Royalty streams provide investors with ongoing income derived from intellectual property rights such as patents, copyrights, or trademarks, often offering variable returns based on sales or usage. Annuities guarantee fixed periodic payments to investors over a predetermined period or lifetime, ensuring predictable and stable income. Explore the key differences and benefits to determine which investment suits your financial goals best.

Why it is important

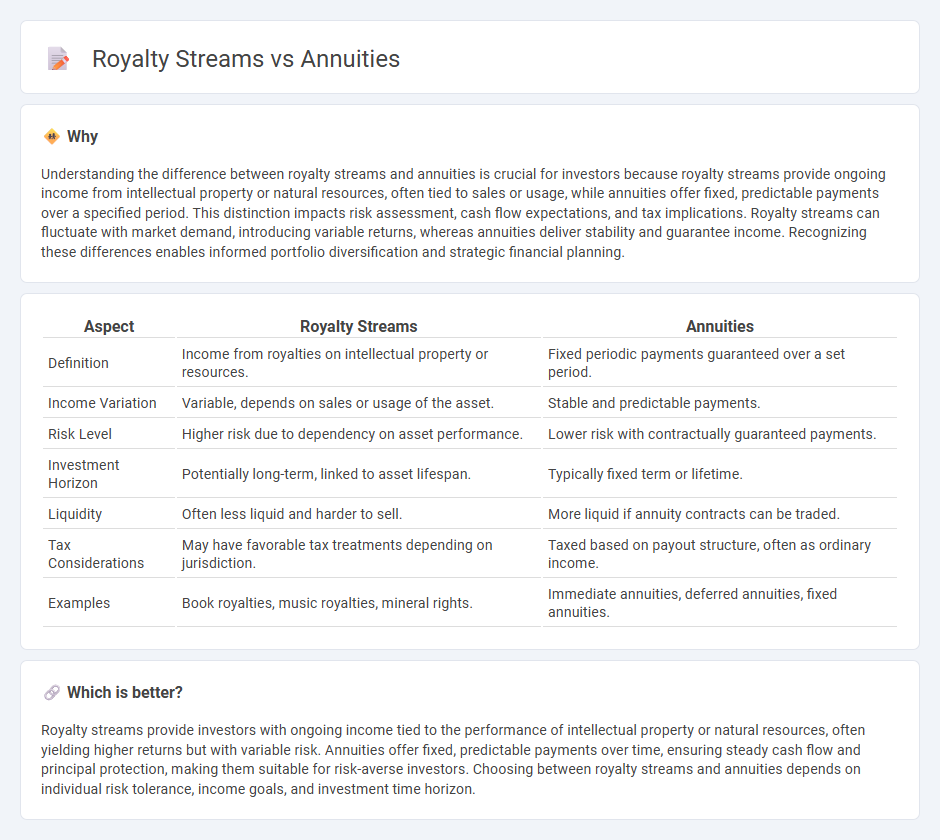

Understanding the difference between royalty streams and annuities is crucial for investors because royalty streams provide ongoing income from intellectual property or natural resources, often tied to sales or usage, while annuities offer fixed, predictable payments over a specified period. This distinction impacts risk assessment, cash flow expectations, and tax implications. Royalty streams can fluctuate with market demand, introducing variable returns, whereas annuities deliver stability and guarantee income. Recognizing these differences enables informed portfolio diversification and strategic financial planning.

Comparison Table

| Aspect | Royalty Streams | Annuities |

|---|---|---|

| Definition | Income from royalties on intellectual property or resources. | Fixed periodic payments guaranteed over a set period. |

| Income Variation | Variable, depends on sales or usage of the asset. | Stable and predictable payments. |

| Risk Level | Higher risk due to dependency on asset performance. | Lower risk with contractually guaranteed payments. |

| Investment Horizon | Potentially long-term, linked to asset lifespan. | Typically fixed term or lifetime. |

| Liquidity | Often less liquid and harder to sell. | More liquid if annuity contracts can be traded. |

| Tax Considerations | May have favorable tax treatments depending on jurisdiction. | Taxed based on payout structure, often as ordinary income. |

| Examples | Book royalties, music royalties, mineral rights. | Immediate annuities, deferred annuities, fixed annuities. |

Which is better?

Royalty streams provide investors with ongoing income tied to the performance of intellectual property or natural resources, often yielding higher returns but with variable risk. Annuities offer fixed, predictable payments over time, ensuring steady cash flow and principal protection, making them suitable for risk-averse investors. Choosing between royalty streams and annuities depends on individual risk tolerance, income goals, and investment time horizon.

Connection

Royalty streams and annuities are connected through their role in generating consistent, predictable income over time. Both investment vehicles provide investors with periodic payments, where royalty streams derive from intellectual property or natural resource revenues, and annuities are financial contracts offering fixed or variable payouts. This connection makes them attractive for income-focused portfolios seeking steady cash flow and risk mitigation.

Key Terms

Cash Flow Structure

Annuities provide a fixed, predictable cash flow over a set period or lifetime, offering stability and reduced risk for investors. Royalty streams generate variable income based on sales or production volumes, creating potential for higher returns but with fluctuating cash flow. Explore how different cash flow structures impact investment strategy and risk management.

Duration

Annuities provide guaranteed income over a fixed period or lifetime, ensuring predictable cash flow for the duration specified in the contract. Royalty streams generate income based on the ongoing revenue from intellectual property or natural resources, often extending indefinitely as long as the asset remains valuable and in use. Explore in-depth comparisons to understand which income stream aligns best with your financial goals.

Risk Profile

Annuities provide a predictable income stream with relatively low risk, backed by the financial strength of the issuing insurance company. Royalty streams involve variable income dependent on the performance of underlying assets, presenting higher risk but potentially greater returns. Explore the nuances of risk profiles in annuities versus royalty streams to make informed investment decisions.

Source and External Links

Annuities - A brief description | Internal Revenue Service - An annuity is a contract requiring regular payments over more than one year to an annuitant, with types including fixed period, variable, single life, joint and survivor, qualified employee, and tax-sheltered annuities.

Guide to Annuities: Types, Payouts and Expert Q&A - Annuities are contracts from insurers that convert a premium into fixed or variable income streams, featuring accumulation and payout phases, tax-deferred growth, and protection from market risks in exchange for fees and surrender charges.

Learn how annuities work | Office of the Insurance Commissioner - Annuities are insurance contracts offering tax-deferred growth and steady income, commonly used for retirement savings, with benefits like death guarantees, lifetime income options, and tax deferral on earnings until withdrawal.

dowidth.com

dowidth.com