Music royalties platforms offer investors access to consistent cash flows generated from song licensing, streaming, and royalties, often providing diversified income streams within the entertainment industry. Timberland investment platforms focus on long-term asset appreciation and sustainable income through timber harvests and land value growth, appealing to those interested in natural resource assets. Explore the distinct financial opportunities and risk profiles of both investment types to determine the best fit for your portfolio.

Why it is important

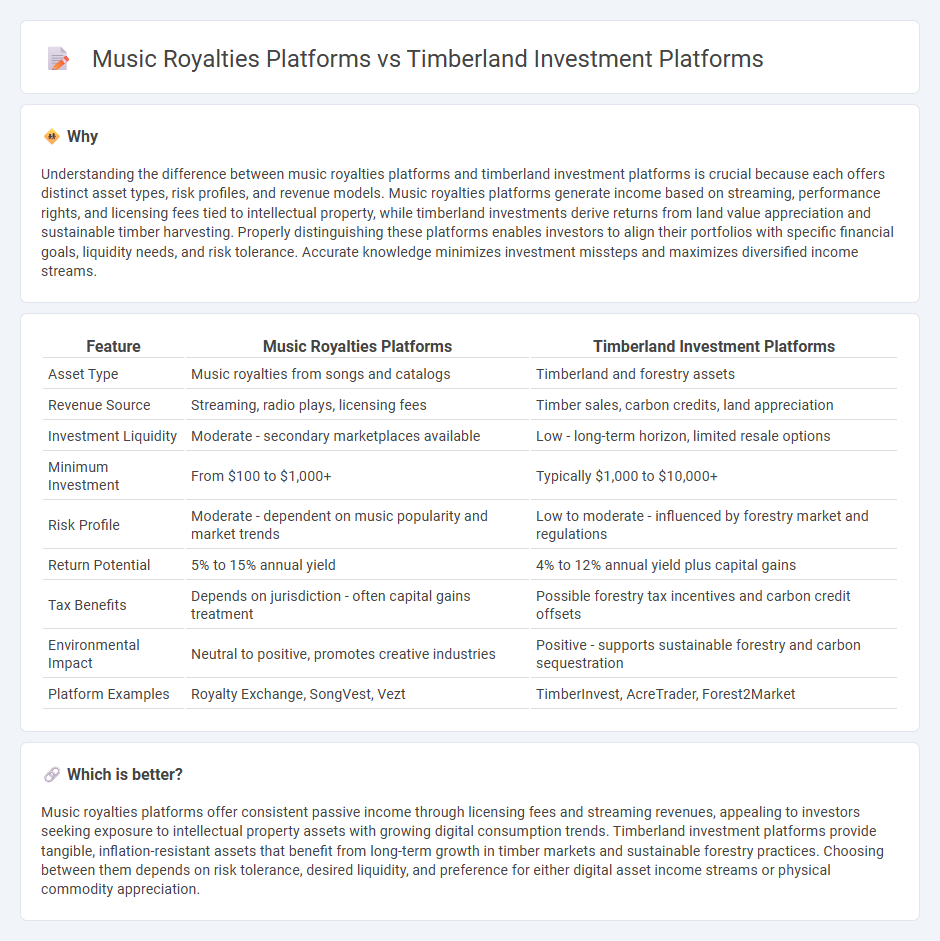

Understanding the difference between music royalties platforms and timberland investment platforms is crucial because each offers distinct asset types, risk profiles, and revenue models. Music royalties platforms generate income based on streaming, performance rights, and licensing fees tied to intellectual property, while timberland investments derive returns from land value appreciation and sustainable timber harvesting. Properly distinguishing these platforms enables investors to align their portfolios with specific financial goals, liquidity needs, and risk tolerance. Accurate knowledge minimizes investment missteps and maximizes diversified income streams.

Comparison Table

| Feature | Music Royalties Platforms | Timberland Investment Platforms |

|---|---|---|

| Asset Type | Music royalties from songs and catalogs | Timberland and forestry assets |

| Revenue Source | Streaming, radio plays, licensing fees | Timber sales, carbon credits, land appreciation |

| Investment Liquidity | Moderate - secondary marketplaces available | Low - long-term horizon, limited resale options |

| Minimum Investment | From $100 to $1,000+ | Typically $1,000 to $10,000+ |

| Risk Profile | Moderate - dependent on music popularity and market trends | Low to moderate - influenced by forestry market and regulations |

| Return Potential | 5% to 15% annual yield | 4% to 12% annual yield plus capital gains |

| Tax Benefits | Depends on jurisdiction - often capital gains treatment | Possible forestry tax incentives and carbon credit offsets |

| Environmental Impact | Neutral to positive, promotes creative industries | Positive - supports sustainable forestry and carbon sequestration |

| Platform Examples | Royalty Exchange, SongVest, Vezt | TimberInvest, AcreTrader, Forest2Market |

Which is better?

Music royalties platforms offer consistent passive income through licensing fees and streaming revenues, appealing to investors seeking exposure to intellectual property assets with growing digital consumption trends. Timberland investment platforms provide tangible, inflation-resistant assets that benefit from long-term growth in timber markets and sustainable forestry practices. Choosing between them depends on risk tolerance, desired liquidity, and preference for either digital asset income streams or physical commodity appreciation.

Connection

Music royalty platforms and timberland investment platforms both offer alternative asset investments that generate passive income streams for investors. By leveraging intellectual property rights in music or physical land assets in timberland, these platforms provide diversification beyond traditional stocks and bonds. Both utilize digital marketplaces to connect investors with revenue-generating assets, enhancing portfolio stability through consistent royalty payments or timber harvest revenues.

Key Terms

**Timberland Investment Platforms:**

Timberland investment platforms allow investors to acquire fractional ownership in sustainable forestlands, generating returns through timber sales, land appreciation, and carbon credit opportunities. These platforms emphasize long-term asset stability and environmental impact, often appealing to eco-conscious investors seeking diversification beyond traditional markets. Explore how timberland investments can balance profitability with sustainability and learn more about their unique benefits.

Land Appreciation

Timberland investment platforms primarily capitalize on land appreciation through sustainable forestry practices that increase the intrinsic value of the property over time. Music royalties platforms generate income via the continuous monetization of songs rather than asset appreciation, reflecting earnings from intellectual property rights instead of physical asset value growth. Explore the distinct financial benefits and growth potentials of these investment types to determine which matches your portfolio goals.

Sustainable Yield

Timberland investment platforms offer sustainable yield by leveraging the natural growth and carbon sequestration of forests, providing investors with steady, long-term returns and environmental benefits. Music royalties platforms generate passive income from the ongoing consumption of music content, with yield stability influenced by streaming trends and copyright longevity. Explore the comparative advantages of sustainable yields in these diverse asset classes to make informed investment decisions.

Source and External Links

Timberland | Institutional - Manulife Investment Management - Offers global, sustainable timberland investment solutions through commingled funds and individually managed accounts for institutional investors, emphasizing diversified exposure and tailored strategies.

Timberland - J.P. Morgan Asset Management - Provides access to core timberland assets worldwide with a focus on inflation hedging, regular income, portfolio diversification, and sustainable management, partnering with forestry expert Campbell Global.

Global timberland strategy - Nuveen - Seeks consistent, long-term risk-adjusted returns and regular income through a diversified portfolio of high-quality timberland assets across geographies.

dowidth.com

dowidth.com