Royalty rights investing involves acquiring a percentage of revenue generated by intellectual property or natural resources, offering steady cash flow with lower risk compared to venture capital. Venture capital focuses on funding early-stage startups with high growth potential but carries significant risk and no guaranteed returns. Explore the differences and benefits of each investment strategy to determine the best fit for your portfolio.

Why it is important

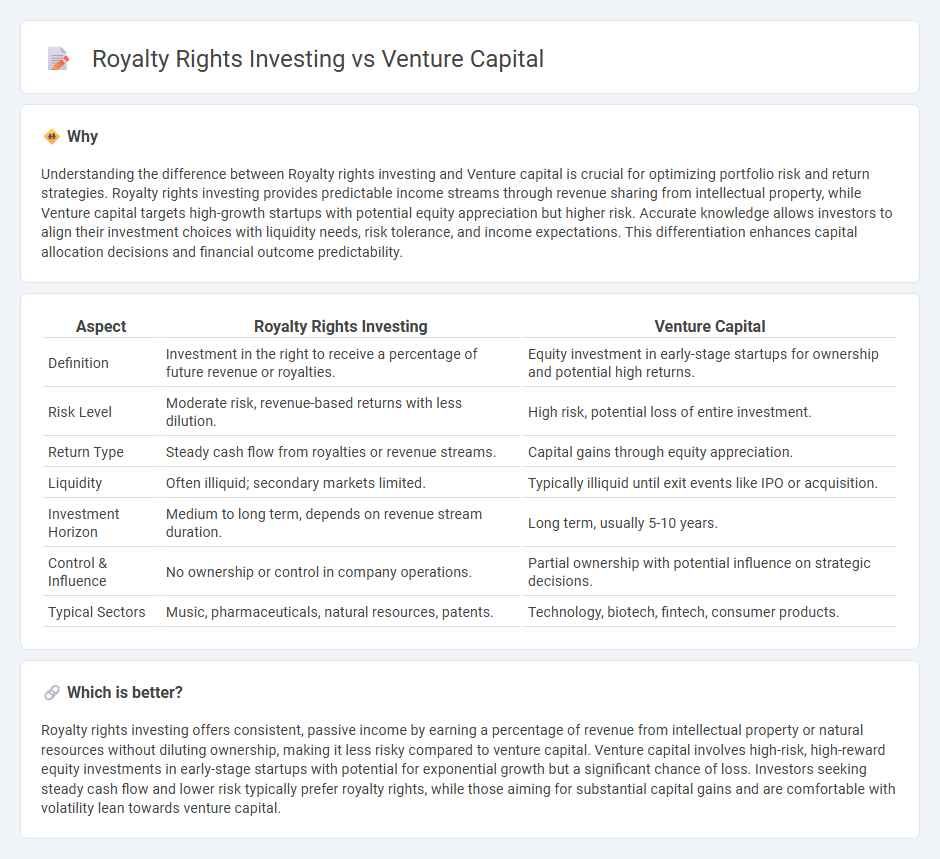

Understanding the difference between Royalty rights investing and Venture capital is crucial for optimizing portfolio risk and return strategies. Royalty rights investing provides predictable income streams through revenue sharing from intellectual property, while Venture capital targets high-growth startups with potential equity appreciation but higher risk. Accurate knowledge allows investors to align their investment choices with liquidity needs, risk tolerance, and income expectations. This differentiation enhances capital allocation decisions and financial outcome predictability.

Comparison Table

| Aspect | Royalty Rights Investing | Venture Capital |

|---|---|---|

| Definition | Investment in the right to receive a percentage of future revenue or royalties. | Equity investment in early-stage startups for ownership and potential high returns. |

| Risk Level | Moderate risk, revenue-based returns with less dilution. | High risk, potential loss of entire investment. |

| Return Type | Steady cash flow from royalties or revenue streams. | Capital gains through equity appreciation. |

| Liquidity | Often illiquid; secondary markets limited. | Typically illiquid until exit events like IPO or acquisition. |

| Investment Horizon | Medium to long term, depends on revenue stream duration. | Long term, usually 5-10 years. |

| Control & Influence | No ownership or control in company operations. | Partial ownership with potential influence on strategic decisions. |

| Typical Sectors | Music, pharmaceuticals, natural resources, patents. | Technology, biotech, fintech, consumer products. |

Which is better?

Royalty rights investing offers consistent, passive income by earning a percentage of revenue from intellectual property or natural resources without diluting ownership, making it less risky compared to venture capital. Venture capital involves high-risk, high-reward equity investments in early-stage startups with potential for exponential growth but a significant chance of loss. Investors seeking steady cash flow and lower risk typically prefer royalty rights, while those aiming for substantial capital gains and are comfortable with volatility lean towards venture capital.

Connection

Royalty rights investing and venture capital are connected through their focus on funding early-stage companies and securing future revenue streams. Royalty rights investing provides investors with ongoing payments tied to a company's sales or revenue, aligning with venture capital's goal of supporting startups to achieve high growth and profitability. Both investment types share risk exposure in emerging businesses while offering potential for substantial financial returns linked to company performance.

Key Terms

Equity ownership

Venture capital involves acquiring equity ownership in startups, offering investors potential high returns through company growth and eventual exit events like IPOs or acquisitions. Royalty rights investing provides a stream of income based on revenue generated, without giving investors ownership or control in the company. Explore detailed comparisons to understand which investment type aligns best with your financial goals.

Dividend/royalty payments

Venture capital investments typically yield returns through equity appreciation and potential dividends, but these returns are often uncertain and linked to company performance. Royalty rights investing provides more predictable income streams via fixed royalty or dividend payments tied to revenue or sales, offering steady cash flow without equity ownership risks. Discover how these distinct payment structures impact investment strategies and income stability.

Exit strategy

Venture capital investments typically rely on high-value exit strategies such as initial public offerings (IPOs) or acquisitions, aiming for exponential returns within 5 to 10 years. Royalty rights investing offers a steady income stream based on a percentage of revenue generated, with the potential for long-term cash flow but less focus on a singular exit event. Explore further to understand which strategy aligns best with your financial goals and risk tolerance.

Source and External Links

What is Venture Capital? - Venture capital is a form of financing that helps turn ideas and basic research into products and services by providing high-risk, long-term equity investments into innovative young companies with high growth potential, often supporting firms for five to eight years or more while generating significant economic impact and jobs.

Fund your business | U.S. Small Business Administration - Venture capital investment is funding given to high-growth companies in exchange for equity and active roles, featuring a longer investment horizon and higher risk than traditional loans, and generally requiring entrepreneurs to give investors board seats and part ownership.

What is Venture Capital? - Venture capital finances startups developing innovative technologies with high growth potential and risk, typically via equity or convertible debt, with investors taking a long-term perspective and diversifying investments across numerous companies to identify a few high-return successes.

dowidth.com

dowidth.com