Litigation funding provides financial backing for legal cases in exchange for a portion of the settlement or judgment, enabling plaintiffs to pursue justice without upfront costs. Crowdfunding pools small contributions from a large number of people to support various projects, including investments and startups, through platforms like Kickstarter and GoFundMe. Discover the key differences and benefits of litigation funding versus crowdfunding to make informed investment decisions.

Why it is important

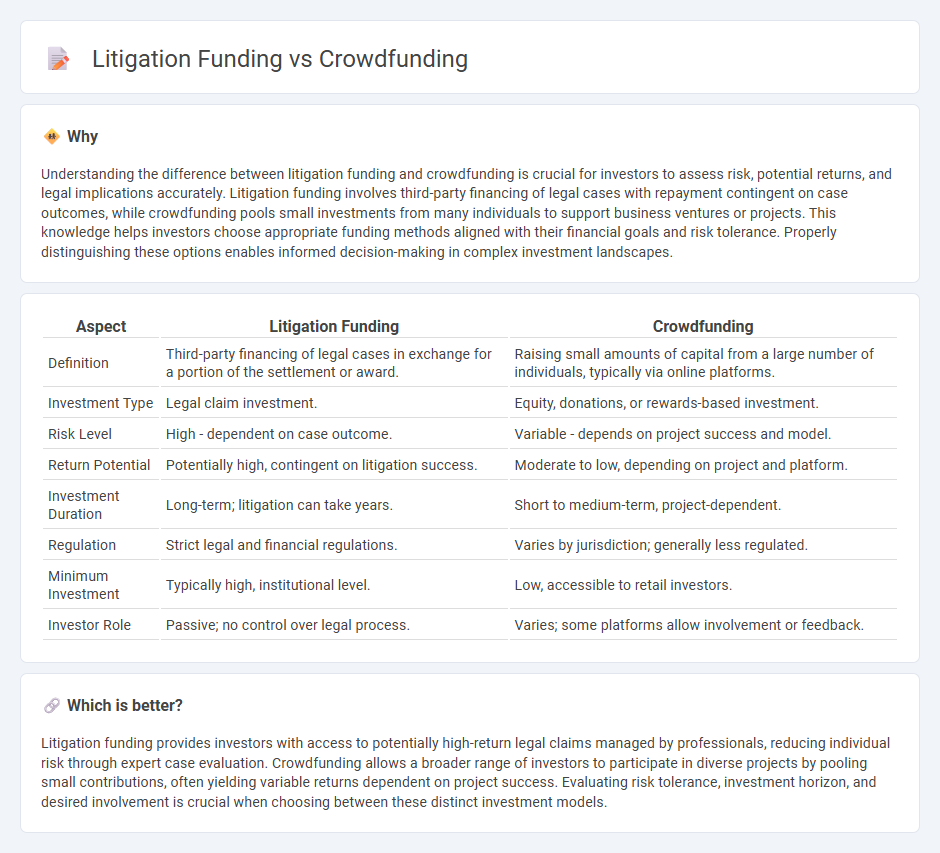

Understanding the difference between litigation funding and crowdfunding is crucial for investors to assess risk, potential returns, and legal implications accurately. Litigation funding involves third-party financing of legal cases with repayment contingent on case outcomes, while crowdfunding pools small investments from many individuals to support business ventures or projects. This knowledge helps investors choose appropriate funding methods aligned with their financial goals and risk tolerance. Properly distinguishing these options enables informed decision-making in complex investment landscapes.

Comparison Table

| Aspect | Litigation Funding | Crowdfunding |

|---|---|---|

| Definition | Third-party financing of legal cases in exchange for a portion of the settlement or award. | Raising small amounts of capital from a large number of individuals, typically via online platforms. |

| Investment Type | Legal claim investment. | Equity, donations, or rewards-based investment. |

| Risk Level | High - dependent on case outcome. | Variable - depends on project success and model. |

| Return Potential | Potentially high, contingent on litigation success. | Moderate to low, depending on project and platform. |

| Investment Duration | Long-term; litigation can take years. | Short to medium-term, project-dependent. |

| Regulation | Strict legal and financial regulations. | Varies by jurisdiction; generally less regulated. |

| Minimum Investment | Typically high, institutional level. | Low, accessible to retail investors. |

| Investor Role | Passive; no control over legal process. | Varies; some platforms allow involvement or feedback. |

Which is better?

Litigation funding provides investors with access to potentially high-return legal claims managed by professionals, reducing individual risk through expert case evaluation. Crowdfunding allows a broader range of investors to participate in diverse projects by pooling small contributions, often yielding variable returns dependent on project success. Evaluating risk tolerance, investment horizon, and desired involvement is crucial when choosing between these distinct investment models.

Connection

Litigation funding and crowdfunding both serve as alternative investment strategies by pooling resources from multiple investors to finance legal cases or business ventures. Litigation funding provides capital to plaintiffs in exchange for a portion of the judgment or settlement, while crowdfunding gathers small investments from a large number of people to support projects or startups. Both methods leverage collective financial power to mitigate individual risk and enable access to capital outside traditional financial institutions.

Key Terms

Equity

Equity crowdfunding involves raising capital from a large group of investors in exchange for ownership shares, allowing businesses to access funds without incurring debt. Litigation funding provides financial support to plaintiffs by investing in legal cases in return for a portion of the settlement or judgment, reducing upfront costs and risk. Explore the differences in risk, ownership, and returns between equity crowdfunding and litigation funding to determine the best option for your investment strategy.

Case Merit

Case merit is a crucial determinant in both crowdfunding and litigation funding, directly influencing the likelihood of financial support and success. Litigation funding firms thoroughly assess the strength and viability of a case before committing resources, while crowdfunding platforms rely on public perception and potential social impact to attract contributions. Explore the key differences and strategic considerations between these funding models to optimize your legal financing approach.

Returns

Crowdfunding typically offers variable returns depending on project success, often framed as rewards or equity, while litigation funding delivers returns tied directly to legal settlement or judgment outcomes. Investors in litigation funding benefit from potentially high returns linked to case valuation but face the risk of total loss if the case fails, contrasting with crowdfunding's broader, often less risky participation model. Explore deeper insights into how each funding method impacts investor returns and risk profiles.

Source and External Links

Crowdfunding - Crowdfunding is the practice of funding projects or ventures by raising money online from a large number of people, involving a project initiator, supporters, and a moderating platform to connect them, often used for entrepreneurial and social projects.

What is crowdfunding? Here are four types to know - Crowdfunding allows startups and projects to raise funds collectively from individuals, primarily online, bypassing traditional financing by leveraging the networks of friends, family, and the public for financial support.

Small Business Financing: A Resource Guide: Crowdfunding - Crowdfunding can be donation-based, rewards-based, or equity-based, where people contribute small amounts via online platforms like GoFundMe or Kickstarter, with possibilities for rewards or equity stakes depending on the model.

dowidth.com

dowidth.com