Tangible asset tokenization involves converting physical assets like real estate, precious metals, or artwork into digital tokens that represent ownership, enhancing liquidity and accessibility. Equity tokenization refers to issuing digital tokens that represent shares in a company, allowing fractional ownership and streamlined trading on blockchain platforms. Explore how these innovative investment approaches transform asset management and investor opportunities.

Why it is important

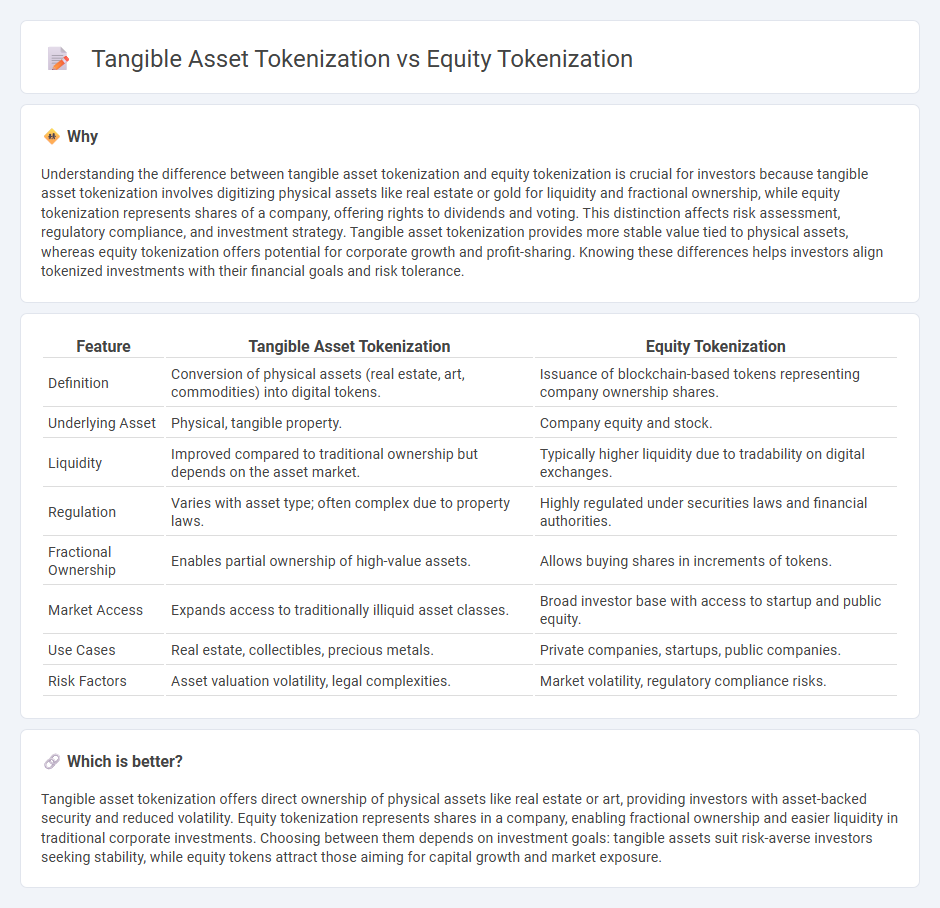

Understanding the difference between tangible asset tokenization and equity tokenization is crucial for investors because tangible asset tokenization involves digitizing physical assets like real estate or gold for liquidity and fractional ownership, while equity tokenization represents shares of a company, offering rights to dividends and voting. This distinction affects risk assessment, regulatory compliance, and investment strategy. Tangible asset tokenization provides more stable value tied to physical assets, whereas equity tokenization offers potential for corporate growth and profit-sharing. Knowing these differences helps investors align tokenized investments with their financial goals and risk tolerance.

Comparison Table

| Feature | Tangible Asset Tokenization | Equity Tokenization |

|---|---|---|

| Definition | Conversion of physical assets (real estate, art, commodities) into digital tokens. | Issuance of blockchain-based tokens representing company ownership shares. |

| Underlying Asset | Physical, tangible property. | Company equity and stock. |

| Liquidity | Improved compared to traditional ownership but depends on the asset market. | Typically higher liquidity due to tradability on digital exchanges. |

| Regulation | Varies with asset type; often complex due to property laws. | Highly regulated under securities laws and financial authorities. |

| Fractional Ownership | Enables partial ownership of high-value assets. | Allows buying shares in increments of tokens. |

| Market Access | Expands access to traditionally illiquid asset classes. | Broad investor base with access to startup and public equity. |

| Use Cases | Real estate, collectibles, precious metals. | Private companies, startups, public companies. |

| Risk Factors | Asset valuation volatility, legal complexities. | Market volatility, regulatory compliance risks. |

Which is better?

Tangible asset tokenization offers direct ownership of physical assets like real estate or art, providing investors with asset-backed security and reduced volatility. Equity tokenization represents shares in a company, enabling fractional ownership and easier liquidity in traditional corporate investments. Choosing between them depends on investment goals: tangible assets suit risk-averse investors seeking stability, while equity tokens attract those aiming for capital growth and market exposure.

Connection

Tangible asset tokenization and equity tokenization are connected through their shared use of blockchain technology to represent ownership rights digitally, enabling fractional investment and increased liquidity. Both processes transform physical or equity-based assets into secure, tradable tokens, facilitating access to previously illiquid markets. This convergence enhances transparency, reduces transaction costs, and broadens investment opportunities across diverse asset classes.

Key Terms

Ownership Representation

Equity tokenization involves representing shares of ownership in a company through digital tokens, enabling fractional ownership and increased liquidity in financial markets. Tangible asset tokenization refers to digitizing ownership rights of physical assets like real estate or commodities, allowing seamless transfer and enhanced access to investment opportunities. Discover how these tokenization methods revolutionize ownership representation by exploring their distinct advantages and applications.

Asset Underlying

Equity tokenization represents ownership shares in a company, directly linked to the underlying equity assets such as stocks or shares. Tangible asset tokenization involves digital tokens backed by physical assets like real estate, gold, or commodities, ensuring asset-backed security and liquidity. Explore the distinct advantages and legal implications of both asset underlying approaches to enhance your investment strategy.

Regulatory Compliance

Equity tokenization involves issuing digital tokens that represent shares in a company, requiring strict adherence to securities regulations such as the SEC's guidelines under the Howey Test and KYC/AML protocols to ensure investor protection. Tangible asset tokenization, which digitizes physical assets like real estate or artwork, must comply with property laws, custodial requirements, and local jurisdictional regulations to maintain asset custody and transfer legitimacy. Explore further to understand how these regulatory frameworks shape the security and viability of tokenized assets in the evolving blockchain landscape.

Source and External Links

Tokenized Equities: Transforming liquidity and accessibility - Kraken - Equity tokenization involves representing traditional company shares as digital tokens on a blockchain, enabling fractional ownership, increased liquidity, global accessibility, instant settlement, and trading outside market hours, all while maintaining the underlying shares in regulated custody.

Private Equity Tokenization Explained - InvestaX - Private equity tokenization converts ownership in private assets into tradable digital tokens on a blockchain, democratizing access by lowering minimum investment thresholds and integrating with DeFi applications for enhanced financial utility.

Tokenized Stocks & Equities Explained - Chainlink - Tokenized equity extends beyond public shares to private company ownership recorded on blockchain, allowing programmable compliance, global investor access, automatic cap table updates, and regulatory control embedded in smart contracts for efficient capital raising and ownership management.

dowidth.com

dowidth.com