Investing in wine futures offers exposure to rare and collectible wines before they are bottled, potentially yielding high returns driven by vintage quality and scarcity. Gold bullion provides a tangible asset known for its stability, liquidity, and role as a hedge against inflation and economic uncertainty. Explore the advantages and risks of each investment type to determine which suits your portfolio goals.

Why it is important

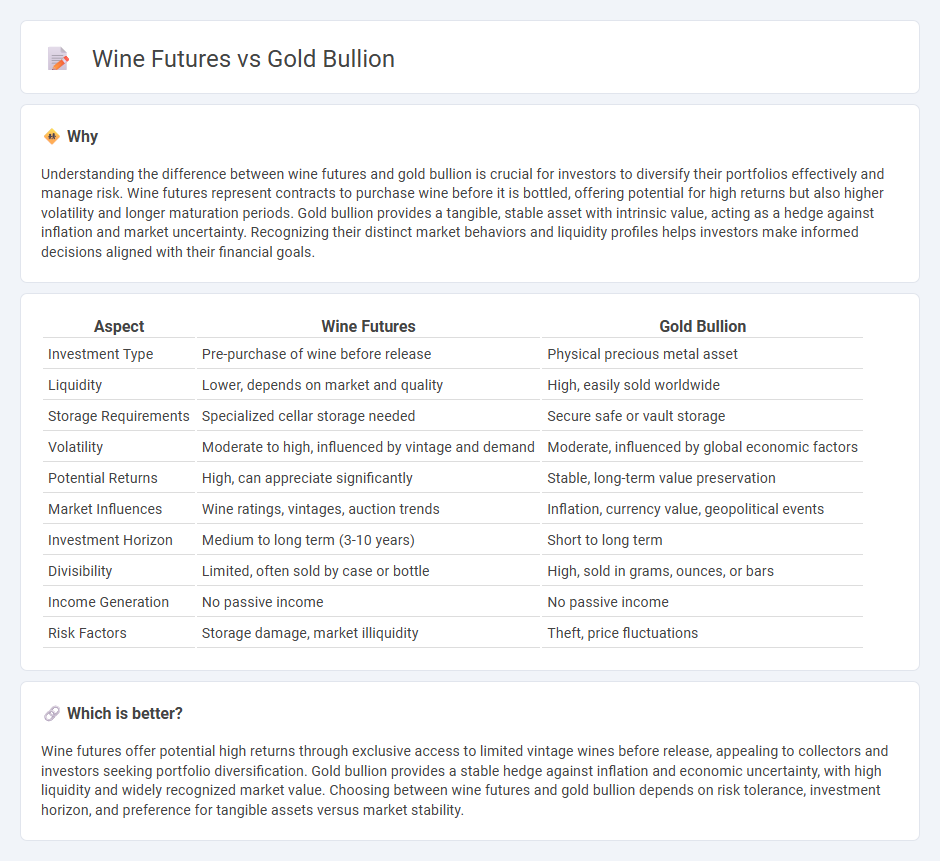

Understanding the difference between wine futures and gold bullion is crucial for investors to diversify their portfolios effectively and manage risk. Wine futures represent contracts to purchase wine before it is bottled, offering potential for high returns but also higher volatility and longer maturation periods. Gold bullion provides a tangible, stable asset with intrinsic value, acting as a hedge against inflation and market uncertainty. Recognizing their distinct market behaviors and liquidity profiles helps investors make informed decisions aligned with their financial goals.

Comparison Table

| Aspect | Wine Futures | Gold Bullion |

|---|---|---|

| Investment Type | Pre-purchase of wine before release | Physical precious metal asset |

| Liquidity | Lower, depends on market and quality | High, easily sold worldwide |

| Storage Requirements | Specialized cellar storage needed | Secure safe or vault storage |

| Volatility | Moderate to high, influenced by vintage and demand | Moderate, influenced by global economic factors |

| Potential Returns | High, can appreciate significantly | Stable, long-term value preservation |

| Market Influences | Wine ratings, vintages, auction trends | Inflation, currency value, geopolitical events |

| Investment Horizon | Medium to long term (3-10 years) | Short to long term |

| Divisibility | Limited, often sold by case or bottle | High, sold in grams, ounces, or bars |

| Income Generation | No passive income | No passive income |

| Risk Factors | Storage damage, market illiquidity | Theft, price fluctuations |

Which is better?

Wine futures offer potential high returns through exclusive access to limited vintage wines before release, appealing to collectors and investors seeking portfolio diversification. Gold bullion provides a stable hedge against inflation and economic uncertainty, with high liquidity and widely recognized market value. Choosing between wine futures and gold bullion depends on risk tolerance, investment horizon, and preference for tangible assets versus market stability.

Connection

Wine futures and gold bullion share an intrinsic connection as alternative investment assets characterized by their potential for long-term value appreciation and portfolio diversification benefits. Both wine futures, which involve purchasing wine before it is bottled and released, and gold bullion, a tangible precious metal asset, serve as hedges against inflation and economic uncertainty. Investors are drawn to their limited supply, intrinsic worth, and historical resilience during market volatility.

Key Terms

Physical Asset

Gold bullion represents a tangible, universally recognized physical asset with intrinsic value and widespread liquidity, making it a preferred choice for wealth preservation and hedging against inflation. Wine futures allow investors to purchase wine prior to its release, combining the potential for appreciation in value with the enjoyment of a luxury collectible, though the asset's liquidity and market risks can be higher compared to gold. Explore the unique benefits and considerations of physical asset investments to make informed decisions tailored to your portfolio.

Liquidity

Gold bullion offers high liquidity with a global market enabling quick buying and selling, often with minimal bid-ask spreads. Wine futures typically have lower liquidity, restricted market participants, and longer settlement periods, making transactions slower and sometimes costlier. Explore detailed comparisons to understand which asset suits your investment liquidity needs.

Storage & Preservation

Gold bullion requires secure, climate-controlled storage to prevent theft and maintain its physical integrity, often held in specialized vaults with stringent security measures. Wine futures, by contrast, demand precise temperature and humidity control in cellars or climate-controlled warehouses to preserve the wine's quality and aging potential, as exposure to fluctuating conditions can damage the product irreversibly. Explore detailed strategies for optimizing storage and preservation to enhance the value of gold bullion and wine futures investments.

Source and External Links

Buy Gold Bullion | Gold Bars & Coins Online - Gold bullion includes bars, rounds, and coins, typically made of .999+ pure gold, with bars and rounds valued close to their gold content and coins often carrying additional premiums due to government backing and collector demand.

Bullion - Wikipedia - Bullion refers to high-purity precious metals like gold and silver, primarily held as an investment for stability during economic uncertainty, with purity standards regulated by market bodies (e.g., 99.5% for gold bars in the EU).

Buy Gold Bullion Bars and Coins Online - Gold bullion bars offer lower premiums over spot price than coins, come in a wide variety of weights and styles, and are produced by both private mints and refineries, with purity typically at least .999.

dowidth.com

dowidth.com