Art tokenization offers fractional ownership of valuable artworks through blockchain technology, enhancing liquidity and accessibility for investors compared to direct real estate ownership, which requires substantial capital and involves physical asset management. Tokenized art markets enable diversified portfolios with lower entry barriers and faster transactions, while real estate investment provides stable cash flow and tangible asset control. Explore these innovative investment approaches to understand which aligns best with your financial goals.

Why it is important

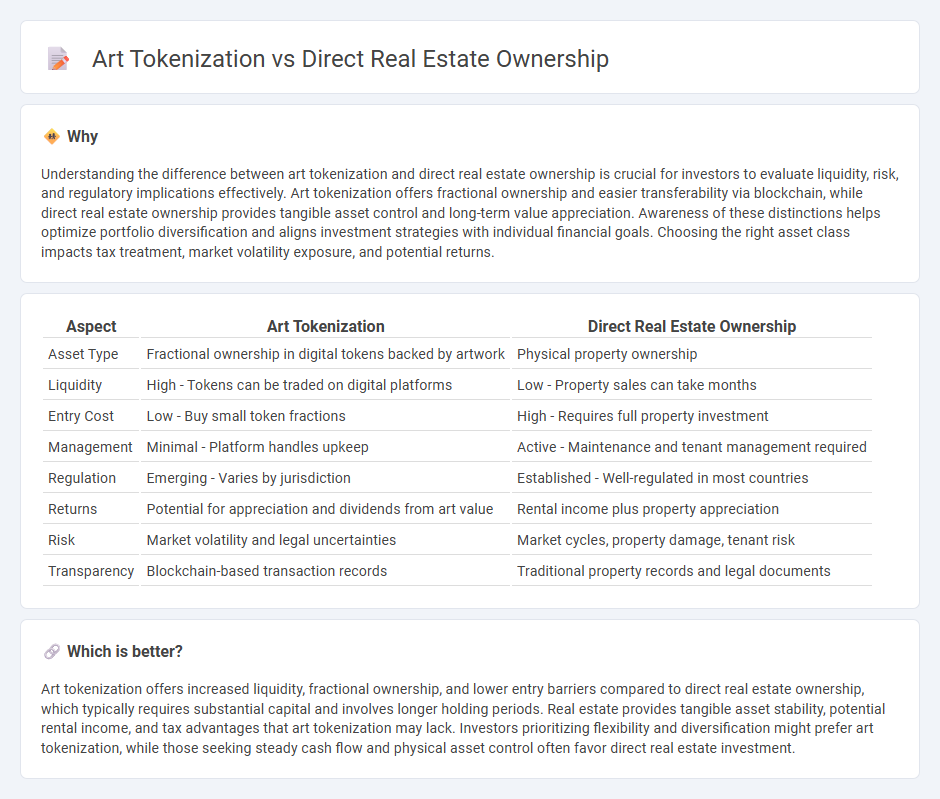

Understanding the difference between art tokenization and direct real estate ownership is crucial for investors to evaluate liquidity, risk, and regulatory implications effectively. Art tokenization offers fractional ownership and easier transferability via blockchain, while direct real estate ownership provides tangible asset control and long-term value appreciation. Awareness of these distinctions helps optimize portfolio diversification and aligns investment strategies with individual financial goals. Choosing the right asset class impacts tax treatment, market volatility exposure, and potential returns.

Comparison Table

| Aspect | Art Tokenization | Direct Real Estate Ownership |

|---|---|---|

| Asset Type | Fractional ownership in digital tokens backed by artwork | Physical property ownership |

| Liquidity | High - Tokens can be traded on digital platforms | Low - Property sales can take months |

| Entry Cost | Low - Buy small token fractions | High - Requires full property investment |

| Management | Minimal - Platform handles upkeep | Active - Maintenance and tenant management required |

| Regulation | Emerging - Varies by jurisdiction | Established - Well-regulated in most countries |

| Returns | Potential for appreciation and dividends from art value | Rental income plus property appreciation |

| Risk | Market volatility and legal uncertainties | Market cycles, property damage, tenant risk |

| Transparency | Blockchain-based transaction records | Traditional property records and legal documents |

Which is better?

Art tokenization offers increased liquidity, fractional ownership, and lower entry barriers compared to direct real estate ownership, which typically requires substantial capital and involves longer holding periods. Real estate provides tangible asset stability, potential rental income, and tax advantages that art tokenization may lack. Investors prioritizing flexibility and diversification might prefer art tokenization, while those seeking steady cash flow and physical asset control often favor direct real estate investment.

Connection

Art tokenization leverages blockchain technology to convert physical artworks into digital tokens, enabling fractional ownership and increased liquidity in the investment market. Direct real estate ownership similarly benefits from tokenization by allowing investors to hold digital shares of properties without traditional barriers like high capital requirements or complex transactions. Both methods democratize access to valuable assets, enhance transparency, and facilitate seamless trading on decentralized platforms.

Key Terms

Asset Liquidity

Direct real estate ownership offers tangible asset control but is often characterized by low liquidity due to lengthy transaction processes and high entry costs. Art tokenization transforms valuable artworks into digital tokens on blockchain, enabling fractional ownership and significantly enhancing liquidity by facilitating faster, more accessible trades on secondary markets. Explore the innovative world of art tokenization to understand how it revolutionizes asset liquidity and investment opportunities.

Fractional Ownership

Fractional ownership allows investors to diversify portfolios by owning a share in tangible assets like real estate or artworks without full acquisition costs. Direct real estate ownership offers control and income generation through rental yields, while art tokenization enables liquidity and broader market access by converting art into digital tokens on blockchain platforms. Explore the benefits and challenges of these investment approaches to determine which fractional ownership model aligns best with your financial goals.

Management Responsibility

Direct real estate ownership demands hands-on management responsibilities including property maintenance, tenant relations, and regulatory compliance, which can be time-consuming and require specialized expertise. In contrast, art tokenization shifts management duties to blockchain technology and smart contracts, significantly reducing the owner's involvement in day-to-day operations while ensuring transparent ownership records. Explore the benefits and challenges of both approaches to find out which management style suits your investment goals best.

Source and External Links

Direct Real Estate Ownership | Definition, Types, Pros, & Cons - Direct real estate ownership involves purchasing and personally owning physical properties--such as residential, commercial, or industrial buildings--to generate income and build wealth, offering direct control over the asset rather than investing through financial products like REITs.

Understanding Direct vs. Indirect Real Estate Investments - SmartAsset - In direct real estate investing, individuals buy and manage physical properties themselves, which requires significant capital and active management but offers potential tax benefits, control, and higher returns, albeit with greater risk and less liquidity compared to indirect investments.

Direct Real Estate Investments vs. REITs | Trion Properties - Direct real estate investing means purchasing an ownership interest in a specific property, distinguishing it from indirect methods like REITs, and is one of the primary ways to privately invest in real estate alongside cash, stocks, and bonds.

dowidth.com

dowidth.com