Regenerative agriculture investing focuses on restoring soil health and enhancing biodiversity through sustainable farming practices, offering long-term carbon sequestration and ecosystem benefits. Blue carbon investing targets coastal and marine ecosystems such as mangroves, seagrasses, and salt marshes to capture and store significant amounts of carbon while protecting biodiversity and supporting climate resilience. Explore the distinct advantages and impacts of regenerative agriculture and blue carbon investments to make informed sustainable financial decisions.

Why it is important

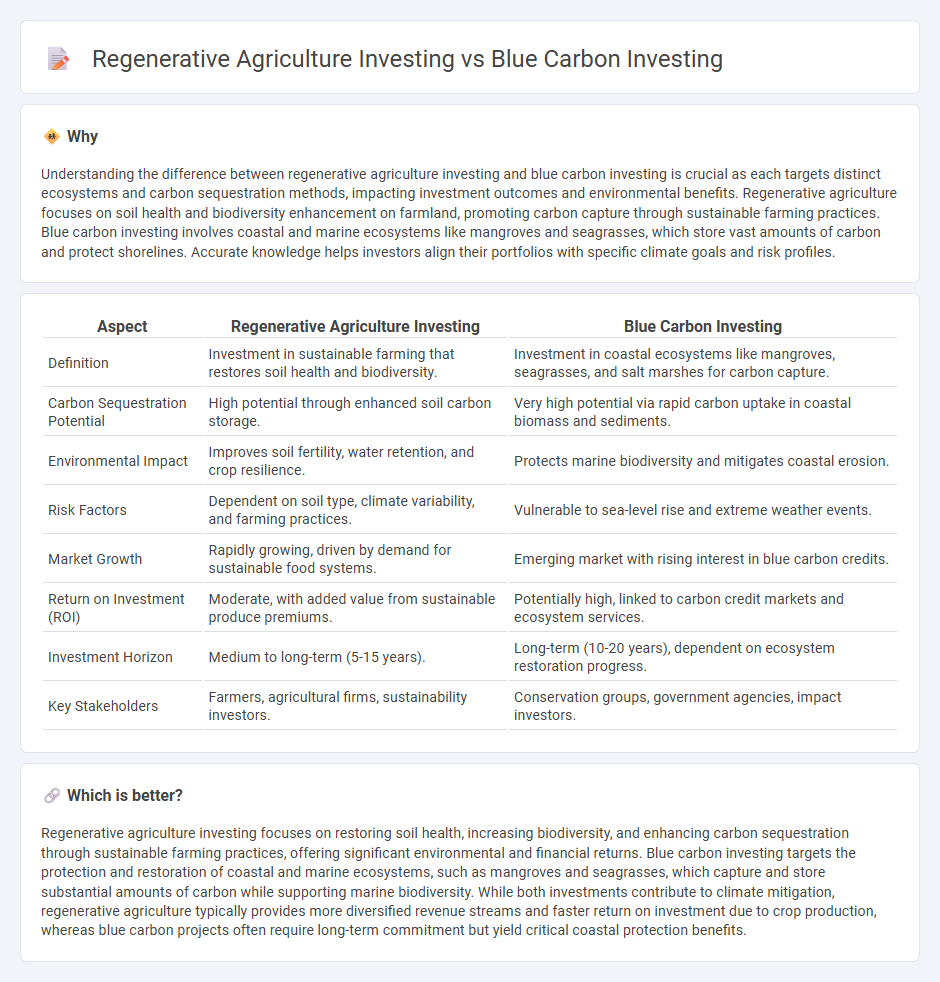

Understanding the difference between regenerative agriculture investing and blue carbon investing is crucial as each targets distinct ecosystems and carbon sequestration methods, impacting investment outcomes and environmental benefits. Regenerative agriculture focuses on soil health and biodiversity enhancement on farmland, promoting carbon capture through sustainable farming practices. Blue carbon investing involves coastal and marine ecosystems like mangroves and seagrasses, which store vast amounts of carbon and protect shorelines. Accurate knowledge helps investors align their portfolios with specific climate goals and risk profiles.

