Wine funds offer investors exposure to the niche market of collectible wines, leveraging the potential for high returns through appreciation and global demand. Private equity involves investing in privately-held companies with the goal of driving growth and achieving substantial capital gains over a medium to long-term horizon. Explore the distinct advantages and risks of wine funds versus private equity to make informed investment decisions.

Why it is important

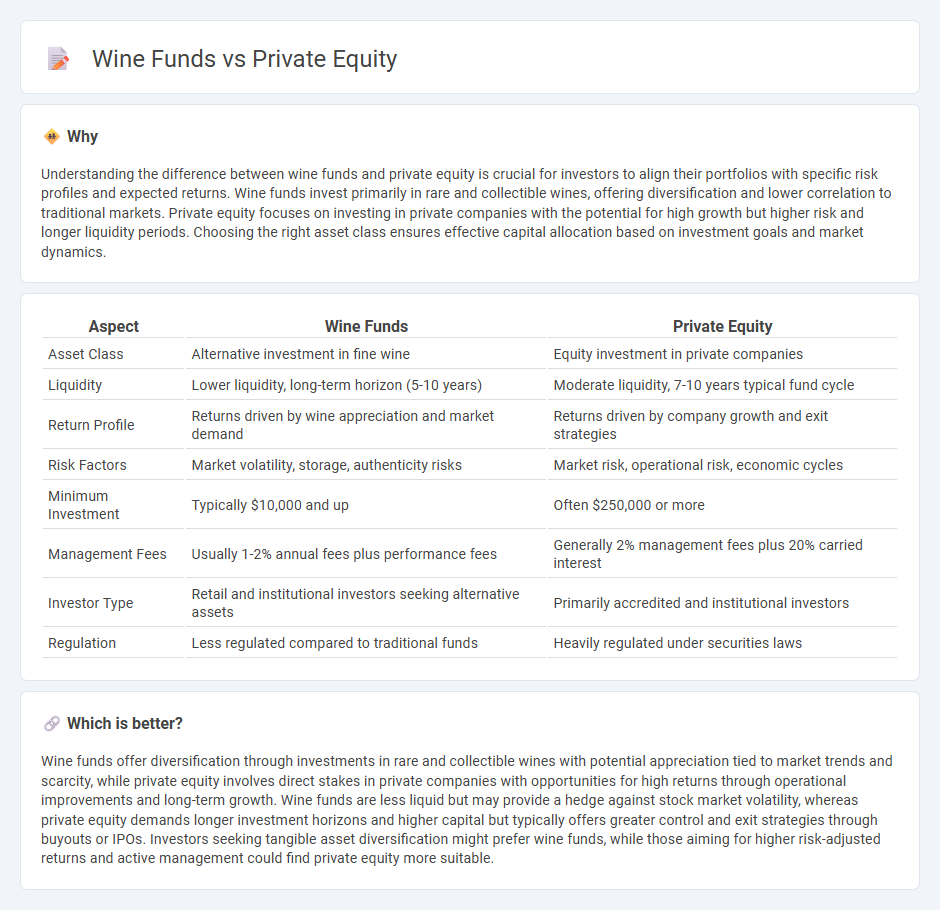

Understanding the difference between wine funds and private equity is crucial for investors to align their portfolios with specific risk profiles and expected returns. Wine funds invest primarily in rare and collectible wines, offering diversification and lower correlation to traditional markets. Private equity focuses on investing in private companies with the potential for high growth but higher risk and longer liquidity periods. Choosing the right asset class ensures effective capital allocation based on investment goals and market dynamics.

Comparison Table

| Aspect | Wine Funds | Private Equity |

|---|---|---|

| Asset Class | Alternative investment in fine wine | Equity investment in private companies |

| Liquidity | Lower liquidity, long-term horizon (5-10 years) | Moderate liquidity, 7-10 years typical fund cycle |

| Return Profile | Returns driven by wine appreciation and market demand | Returns driven by company growth and exit strategies |

| Risk Factors | Market volatility, storage, authenticity risks | Market risk, operational risk, economic cycles |

| Minimum Investment | Typically $10,000 and up | Often $250,000 or more |

| Management Fees | Usually 1-2% annual fees plus performance fees | Generally 2% management fees plus 20% carried interest |

| Investor Type | Retail and institutional investors seeking alternative assets | Primarily accredited and institutional investors |

| Regulation | Less regulated compared to traditional funds | Heavily regulated under securities laws |

Which is better?

Wine funds offer diversification through investments in rare and collectible wines with potential appreciation tied to market trends and scarcity, while private equity involves direct stakes in private companies with opportunities for high returns through operational improvements and long-term growth. Wine funds are less liquid but may provide a hedge against stock market volatility, whereas private equity demands longer investment horizons and higher capital but typically offers greater control and exit strategies through buyouts or IPOs. Investors seeking tangible asset diversification might prefer wine funds, while those aiming for higher risk-adjusted returns and active management could find private equity more suitable.

Connection

Wine funds and private equity share a common investment strategy by pooling capital to acquire high-value assets expected to appreciate over time. Both focus on long-term capital growth with portfolio diversification, leveraging expertise to manage niche markets--wine funds targeting rare vintages and private equity targeting private companies. These investment vehicles attract investors seeking alternative assets beyond traditional stocks and bonds for enhanced returns.

Key Terms

Liquidity

Private equity investments typically have long lock-up periods, restricting liquidity as capital is committed for years before returns are realized. Wine funds offer a relatively higher liquidity through periodic auctions and secondary market sales, allowing investors to exit positions sooner. Explore more insights on liquidity differences between private equity and wine funds to inform your investment strategy.

Valuation

Private equity funds primarily value companies based on cash flow multiples and earnings before interest, taxes, depreciation, and amortization (EBITDA), emphasizing financial performance and growth potential. Wine funds, however, assess vineyards and wine collectibles using rarity, provenance, vintage quality, and market demand, with valuations often influenced by auction results and expert appraisals. Explore further to understand the unique valuation metrics driving these distinct investment vehicles.

Due Diligence

Due diligence in private equity involves comprehensive financial analysis, legal reviews, and market assessments to identify risks and validate investment value. Wine funds require specialized due diligence including provenance verification, condition reports, authenticity checks, and market demand analysis for fine wines. Explore how targeted due diligence strategies optimize risk management and return potential in these distinct investment vehicles.

Source and External Links

What is Private Equity? - Private equity is medium to long-term finance provided for an equity stake in high-growth unquoted companies, involving active ownership to drive sustainable growth typically over four to seven years before exit.

Private equity - Wikipedia - Private equity involves investment managers raising funds from institutional investors to buy stakes in private companies, employing strategies like revenue growth and margin expansion to generate returns over 4-7 years.

Private Equity: What You Need to Know - KKR - Private equity fund managers invest in non-public companies to improve operations, strengthen management, develop new products, and optimize capital structure aiming for outperformance and diversification benefits.

dowidth.com

dowidth.com