rarity

Antique investments often derive value from their historical significance and rarity, with unique craftsmanship and limited availability driving collector demand. Sports memorabilia investments focus on rarity through limited editions, game-used items, and autographs from iconic athletes, making scarcity a key factor in valuation. Explore the nuances of rarity in both markets to make informed investment decisions.

Source and External Links

Complete Guide to Antique Investing: Expert Strategies for 2025 - Focus on high-quality antiques like fine silver, designer jewelry, and rare decorative objects, which appreciate steadily and can outperform traditional investments over the long term with the right knowledge and patience.

10 Types of Antiques to Consider for an Investment - SmartAsset - Popular antique investment categories include furniture, jewelry, classic cars, and art, with value appreciation driven by quality, historical significance, and collector demand.

Collecting Investment Grade Antiques - Investment grade antiques require long-term holding (10-30 years) and include the finest art glass, period furniture, and paintings, offering wealth addition but with risks similar to the stock market.

dowidth.com

dowidth.com