Comparison Table

| Aspect | Regenerative Agriculture Investing | Blue Carbon Investing |

|---|---|---|

| Definition | Investment in sustainable farming that restores soil health and biodiversity. | Investment in coastal ecosystems like mangroves, seagrasses, and salt marshes for carbon capture. |

| Carbon Sequestration Potential | High potential through enhanced soil carbon storage. | Very high potential via rapid carbon uptake in coastal biomass and sediments. |

| Environmental Impact | Improves soil fertility, water retention, and crop resilience. | Protects marine biodiversity and mitigates coastal erosion. |

| Risk Factors | Dependent on soil type, climate variability, and farming practices. | Vulnerable to sea-level rise and extreme weather events. |

| Market Growth | Rapidly growing, driven by demand for sustainable food systems. | Emerging market with rising interest in blue carbon credits. |

| Return on Investment (ROI) | Moderate, with added value from sustainable produce premiums. | Potentially high, linked to carbon credit markets and ecosystem services. |

| Investment Horizon | Medium to long-term (5-15 years). | Long-term (10-20 years), dependent on ecosystem restoration progress. |

| Key Stakeholders | Farmers, agricultural firms, sustainability investors. | Conservation groups, government agencies, impact investors. |

Which is better?

Regenerative agriculture investing focuses on restoring soil health, increasing biodiversity, and enhancing carbon sequestration through sustainable farming practices, offering significant environmental and financial returns. Blue carbon investing targets the protection and restoration of coastal and marine ecosystems, such as mangroves and seagrasses, which capture and store substantial amounts of carbon while supporting marine biodiversity. While both investments contribute to climate mitigation, regenerative agriculture typically provides more diversified revenue streams and faster return on investment due to crop production, whereas blue carbon projects often require long-term commitment but yield critical coastal protection benefits.

Connection

Regenerative agriculture investing and blue carbon investing are connected through their shared focus on enhancing carbon sequestration to combat climate change while promoting ecosystem health. Investments in regenerative agriculture improve soil carbon storage on land, whereas blue carbon investing targets coastal and marine ecosystems like mangroves and seagrasses to capture carbon dioxide. Both investment strategies contribute to sustainable environmental management, carbon offsetting, and biodiversity preservation.

Key Terms

**Blue Carbon Investing:**

Blue carbon investing targets the protection and restoration of coastal and marine ecosystems like mangroves, seagrasses, and salt marshes, which sequester significant amounts of carbon and help mitigate climate change. This approach not only enhances biodiversity but also supports coastal resilience against rising sea levels and extreme weather events. Explore how blue carbon investments generate both environmental impact and financial returns in advancing climate solutions.

Coastal ecosystems

Investing in blue carbon focuses on coastal ecosystems such as mangroves, tidal marshes, and seagrasses that capture and store significant amounts of carbon, playing a crucial role in climate mitigation and biodiversity conservation. Regenerative agriculture, while primarily land-based and aimed at enhancing soil health and carbon sequestration, has a complementary but distinct impact on terrestrial ecosystems rather than coastal zones. Explore the synergies and specific benefits of blue carbon projects in coastal ecosystems to maximize environmental and economic returns.

Carbon sequestration

Blue carbon investing targets coastal and marine ecosystems such as mangroves, salt marshes, and seagrasses to maximize carbon sequestration through natural processes that trap carbon in plant biomass and sediments. Regenerative agriculture investing emphasizes soil health and biodiversity to enhance carbon storage in terrestrial ecosystems by using techniques such as cover cropping, reduced tillage, and crop rotation. Explore the comparative impacts and opportunities of these innovative investments to support climate resilience and sustainable development.

Source and External Links

What are Blue Carbon Credits? Everything You Need to Know - Blue carbon investing involves putting money into projects that conserve or restore coastal ecosystems like mangroves and seagrass, either through direct project investment or by buying blue carbon credits on voluntary carbon markets, with corporate participants including Microsoft and Shell, although natural and regulatory risks exist.

Opportunities for BLUE CARBON FINANCE in coastal ecosystems - Blue carbon projects are expected to generate higher-value carbon credits compared to generic forest projects, with prices driven by corporate net-zero commitments and growing demand, offering a cost-effective nature-based solution for GHG reduction and an emerging investment opportunity.

Why we need to expand the horizons of blue carbon projects - Innovative blue carbon investing emphasizes not just carbon offsets but also community benefits and ecosystem services, making smaller projects financially viable by integrating local livelihoods and food security, especially in areas challenged by limited large restoration sites.

dowidth.com

dowidth.com