Royalty rights investing offers investors a share of revenue generated from intellectual property or natural resources, providing income linked directly to asset performance rather than fixed returns. Fixed income securities, such as bonds, deliver predictable interest payments and principal repayment, emphasizing capital preservation and steady cash flow. Explore the unique benefits and risks of each option to enhance your investment strategy.

Why it is important

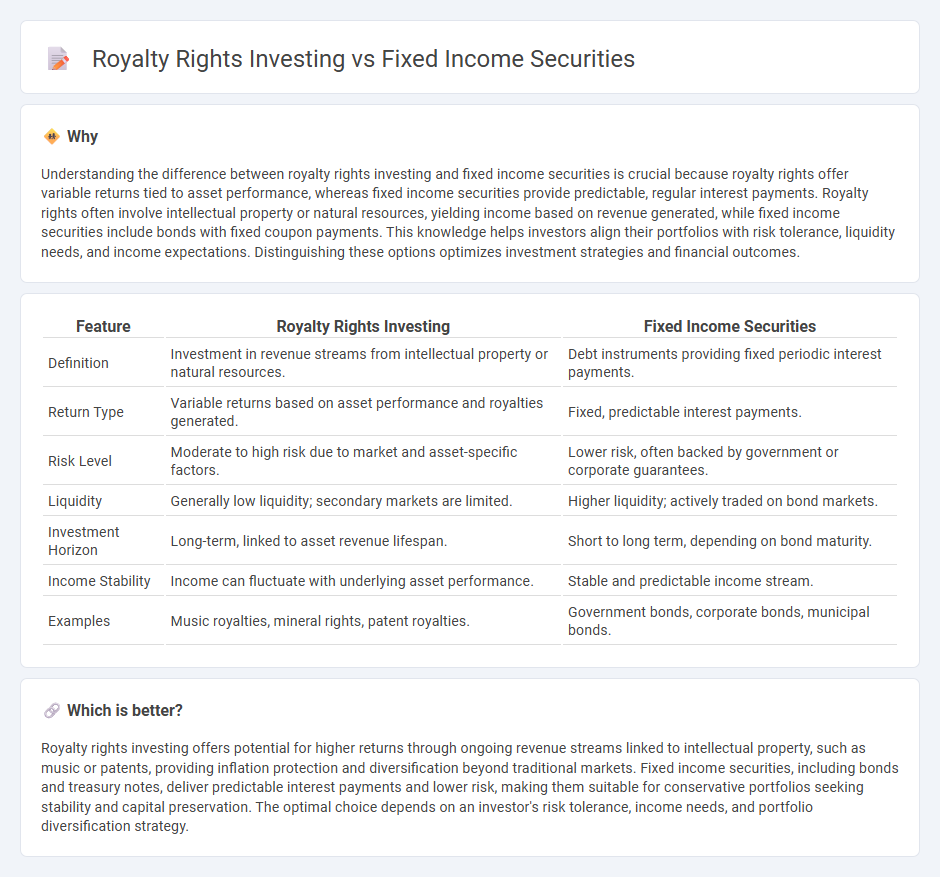

Understanding the difference between royalty rights investing and fixed income securities is crucial because royalty rights offer variable returns tied to asset performance, whereas fixed income securities provide predictable, regular interest payments. Royalty rights often involve intellectual property or natural resources, yielding income based on revenue generated, while fixed income securities include bonds with fixed coupon payments. This knowledge helps investors align their portfolios with risk tolerance, liquidity needs, and income expectations. Distinguishing these options optimizes investment strategies and financial outcomes.

Comparison Table

| Feature | Royalty Rights Investing | Fixed Income Securities |

|---|---|---|

| Definition | Investment in revenue streams from intellectual property or natural resources. | Debt instruments providing fixed periodic interest payments. |

| Return Type | Variable returns based on asset performance and royalties generated. | Fixed, predictable interest payments. |

| Risk Level | Moderate to high risk due to market and asset-specific factors. | Lower risk, often backed by government or corporate guarantees. |

| Liquidity | Generally low liquidity; secondary markets are limited. | Higher liquidity; actively traded on bond markets. |

| Investment Horizon | Long-term, linked to asset revenue lifespan. | Short to long term, depending on bond maturity. |

| Income Stability | Income can fluctuate with underlying asset performance. | Stable and predictable income stream. |

| Examples | Music royalties, mineral rights, patent royalties. | Government bonds, corporate bonds, municipal bonds. |

Which is better?

Royalty rights investing offers potential for higher returns through ongoing revenue streams linked to intellectual property, such as music or patents, providing inflation protection and diversification beyond traditional markets. Fixed income securities, including bonds and treasury notes, deliver predictable interest payments and lower risk, making them suitable for conservative portfolios seeking stability and capital preservation. The optimal choice depends on an investor's risk tolerance, income needs, and portfolio diversification strategy.

Connection

Royalty rights investing and fixed income securities are connected through their ability to provide predictable income streams; royalty rights generate ongoing payments from intellectual property or natural resources, similar to how fixed income securities offer regular interest payments. Both investment types attract investors seeking stable cash flows with lower volatility compared to equities. This connection highlights their role in diversified portfolios aiming to balance risk and income consistency.

Key Terms

Coupon Rate

Fixed income securities typically offer a fixed coupon rate, providing predictable income streams to investors through periodic interest payments. In contrast, royalty rights investing yields income based on the revenue generated by an underlying asset, resulting in variable returns without a fixed coupon rate. Explore the distinct risk and return profiles of both to optimize your investment strategy.

Yield to Maturity

Fixed income securities offer a predictable Yield to Maturity (YTM) based on fixed coupon payments and principal repayment at maturity, providing investors with a clear income forecast. Royalty rights investing generates returns through a percentage of revenue from underlying assets, where yield depends on asset performance and market demand rather than fixed schedules. Explore the nuances of yield calculations and risk profiles in both to optimize your investment strategy.

Royalty Streams

Royalty rights investing provides investors with income derived from a percentage of revenue generated by intellectual property, natural resources, or other assets, often yielding higher returns compared to fixed income securities like bonds. While fixed income securities offer predictable interest payments and principal repayment schedules, royalty streams present variable cash flows tied directly to the performance of the underlying asset, adding both risk and reward potential. Explore the nuances of royalty streams and their benefits compared to traditional fixed income investments to enhance your portfolio strategy.

Source and External Links

Fixed Income Securities | Definition + Examples - Wall Street Prep - Fixed income securities are investment products where investors loan capital to governments or corporations for a set time in exchange for regular interest payments and return of the principal at maturity, focused on capital preservation and steady income.

Definition and Examples of Fixed Income Securities - Corporate Finance Institute - Fixed income securities are debt instruments like bonds that provide predictable interest payments and principal return at maturity, differ from equities by not representing ownership, and serve to diversify portfolios and generate steady cash flow.

What are fixed-income securities? - RBC Wealth Management - Fixed income securities are debt instruments issued by entities like governments or corporations that pay fixed periodic income and principal upon maturity, offering a low-risk and secure way for investors, especially retirees, to generate steady income within diversified portfolios.

dowidth.com

dowidth.com