Fractional real estate offers investors the opportunity to purchase partial ownership in individual properties, enabling diversified portfolios with lower capital requirements. Commercial real estate funds pool capital from multiple investors to invest in large-scale properties, providing professional management and reduced individual risk exposure. Explore how each option aligns with your investment goals to make informed decisions.

Why it is important

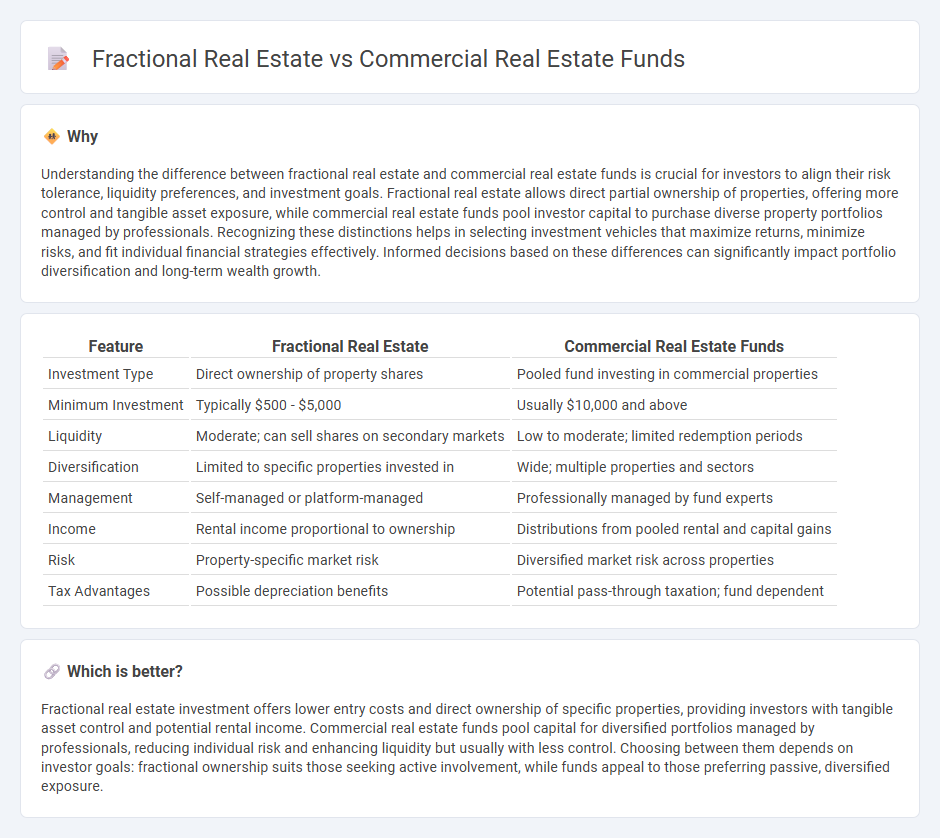

Understanding the difference between fractional real estate and commercial real estate funds is crucial for investors to align their risk tolerance, liquidity preferences, and investment goals. Fractional real estate allows direct partial ownership of properties, offering more control and tangible asset exposure, while commercial real estate funds pool investor capital to purchase diverse property portfolios managed by professionals. Recognizing these distinctions helps in selecting investment vehicles that maximize returns, minimize risks, and fit individual financial strategies effectively. Informed decisions based on these differences can significantly impact portfolio diversification and long-term wealth growth.

Comparison Table

| Feature | Fractional Real Estate | Commercial Real Estate Funds |

|---|---|---|

| Investment Type | Direct ownership of property shares | Pooled fund investing in commercial properties |

| Minimum Investment | Typically $500 - $5,000 | Usually $10,000 and above |

| Liquidity | Moderate; can sell shares on secondary markets | Low to moderate; limited redemption periods |

| Diversification | Limited to specific properties invested in | Wide; multiple properties and sectors |

| Management | Self-managed or platform-managed | Professionally managed by fund experts |

| Income | Rental income proportional to ownership | Distributions from pooled rental and capital gains |

| Risk | Property-specific market risk | Diversified market risk across properties |

| Tax Advantages | Possible depreciation benefits | Potential pass-through taxation; fund dependent |

Which is better?

Fractional real estate investment offers lower entry costs and direct ownership of specific properties, providing investors with tangible asset control and potential rental income. Commercial real estate funds pool capital for diversified portfolios managed by professionals, reducing individual risk and enhancing liquidity but usually with less control. Choosing between them depends on investor goals: fractional ownership suits those seeking active involvement, while funds appeal to those preferring passive, diversified exposure.

Connection

Fractional real estate enables investors to buy partial ownership in commercial real estate funds, increasing accessibility to high-value properties. Commercial real estate funds pool capital from multiple investors to acquire and manage income-generating properties, distributing returns proportionally. This connection democratizes real estate investment, diversifies portfolios, and enhances liquidity for investors.

Key Terms

Ownership Structure

Commercial real estate funds pool capital from multiple investors to collectively own and manage large properties, offering diversified exposure but limited individual control. Fractional real estate involves investors directly owning a percentage share of a specific property, providing clearer ownership rights and potentially greater transparency. Explore the differences in ownership structure to determine which investment model aligns best with your financial goals.

Liquidity

Commercial real estate funds typically offer higher liquidity than direct property investments as they allow investors to buy and sell shares on secondary markets more easily. Fractional real estate investments provide partial ownership in properties but often come with longer lock-up periods and limited exit options, reducing liquidity. Explore detailed comparisons to understand how liquidity impacts your real estate investment strategy.

Minimum Investment

Commercial real estate funds typically require minimum investments ranging from $25,000 to $100,000, making them accessible primarily to accredited investors. Fractional real estate platforms often lower entry barriers with minimum investments as low as $500, allowing broader market participation. Explore detailed comparisons to identify which investment model aligns best with your budget and goals.

Source and External Links

Commercial Real Estate Fund by Wellings Capital - Offers professionally managed, diversified real estate portfolios with potential income and capital appreciation through commercial properties.

Fundrise Real Estate - Provides access to private real estate investments, offering a portfolio of residential and eCommerce-centric industrial assets.

KKR Real Estate - Presents a global integrated platform for real estate investing, offering debt and equity solutions across various market conditions.

dowidth.com

dowidth.com