Art tokenization transforms tangible artworks into digital shares, enabling fractional ownership and access to a broader investor base. Cryptocurrency operates as a decentralized digital currency, primarily used for peer-to-peer transactions and speculative investment. Explore the key differences and benefits of art tokenization versus cryptocurrency to enhance your investment strategy.

Why it is important

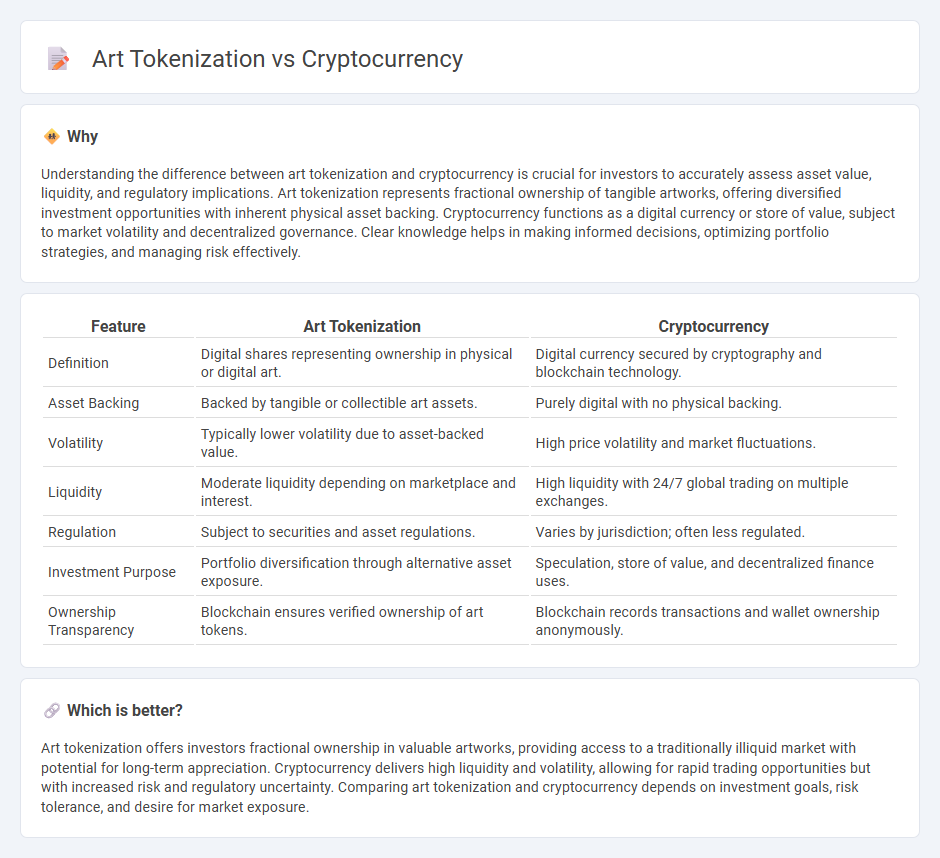

Understanding the difference between art tokenization and cryptocurrency is crucial for investors to accurately assess asset value, liquidity, and regulatory implications. Art tokenization represents fractional ownership of tangible artworks, offering diversified investment opportunities with inherent physical asset backing. Cryptocurrency functions as a digital currency or store of value, subject to market volatility and decentralized governance. Clear knowledge helps in making informed decisions, optimizing portfolio strategies, and managing risk effectively.

Comparison Table

| Feature | Art Tokenization | Cryptocurrency |

|---|---|---|

| Definition | Digital shares representing ownership in physical or digital art. | Digital currency secured by cryptography and blockchain technology. |

| Asset Backing | Backed by tangible or collectible art assets. | Purely digital with no physical backing. |

| Volatility | Typically lower volatility due to asset-backed value. | High price volatility and market fluctuations. |

| Liquidity | Moderate liquidity depending on marketplace and interest. | High liquidity with 24/7 global trading on multiple exchanges. |

| Regulation | Subject to securities and asset regulations. | Varies by jurisdiction; often less regulated. |

| Investment Purpose | Portfolio diversification through alternative asset exposure. | Speculation, store of value, and decentralized finance uses. |

| Ownership Transparency | Blockchain ensures verified ownership of art tokens. | Blockchain records transactions and wallet ownership anonymously. |

Which is better?

Art tokenization offers investors fractional ownership in valuable artworks, providing access to a traditionally illiquid market with potential for long-term appreciation. Cryptocurrency delivers high liquidity and volatility, allowing for rapid trading opportunities but with increased risk and regulatory uncertainty. Comparing art tokenization and cryptocurrency depends on investment goals, risk tolerance, and desire for market exposure.

Connection

Art tokenization leverages blockchain technology to convert physical artworks into digital tokens, enabling fractional ownership and increased liquidity in the art market. Cryptocurrency facilitates seamless, secure transactions for these tokens, allowing investors to buy, sell, or trade art assets globally without traditional intermediaries. This integration enhances transparency, reduces transaction costs, and opens new avenues for alternative investments in the digital economy.

Key Terms

Blockchain

Blockchain technology enables both cryptocurrency transactions and art tokenization by providing a decentralized and immutable ledger. Cryptocurrency leverages blockchain for secure peer-to-peer payments, while art tokenization uses the same technology to create verifiable digital ownership of artwork through non-fungible tokens (NFTs). Explore how blockchain reshapes finance and the art market by unlocking new opportunities for transparency and asset liquidity.

Non-Fungible Token (NFT)

Cryptocurrency primarily functions as a digital medium of exchange secured by blockchain technology, whereas art tokenization uses Non-Fungible Tokens (NFTs) to represent unique ownership of digital or physical artworks, enabling provenance and fractional ownership. NFTs, unlike fungible cryptocurrencies such as Bitcoin or Ethereum, are indivisible and have unique metadata that guarantees the authenticity and rarity of each art piece. Explore how NFTs are revolutionizing the art market by enhancing liquidity, accessibility, and creator royalties.

Liquidity

Cryptocurrency offers high liquidity due to its digital nature and global exchanges that allow quick buying and selling around the clock. Art tokenization provides liquidity to traditionally illiquid art assets by converting ownership into tradeable digital tokens on blockchain platforms. Explore how liquidity varies between these innovative asset classes and their impact on investment strategies.

Source and External Links

What is Cryptocurrency and How Does it Work? - Kaspersky - Cryptocurrency is a digital payment system that enables peer-to-peer transactions without banks, using encryption and a decentralized public ledger called blockchain to secure and record transfers.

Cryptocurrency - Wikipedia - A cryptocurrency is a digital currency operating on a decentralized computer network, with ownership and transactions recorded on a blockchain, not relying on any central authority for issuance or regulation.

Digital Currencies | Explainer | Education - Reserve Bank of Australia - Cryptocurrencies are digital tokens used for direct online payments, with value determined by market demand rather than government backing, and are known for high price volatility and speculative trading activity.

dowidth.com

dowidth.com