Secondaries in venture capital offer investors opportunities to buy pre-existing stakes in startups, providing liquidity and portfolio diversification without waiting for an IPO or acquisition. SPACs (Special Purpose Acquisition Companies) serve as publicly traded shells that raise capital to acquire or merge with a private company, offering a faster route to public markets but often involve higher regulatory scrutiny and market volatility. Explore the differences and strategic benefits of secondaries versus SPACs to enhance your investment decisions.

Why it is important

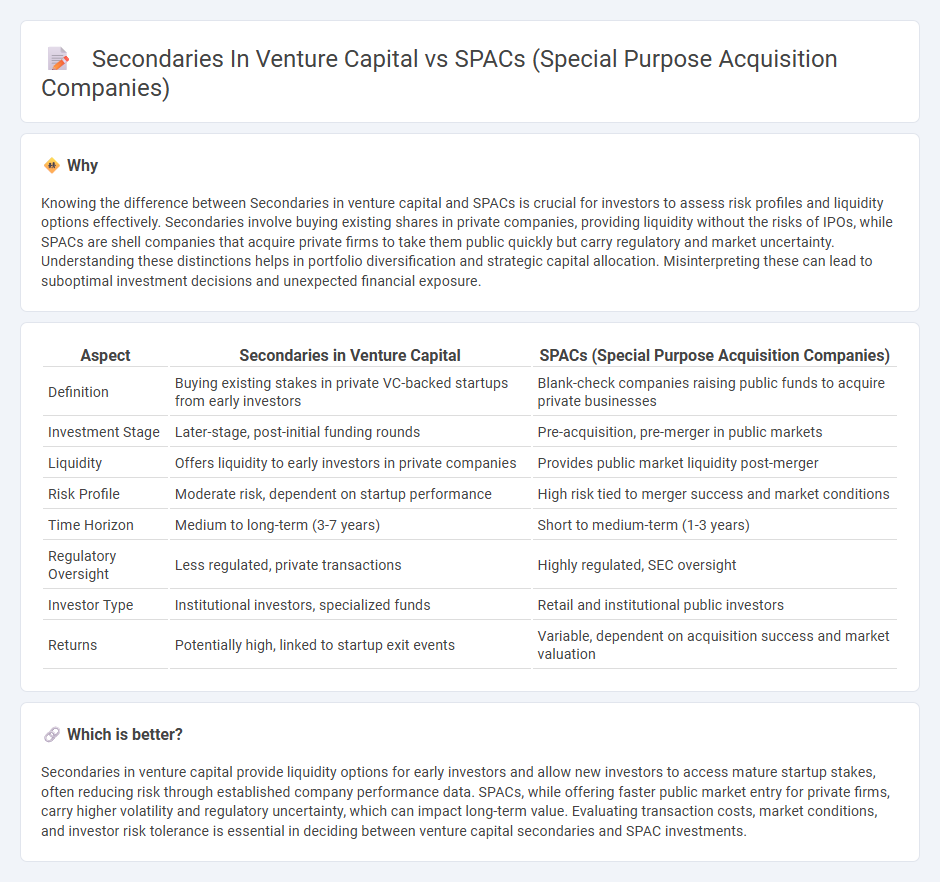

Knowing the difference between Secondaries in venture capital and SPACs is crucial for investors to assess risk profiles and liquidity options effectively. Secondaries involve buying existing shares in private companies, providing liquidity without the risks of IPOs, while SPACs are shell companies that acquire private firms to take them public quickly but carry regulatory and market uncertainty. Understanding these distinctions helps in portfolio diversification and strategic capital allocation. Misinterpreting these can lead to suboptimal investment decisions and unexpected financial exposure.

Comparison Table

| Aspect | Secondaries in Venture Capital | SPACs (Special Purpose Acquisition Companies) |

|---|---|---|

| Definition | Buying existing stakes in private VC-backed startups from early investors | Blank-check companies raising public funds to acquire private businesses |

| Investment Stage | Later-stage, post-initial funding rounds | Pre-acquisition, pre-merger in public markets |

| Liquidity | Offers liquidity to early investors in private companies | Provides public market liquidity post-merger |

| Risk Profile | Moderate risk, dependent on startup performance | High risk tied to merger success and market conditions |

| Time Horizon | Medium to long-term (3-7 years) | Short to medium-term (1-3 years) |

| Regulatory Oversight | Less regulated, private transactions | Highly regulated, SEC oversight |

| Investor Type | Institutional investors, specialized funds | Retail and institutional public investors |

| Returns | Potentially high, linked to startup exit events | Variable, dependent on acquisition success and market valuation |

Which is better?

Secondaries in venture capital provide liquidity options for early investors and allow new investors to access mature startup stakes, often reducing risk through established company performance data. SPACs, while offering faster public market entry for private firms, carry higher volatility and regulatory uncertainty, which can impact long-term value. Evaluating transaction costs, market conditions, and investor risk tolerance is essential in deciding between venture capital secondaries and SPAC investments.

Connection

Secondaries in venture capital allow investors to buy and sell pre-existing stakes in startups, providing liquidity before an exit event, which complements SPACs by offering alternative pathways for private companies to go public. SPACs raise capital through initial public offerings to acquire private firms, often including companies with secondary market activity, thereby linking liquidity mechanisms in venture investing and public markets. This connection enhances market efficiency by diversifying exit options and facilitating capital flow between private and public investment stages.

Key Terms

IPO (Initial Public Offering)

SPACs offer a streamlined IPO process by merging with private companies to facilitate faster public market entry, whereas secondaries involve the sale of existing shares by early investors before a traditional IPO. SPACs provide liquidity and capital infusion upfront, while secondaries allow founders and early backers to realize gains and adjust ownership stakes without diluting company equity. Explore deeper insights into how SPACs and secondaries reshape venture capital exit strategies through public offerings.

Liquidity Event

SPACs (Special Purpose Acquisition Companies) provide faster liquidity events by allowing private companies to go public through a merger, often resulting in quicker access to public market capital compared to traditional IPOs. Secondaries in venture capital enable early investors or employees to sell their shares on the secondary market, offering liquidity without requiring the company to go public or get acquired. Explore the nuances between SPACs and secondaries to optimize your venture capital liquidity strategy.

Valuation

SPACs often present inflated valuations driven by market hype and speculative investor demand, contrasting with secondaries where valuations derive from actual transaction data reflecting company performance and investor appetite in private markets. Secondaries in venture capital provide more transparent price discovery, as valuations emerge from negotiated share transfers, offering a clearer assessment of a startup's worth compared to the frequently optimistic SPAC pricing. Explore our detailed analysis to understand how valuation dynamics impact investment decisions between SPACs and secondaries.

Source and External Links

Special-purpose acquisition company - Wikipedia - A SPAC is a shell corporation created to raise funds through an IPO to acquire or merge with a private company, taking it public with fewer regulatory requirements than a traditional IPO process.

Finding a Better Way Forward with Special Purpose Acquisition ... - SPACs raise capital through IPOs led by sponsors who typically receive 20-25% founder shares and aim to acquire a target company within a specific timeframe to bring it public.

Special Purpose Acquisition Companies (SPAC) - SPACs typically comprise experienced managers or private equity sponsors who raise capital to acquire and operate a new public company, usually completing a transaction within 24 months.

dowidth.com

dowidth.com