Fine art micro-shares allow investors to buy fractional ownership in valuable artworks, providing access to the art market with lower capital requirements and potential long-term appreciation. Commodities trading platforms offer real-time access to markets like gold, oil, and agricultural products, enabling liquidity and short-term speculative opportunities. Explore the advantages and risks of both to determine the best fit for your investment strategy.

Why it is important

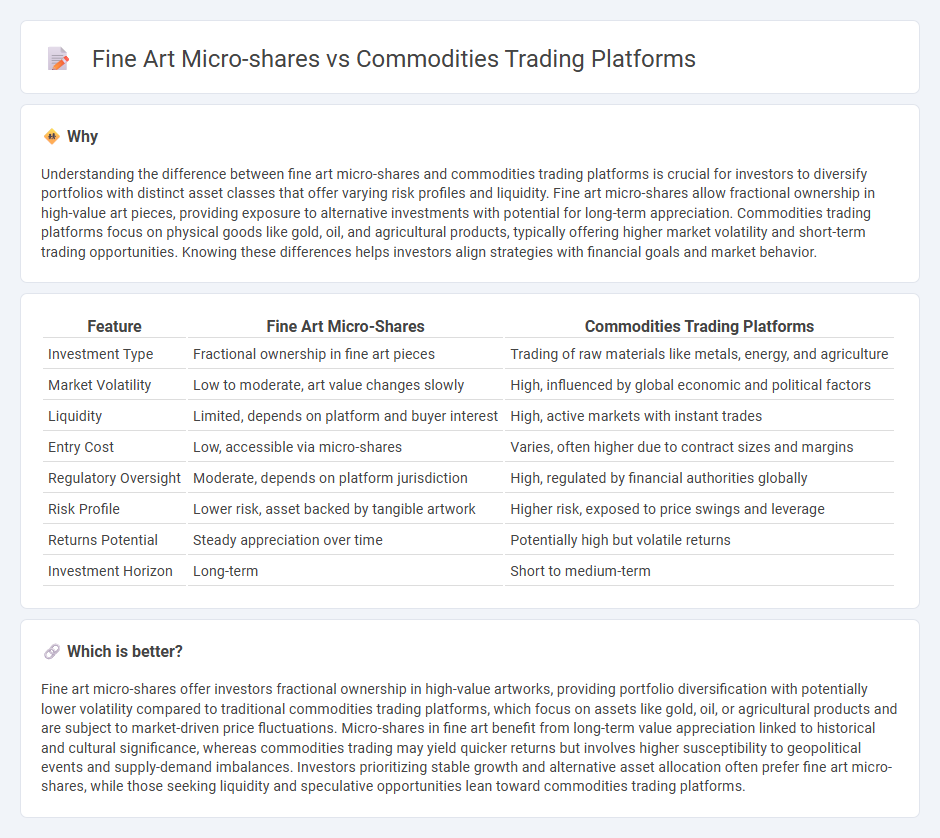

Understanding the difference between fine art micro-shares and commodities trading platforms is crucial for investors to diversify portfolios with distinct asset classes that offer varying risk profiles and liquidity. Fine art micro-shares allow fractional ownership in high-value art pieces, providing exposure to alternative investments with potential for long-term appreciation. Commodities trading platforms focus on physical goods like gold, oil, and agricultural products, typically offering higher market volatility and short-term trading opportunities. Knowing these differences helps investors align strategies with financial goals and market behavior.

Comparison Table

| Feature | Fine Art Micro-Shares | Commodities Trading Platforms |

|---|---|---|

| Investment Type | Fractional ownership in fine art pieces | Trading of raw materials like metals, energy, and agriculture |

| Market Volatility | Low to moderate, art value changes slowly | High, influenced by global economic and political factors |

| Liquidity | Limited, depends on platform and buyer interest | High, active markets with instant trades |

| Entry Cost | Low, accessible via micro-shares | Varies, often higher due to contract sizes and margins |

| Regulatory Oversight | Moderate, depends on platform jurisdiction | High, regulated by financial authorities globally |

| Risk Profile | Lower risk, asset backed by tangible artwork | Higher risk, exposed to price swings and leverage |

| Returns Potential | Steady appreciation over time | Potentially high but volatile returns |

| Investment Horizon | Long-term | Short to medium-term |

Which is better?

Fine art micro-shares offer investors fractional ownership in high-value artworks, providing portfolio diversification with potentially lower volatility compared to traditional commodities trading platforms, which focus on assets like gold, oil, or agricultural products and are subject to market-driven price fluctuations. Micro-shares in fine art benefit from long-term value appreciation linked to historical and cultural significance, whereas commodities trading may yield quicker returns but involves higher susceptibility to geopolitical events and supply-demand imbalances. Investors prioritizing stable growth and alternative asset allocation often prefer fine art micro-shares, while those seeking liquidity and speculative opportunities lean toward commodities trading platforms.

Connection

Fine art micro-shares and commodities trading platforms intersect through tokenization, enabling fractional ownership of traditionally illiquid assets like artwork alongside commodities such as gold or oil. This integration leverages blockchain technology to provide enhanced liquidity, transparency, and accessibility to a broader investor base. Investors benefit from diversified portfolios by combining art and commodity assets on unified trading platforms that support real-time transactions and secure digital custody.

Key Terms

Liquidity

Commodities trading platforms offer high liquidity with active markets allowing rapid buying and selling of assets like oil, gold, and agricultural products. Fine art micro-shares provide fractional ownership in valuable artworks but tend to exhibit lower liquidity due to limited buyers and longer holding periods. Explore the differences in liquidity dynamics between these investment options to make informed decisions.

Custodianship

Commodities trading platforms typically rely on regulated custodians to securely hold physical assets such as gold, oil, or agricultural products, ensuring transparency and compliance with market standards. Fine art micro-shares platforms emphasize specialized custodianship, often partnering with art storage facilities and insurance providers to protect fractional ownership of high-value artworks. Explore the unique custodial frameworks that safeguard your investments in both markets.

Price transparency

Commodities trading platforms offer high price transparency through real-time market data and liquid exchanges, enabling traders to make informed decisions based on current supply and demand. Fine art micro-shares, however, often lack standardized pricing and rely on appraisals or auction results, leading to less transparent valuation and potential price volatility. Explore the nuances of price transparency in these distinct investment arenas to make smarter choices.

Source and External Links

Commodity Trading via CFDs - FOREX.com - FOREX.com offers commodity trading with CFDs on futures or spot contracts, enabling trading on rising and falling markets with leverage and access via FOREX.com, TradingView, or MT5 platforms, featuring advanced charting and integrated market news.

Best Commodity Trading Platforms/Brokers Compared & Reviewed - This guide reviews top commodity brokers like XTB and Saxo, highlighting CFD and ETF options, direct market access, professional tools, and trading via futures, options, and ETFs with integrated news and risk management features.

Best Commodity Trading Apps | 2025 Investing Guide - eToro is recommended for beginner commodity traders offering commodity ETFs, CFDs, free paper trading accounts, and educational resources, though it lacks futures contracts, ideal for diversified commodity portfolio exposure with low risk.

dowidth.com

dowidth.com