Fractional farmland ownership allows investors to acquire a share of productive agricultural land, benefiting from crop yields and land appreciation without managing day-to-day operations. Urban real estate tokens offer a digital stake in city properties, providing liquidity and easy transferability on blockchain platforms. Explore how these innovative investment options can diversify your portfolio and maximize returns.

Why it is important

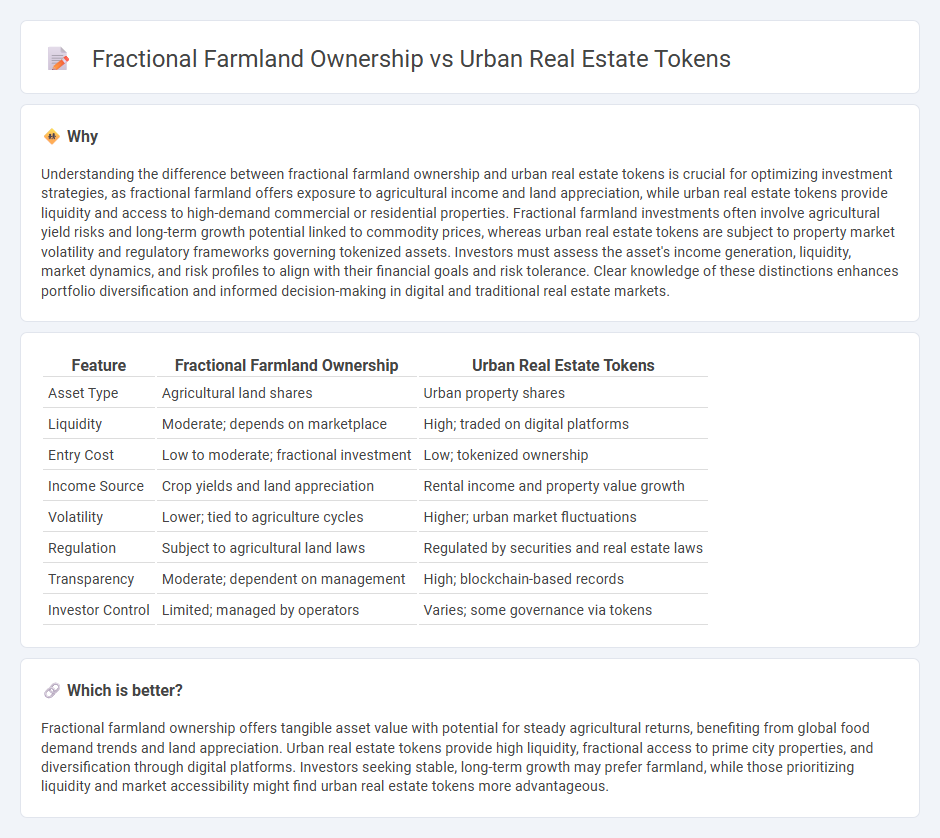

Understanding the difference between fractional farmland ownership and urban real estate tokens is crucial for optimizing investment strategies, as fractional farmland offers exposure to agricultural income and land appreciation, while urban real estate tokens provide liquidity and access to high-demand commercial or residential properties. Fractional farmland investments often involve agricultural yield risks and long-term growth potential linked to commodity prices, whereas urban real estate tokens are subject to property market volatility and regulatory frameworks governing tokenized assets. Investors must assess the asset's income generation, liquidity, market dynamics, and risk profiles to align with their financial goals and risk tolerance. Clear knowledge of these distinctions enhances portfolio diversification and informed decision-making in digital and traditional real estate markets.

Comparison Table

| Feature | Fractional Farmland Ownership | Urban Real Estate Tokens |

|---|---|---|

| Asset Type | Agricultural land shares | Urban property shares |

| Liquidity | Moderate; depends on marketplace | High; traded on digital platforms |

| Entry Cost | Low to moderate; fractional investment | Low; tokenized ownership |

| Income Source | Crop yields and land appreciation | Rental income and property value growth |

| Volatility | Lower; tied to agriculture cycles | Higher; urban market fluctuations |

| Regulation | Subject to agricultural land laws | Regulated by securities and real estate laws |

| Transparency | Moderate; dependent on management | High; blockchain-based records |

| Investor Control | Limited; managed by operators | Varies; some governance via tokens |

Which is better?

Fractional farmland ownership offers tangible asset value with potential for steady agricultural returns, benefiting from global food demand trends and land appreciation. Urban real estate tokens provide high liquidity, fractional access to prime city properties, and diversification through digital platforms. Investors seeking stable, long-term growth may prefer farmland, while those prioritizing liquidity and market accessibility might find urban real estate tokens more advantageous.

Connection

Fractional farmland ownership and urban real estate tokens both leverage blockchain technology to democratize access to high-value property markets by dividing assets into smaller, tradable units. These digital tokens increase liquidity and transparency, enabling investors to diversify portfolios with fractional stakes in farmland and urban properties. By reducing entry barriers, fractional ownership and real estate tokens enhance affordability and broaden investor participation across agricultural and urban real estate sectors.

Key Terms

Liquidity

Urban real estate tokens offer enhanced liquidity by enabling investors to trade assets on secondary markets quickly, often with lower entry barriers and minimal transaction costs. Fractional farmland ownership typically involves longer lock-up periods and limited market options, making liquidity less accessible despite potential steady income streams from agricultural yields. Explore how liquidity differences impact investment strategies between these asset classes.

Regulatory compliance

Urban real estate tokens operate within a dynamic regulatory environment shaped by securities laws and digital asset regulations, requiring adherence to frameworks like the SEC's guidelines and AML/KYC protocols. Fractional farmland ownership also demands compliance with agricultural land use regulations, environmental standards, and specific state property laws, often involving additional approvals for agricultural activities. Explore further to understand the nuanced regulatory landscapes governing these innovative investment models.

Asset yield

Urban real estate tokens typically offer higher liquidity and quicker asset yield through rental income and property appreciation in densely populated areas. Fractional farmland ownership provides steady, long-term returns derived from crop production and land value growth, often linked to sustainable agricultural practices. Discover how these asset classes compare in yield potential and investment strategy by exploring detailed market analyses.

Source and External Links

Real Estate Tokenization: Transforming Property Investment - Real estate tokenization converts properties into digital tokens representing fractional ownership or economic rights, enabling more direct investment and simplified trading on blockchain platforms through smart contracts managing dividends and transfers.

Leading Real Estate Tokenization Platforms of 2025 - Tokenization breaks down physical real estate into blockchain-based digital tokens that represent fractional ownership, with processes including asset valuation, legal structuring, token creation, and trading on secondary markets.

Real estate tokenization: what is it and how does it work? - Urban real estate tokens often do not confer legal ownership but grant economic rights to returns such as rent or sales profit, allowing investors liquidity and accessibility to property investments through digital tokens on blockchain.

dowidth.com

dowidth.com