Whisky cask investment offers tangible asset growth through aging premium Scotch, often yielding increased value as casks mature and rare editions become scarce, while comic book investment capitalizes on the increasing demand for vintage and rare editions within a thriving collector's market. Both asset classes provide alternative investment opportunities with unique risks and potential returns tied to market trends, rarity, and condition. Discover which investment aligns best with your portfolio goals and risk tolerance.

Why it is important

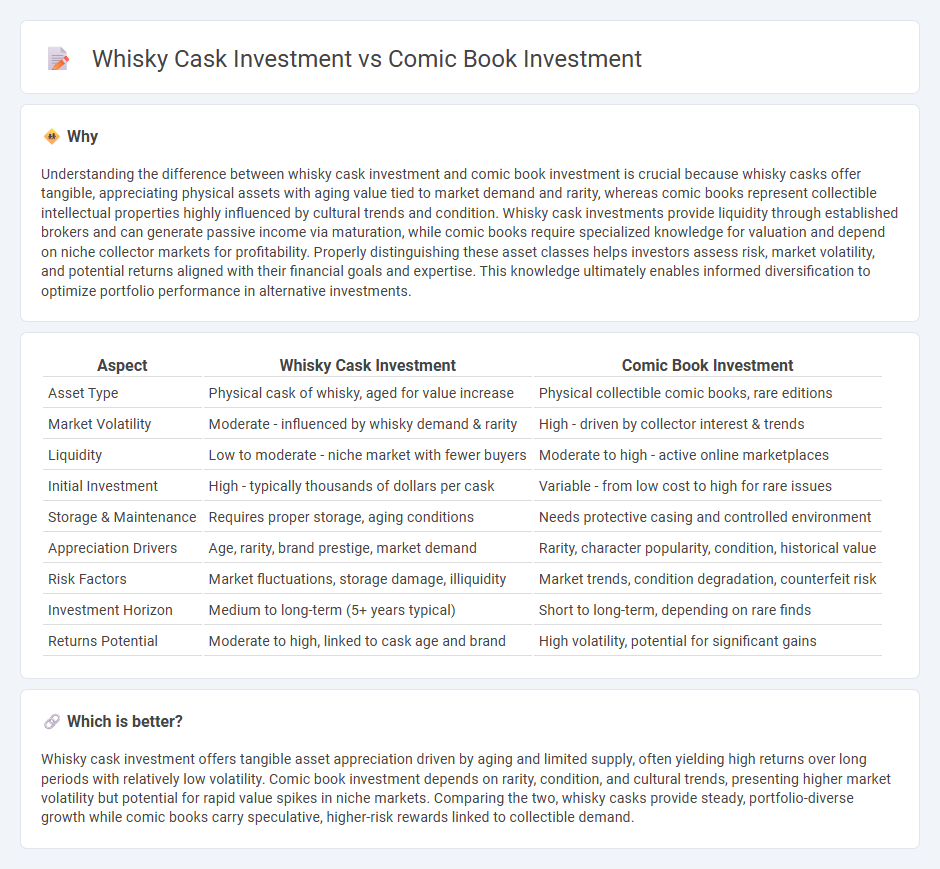

Understanding the difference between whisky cask investment and comic book investment is crucial because whisky casks offer tangible, appreciating physical assets with aging value tied to market demand and rarity, whereas comic books represent collectible intellectual properties highly influenced by cultural trends and condition. Whisky cask investments provide liquidity through established brokers and can generate passive income via maturation, while comic books require specialized knowledge for valuation and depend on niche collector markets for profitability. Properly distinguishing these asset classes helps investors assess risk, market volatility, and potential returns aligned with their financial goals and expertise. This knowledge ultimately enables informed diversification to optimize portfolio performance in alternative investments.

Comparison Table

| Aspect | Whisky Cask Investment | Comic Book Investment |

|---|---|---|

| Asset Type | Physical cask of whisky, aged for value increase | Physical collectible comic books, rare editions |

| Market Volatility | Moderate - influenced by whisky demand & rarity | High - driven by collector interest & trends |

| Liquidity | Low to moderate - niche market with fewer buyers | Moderate to high - active online marketplaces |

| Initial Investment | High - typically thousands of dollars per cask | Variable - from low cost to high for rare issues |

| Storage & Maintenance | Requires proper storage, aging conditions | Needs protective casing and controlled environment |

| Appreciation Drivers | Age, rarity, brand prestige, market demand | Rarity, character popularity, condition, historical value |

| Risk Factors | Market fluctuations, storage damage, illiquidity | Market trends, condition degradation, counterfeit risk |

| Investment Horizon | Medium to long-term (5+ years typical) | Short to long-term, depending on rare finds |

| Returns Potential | Moderate to high, linked to cask age and brand | High volatility, potential for significant gains |

Which is better?

Whisky cask investment offers tangible asset appreciation driven by aging and limited supply, often yielding high returns over long periods with relatively low volatility. Comic book investment depends on rarity, condition, and cultural trends, presenting higher market volatility but potential for rapid value spikes in niche markets. Comparing the two, whisky casks provide steady, portfolio-diverse growth while comic books carry speculative, higher-risk rewards linked to collectible demand.

Connection

Whisky cask investment and comic book investment both represent niche asset classes that capitalize on the growing demand for tangible collectibles with historical value. These investments rely on rarity, provenance, and market trends to appreciate over time, providing diversification beyond traditional securities. Collectors and investors benefit from the cultural significance and limited supply inherent in whisky casks and vintage comic books, driving potential long-term returns.

Key Terms

Comic book investment:

Comic book investment has surged in popularity due to the growing demand for rare, first-edition issues and iconic superhero titles, with collectors seeking high-grade copies that appreciate significantly over time. Key factors influencing value include limited print runs, cultural significance, and condition grading by certified companies like CGC, making comics a tangible alternative asset with potential for substantial returns. Explore the dynamics of comic book investment further to understand market trends and strategies for maximizing profit.

Grading

Comic book investment heavily relies on grading systems like CGC, which quantify condition from 0.5 to 10, significantly influencing market value; pristine grades can exponentially increase worth. Whisky cask investment depends on cask condition and age, with expert evaluations assessing maturation, filling level, and cask integrity to estimate value growth potential. Explore detailed grading standards and impact on returns to make informed investment decisions.

Key Issues

Comic book investment offers unique opportunities through rarity, condition grading, and iconic titles driving value, while whisky cask investment depends heavily on age, provenance, and market demand for limited or exclusive barrels. Both markets require careful authentication and storage considerations, but whisky casks can appreciate through maturation, unlike static comic books. Explore our detailed guide to understand the nuances and maximize returns in comic book and whisky cask investments.

Source and External Links

Everything You Need To Know About Investing In Comic Books - This video explains how to identify investable comic books, highlighting key metrics and showing examples of significant return on investment, such as Action Comics #1 increasing from $300,000 to over $1.6 million in 10 years, making comics a potentially lucrative but also enjoyable investment.

I buy comics as an investment... - Comic books carry long-term risk due to demographic shifts which may reduce future demand, so while picking the right books and selling at the right times can yield gains, comics are not a safe, low-risk investment for holding decades.

About $600-700 to invest in 1 comic - For a moderate budget, some suggest key modern issues like Ultimate Fallout #4 and Edge of Spider-Verse #2, and caution against store exclusives or incentive covers, emphasizing investing in comics likely to hold or increase value over time.

dowidth.com

dowidth.com