Digital real estate offers investors access to virtual properties and online assets with growth tied to emerging technologies and internet trends. Mutual funds provide diversification through professionally managed portfolios of stocks, bonds, and other securities, spreading risk across various industries. Discover how these investment options align with your financial goals and risk tolerance.

Why it is important

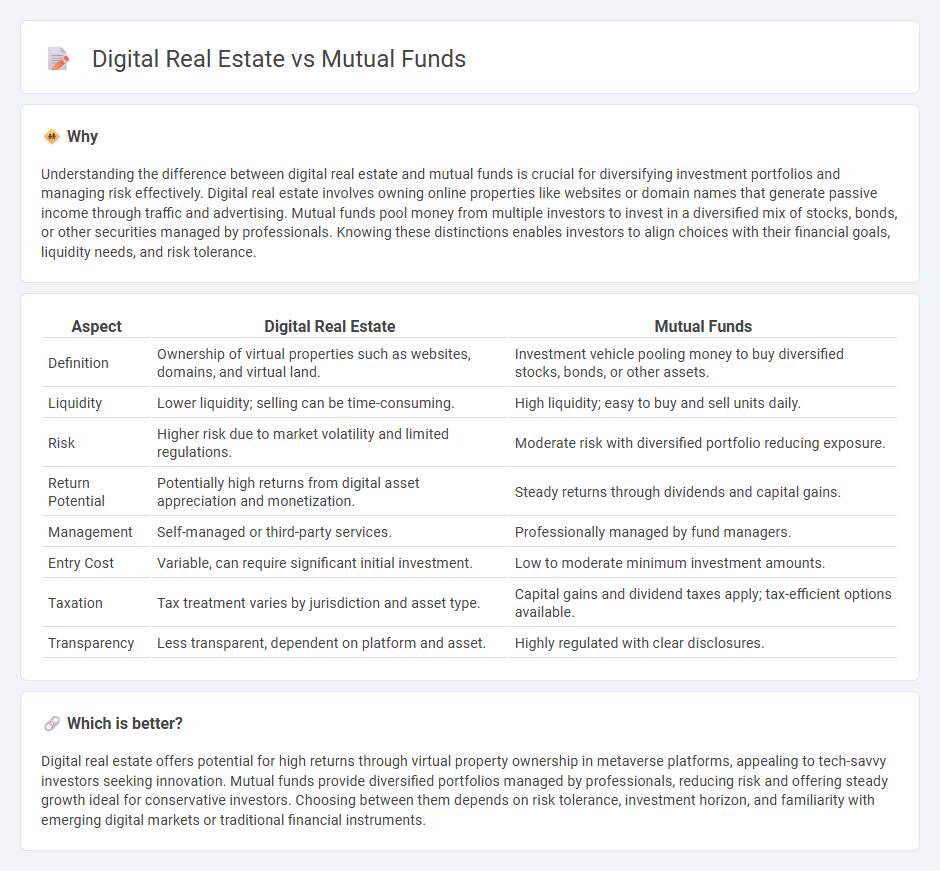

Understanding the difference between digital real estate and mutual funds is crucial for diversifying investment portfolios and managing risk effectively. Digital real estate involves owning online properties like websites or domain names that generate passive income through traffic and advertising. Mutual funds pool money from multiple investors to invest in a diversified mix of stocks, bonds, or other securities managed by professionals. Knowing these distinctions enables investors to align choices with their financial goals, liquidity needs, and risk tolerance.

Comparison Table

| Aspect | Digital Real Estate | Mutual Funds |

|---|---|---|

| Definition | Ownership of virtual properties such as websites, domains, and virtual land. | Investment vehicle pooling money to buy diversified stocks, bonds, or other assets. |

| Liquidity | Lower liquidity; selling can be time-consuming. | High liquidity; easy to buy and sell units daily. |

| Risk | Higher risk due to market volatility and limited regulations. | Moderate risk with diversified portfolio reducing exposure. |

| Return Potential | Potentially high returns from digital asset appreciation and monetization. | Steady returns through dividends and capital gains. |

| Management | Self-managed or third-party services. | Professionally managed by fund managers. |

| Entry Cost | Variable, can require significant initial investment. | Low to moderate minimum investment amounts. |

| Taxation | Tax treatment varies by jurisdiction and asset type. | Capital gains and dividend taxes apply; tax-efficient options available. |

| Transparency | Less transparent, dependent on platform and asset. | Highly regulated with clear disclosures. |

Which is better?

Digital real estate offers potential for high returns through virtual property ownership in metaverse platforms, appealing to tech-savvy investors seeking innovation. Mutual funds provide diversified portfolios managed by professionals, reducing risk and offering steady growth ideal for conservative investors. Choosing between them depends on risk tolerance, investment horizon, and familiarity with emerging digital markets or traditional financial instruments.

Connection

Digital real estate and mutual funds are connected through diversified investment strategies that leverage online property assets such as virtual land, websites, or digital platforms alongside traditional financial instruments. Investing in digital real estate offers unique growth opportunities due to its scalability and market demand, while mutual funds provide risk mitigation by pooling resources across various sectors. Combining these assets helps investors balance innovation-driven gains with managed portfolio stability, enhancing overall return potential.

Key Terms

Diversification

Mutual funds offer broad diversification by pooling investments across various asset classes, industries, and geographic regions, minimizing risk through professional management. Digital real estate diversification involves acquiring varied virtual properties such as websites, domain names, and digital storefronts, spreading exposure across different online platforms and revenue models. Explore deeper insights on how these investment strategies impact portfolio resilience and growth potential.

Liquidity

Mutual funds offer high liquidity, allowing investors to buy or sell shares on any business day at the fund's net asset value (NAV), ensuring quick access to cash. Digital real estate, such as websites or virtual properties, typically requires longer timeframes to sell, making liquidity more limited compared to mutual funds. Explore the differences in liquidity further to determine which investment fits your financial needs.

Asset Appreciation

Mutual funds offer diversified asset appreciation through stocks and bonds managed by professionals, providing steady growth aligned with market performance. Digital real estate, involving virtual properties and domain assets, presents high potential for value increase driven by emerging online platforms and digital demand. Explore detailed comparisons to understand which asset class suits your investment goals better.

Source and External Links

Mutual Funds - A mutual fund is an SEC-registered open-end investment company that pools money from many investors to invest in a diversified portfolio of stocks, bonds, and other securities, managed by professional investment advisers, offering benefits like diversification, professional management, low minimum investment, and liquidity.

Mutual fund - Mutual funds pool money from investors to purchase securities and are classified by investment type and management style, offering advantages such as diversification, liquidity, and professional management, but also involving fees and expenses.

Understanding mutual funds - Mutual funds allow investors to pool money to buy diversified securities, managed by professionals, providing benefits like diversification, low transaction costs, convenience, and access to various investment strategies.

dowidth.com

dowidth.com