Crypto staking involves locking digital assets in a blockchain network to support operations and earn rewards, offering passive income with varying levels of risk. Peer-to-peer lending connects borrowers directly with investors, facilitating loans without traditional financial intermediaries, often yielding higher returns but with potential credit risks. Explore the unique benefits and considerations of crypto staking and peer-to-peer lending to optimize your investment strategy.

Why it is important

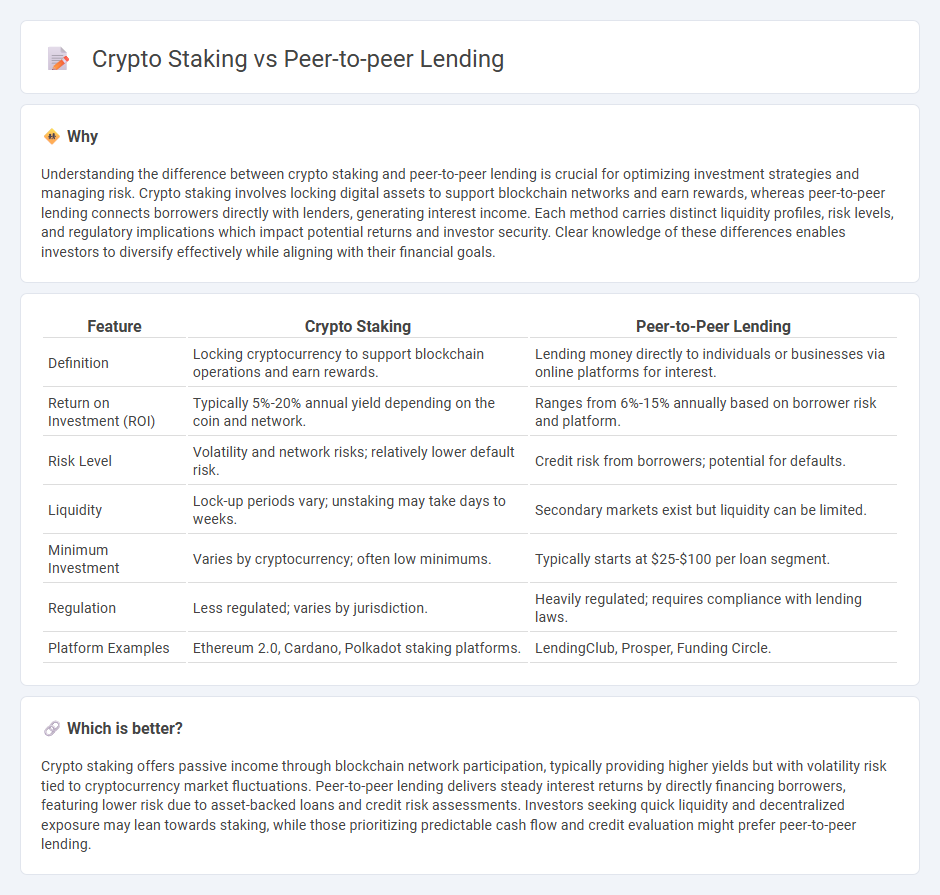

Understanding the difference between crypto staking and peer-to-peer lending is crucial for optimizing investment strategies and managing risk. Crypto staking involves locking digital assets to support blockchain networks and earn rewards, whereas peer-to-peer lending connects borrowers directly with lenders, generating interest income. Each method carries distinct liquidity profiles, risk levels, and regulatory implications which impact potential returns and investor security. Clear knowledge of these differences enables investors to diversify effectively while aligning with their financial goals.

Comparison Table

| Feature | Crypto Staking | Peer-to-Peer Lending |

|---|---|---|

| Definition | Locking cryptocurrency to support blockchain operations and earn rewards. | Lending money directly to individuals or businesses via online platforms for interest. |

| Return on Investment (ROI) | Typically 5%-20% annual yield depending on the coin and network. | Ranges from 6%-15% annually based on borrower risk and platform. |

| Risk Level | Volatility and network risks; relatively lower default risk. | Credit risk from borrowers; potential for defaults. |

| Liquidity | Lock-up periods vary; unstaking may take days to weeks. | Secondary markets exist but liquidity can be limited. |

| Minimum Investment | Varies by cryptocurrency; often low minimums. | Typically starts at $25-$100 per loan segment. |

| Regulation | Less regulated; varies by jurisdiction. | Heavily regulated; requires compliance with lending laws. |

| Platform Examples | Ethereum 2.0, Cardano, Polkadot staking platforms. | LendingClub, Prosper, Funding Circle. |

Which is better?

Crypto staking offers passive income through blockchain network participation, typically providing higher yields but with volatility risk tied to cryptocurrency market fluctuations. Peer-to-peer lending delivers steady interest returns by directly financing borrowers, featuring lower risk due to asset-backed loans and credit risk assessments. Investors seeking quick liquidity and decentralized exposure may lean towards staking, while those prioritizing predictable cash flow and credit evaluation might prefer peer-to-peer lending.

Connection

Crypto staking and peer-to-peer lending both leverage blockchain technology to enable decentralized financial opportunities, allowing users to earn passive income through digital asset participation. Staking involves locking cryptocurrencies to support network operations and earn rewards, while peer-to-peer lending facilitates direct loans between individuals, bypassing traditional financial institutions. Both methods reduce reliance on centralized intermediaries and offer increased transparency, security, and accessibility in investment portfolios.

Key Terms

Interest Rate

Interest rates in peer-to-peer lending typically range from 6% to 12%, offering predictable returns based on borrower creditworthiness and loan terms, while crypto staking yields vary widely from 5% to over 20%, influenced by network participation and token volatility. P2P lending involves lending capital directly to individuals or businesses through a platform, ensuring more stable but moderate income. Explore detailed comparisons to determine which option maximizes your passive income potential.

Risk

Peer-to-peer lending carries risks such as borrower default, platform insolvency, and limited liquidity, while crypto staking exposes investors to market volatility, protocol vulnerabilities, and potential loss of staked assets during slashing events. Both investment methods require thorough understanding of underlying mechanisms and risk mitigation strategies to protect capital. Explore detailed analyses to discern which risk profile aligns best with your investment goals.

Liquidity

Peer-to-peer lending offers variable liquidity depending on loan terms, often requiring borrowers to lock funds for fixed durations, whereas crypto staking liquidity varies by blockchain protocols and can be limited during lock-up periods. Staking enables earning rewards while potentially facing delays in fund withdrawal, contrasting with the often more predictable cash flow from peer-to-peer loan repayments. Explore detailed comparisons of liquidity dynamics between peer-to-peer lending and crypto staking to optimize your investment strategy.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work | Equifax - Peer-to-peer (P2P) lending allows individuals to borrow money directly from individual investors through specialized online platforms, bypassing traditional banks or financial institutions.

Peer-to-peer lending - Wikipedia - P2P lending is the practice of lending money to individuals or businesses via online platforms that match lenders with borrowers, often with flexible loan terms and without the need for prior relationships between the parties involved.

Peer to peer lending: what you need to know - MoneyHelper - Peer-to-peer lending websites act as marketplaces where lenders can earn interest by lending money directly to individuals or businesses, offering higher returns than traditional savings but with increased risk.

dowidth.com

dowidth.com