Investing in wine cask aging offers potential returns through the appreciation of rare vintages and the intrinsic value developed during maturation, appealing to collectors and connoisseurs. Art investment, on the other hand, involves acquiring works that may appreciate based on artist reputation, rarity, and market trends, providing diversification and aesthetic value. Explore the unique advantages and risks of wine cask aging and art investment to make informed decisions tailored to your portfolio.

Why it is important

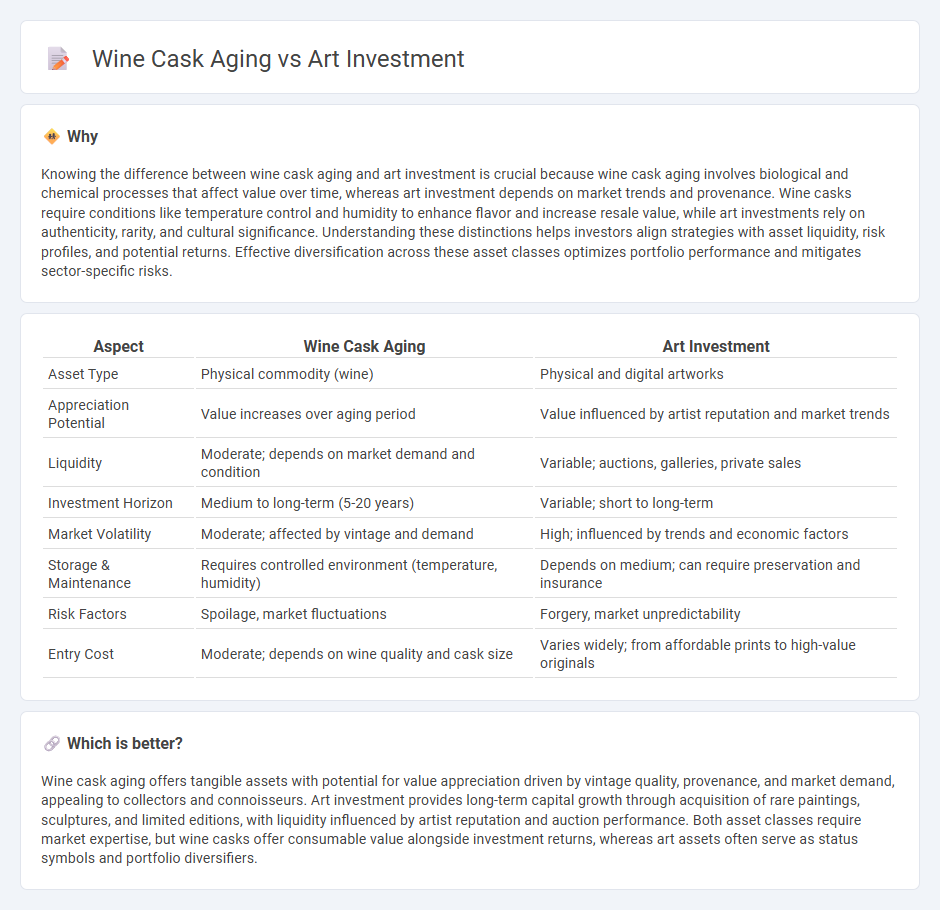

Knowing the difference between wine cask aging and art investment is crucial because wine cask aging involves biological and chemical processes that affect value over time, whereas art investment depends on market trends and provenance. Wine casks require conditions like temperature control and humidity to enhance flavor and increase resale value, while art investments rely on authenticity, rarity, and cultural significance. Understanding these distinctions helps investors align strategies with asset liquidity, risk profiles, and potential returns. Effective diversification across these asset classes optimizes portfolio performance and mitigates sector-specific risks.

Comparison Table

| Aspect | Wine Cask Aging | Art Investment |

|---|---|---|

| Asset Type | Physical commodity (wine) | Physical and digital artworks |

| Appreciation Potential | Value increases over aging period | Value influenced by artist reputation and market trends |

| Liquidity | Moderate; depends on market demand and condition | Variable; auctions, galleries, private sales |

| Investment Horizon | Medium to long-term (5-20 years) | Variable; short to long-term |

| Market Volatility | Moderate; affected by vintage and demand | High; influenced by trends and economic factors |

| Storage & Maintenance | Requires controlled environment (temperature, humidity) | Depends on medium; can require preservation and insurance |

| Risk Factors | Spoilage, market fluctuations | Forgery, market unpredictability |

| Entry Cost | Moderate; depends on wine quality and cask size | Varies widely; from affordable prints to high-value originals |

Which is better?

Wine cask aging offers tangible assets with potential for value appreciation driven by vintage quality, provenance, and market demand, appealing to collectors and connoisseurs. Art investment provides long-term capital growth through acquisition of rare paintings, sculptures, and limited editions, with liquidity influenced by artist reputation and auction performance. Both asset classes require market expertise, but wine casks offer consumable value alongside investment returns, whereas art assets often serve as status symbols and portfolio diversifiers.

Connection

Wine cask aging and art investment share the principle of value appreciation through time and rarity, as well as the cultivation of expert knowledge to evaluate unique assets. Both require specialized markets where authenticity, provenance, and scarcity drive demand and influence pricing trends. Investors leverage these tangible assets to diversify portfolios, hedge against inflation, and capitalize on cultural and aesthetic appreciation.

Key Terms

**Art Investment:**

Art investment offers long-term value appreciation fueled by rarity, cultural significance, and market demand, differentiating it from tangible asset classes like wine cask aging. Art pieces often benefit from global auctions and increased collector interest, contributing to portfolio diversification and potential high returns. Explore more insights on how art investment can enhance your wealth strategy.

Provenance

Art investment relies heavily on provenance to verify authenticity, establish historical relevance, and enhance market value, ensuring buyers can trust the artwork's legitimacy. In wine cask aging, provenance documents the origin, grape variety, and storage conditions, maintaining quality assurance and traceability throughout the maturation process. Explore further to understand how provenance critically impacts investment security in both art and wine cask aging.

Authenticity

Art investment offers tangible authenticity through provenance, artist reputation, and historical significance, providing collectors with verified uniqueness that can appreciate over time. Wine cask aging delivers authenticity via traditional craftsmanship, terroir expression, and natural maturation processes, which imbue the wine with distinct sensory and cultural value. Explore the nuanced authenticity in both assets to make informed investment decisions.

Source and External Links

Basics of Art Funds and their Managers - Art funds are privately offered investment funds aiming for returns through buying and selling art, using strategies like geographic arbitrage, period focus, emerging artists, and providing portfolio diversification and inflation hedging benefits.

Investing in art: What to know about turning a passion into a ... - Art investment offers portfolio diversification, inflation protection, and potential high returns but carries risks such as lack of liquidity, valuation subjectivity, and dependency on provenance and market trends.

Invest in Art - Own Shares in Masterpieces - Yieldstreet - Yieldstreet provides fractional ownership opportunities in contemporary fine art through art equity funds, offering access to a diversified pool of artworks with historical returns outperforming traditional markets.

dowidth.com

dowidth.com