Royalty rights investing offers passive income through earnings from intellectual property or natural resource production, providing diversification beyond traditional asset classes. Real estate investing involves acquiring physical properties to generate rental income and capital appreciation, presenting tangible asset ownership with potential tax benefits. Explore the unique advantages and risks of each investment type to determine which aligns best with your financial goals.

Why it is important

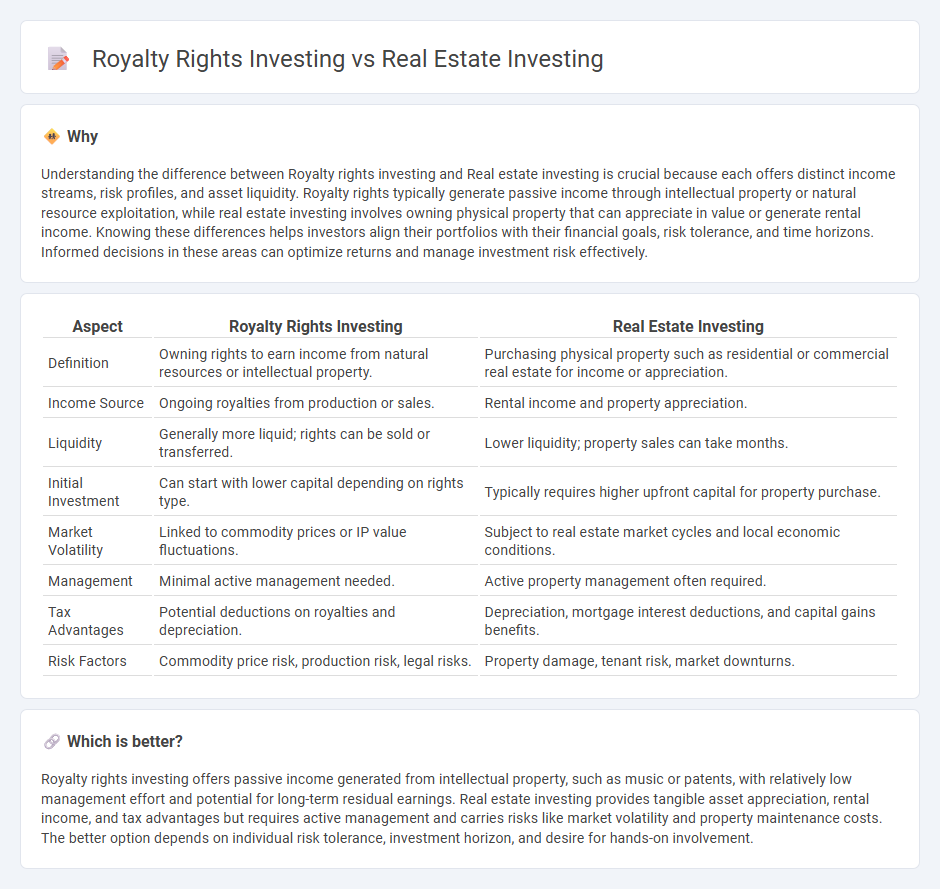

Understanding the difference between Royalty rights investing and Real estate investing is crucial because each offers distinct income streams, risk profiles, and asset liquidity. Royalty rights typically generate passive income through intellectual property or natural resource exploitation, while real estate investing involves owning physical property that can appreciate in value or generate rental income. Knowing these differences helps investors align their portfolios with their financial goals, risk tolerance, and time horizons. Informed decisions in these areas can optimize returns and manage investment risk effectively.

Comparison Table

| Aspect | Royalty Rights Investing | Real Estate Investing |

|---|---|---|

| Definition | Owning rights to earn income from natural resources or intellectual property. | Purchasing physical property such as residential or commercial real estate for income or appreciation. |

| Income Source | Ongoing royalties from production or sales. | Rental income and property appreciation. |

| Liquidity | Generally more liquid; rights can be sold or transferred. | Lower liquidity; property sales can take months. |

| Initial Investment | Can start with lower capital depending on rights type. | Typically requires higher upfront capital for property purchase. |

| Market Volatility | Linked to commodity prices or IP value fluctuations. | Subject to real estate market cycles and local economic conditions. |

| Management | Minimal active management needed. | Active property management often required. |

| Tax Advantages | Potential deductions on royalties and depreciation. | Depreciation, mortgage interest deductions, and capital gains benefits. |

| Risk Factors | Commodity price risk, production risk, legal risks. | Property damage, tenant risk, market downturns. |

Which is better?

Royalty rights investing offers passive income generated from intellectual property, such as music or patents, with relatively low management effort and potential for long-term residual earnings. Real estate investing provides tangible asset appreciation, rental income, and tax advantages but requires active management and carries risks like market volatility and property maintenance costs. The better option depends on individual risk tolerance, investment horizon, and desire for hands-on involvement.

Connection

Royalty rights investing and real estate investing both generate passive income through asset ownership, with royalty rights providing earnings from intellectual property or natural resources, while real estate yields income from property rentals or appreciation. Both investment types require due diligence, market analysis, and risk assessment to maximize returns and manage asset value effectively. Investors often diversify portfolios by combining royalty rights and real estate assets to balance income streams and reduce exposure to market volatility.

Key Terms

Property Appreciation

Property appreciation in real estate investing typically yields long-term capital gains through market-driven value increases in physical assets like residential and commercial properties. Royalty rights investing, on the other hand, generates income from intellectual property or natural resources, where appreciation depends on ongoing revenue streams and the asset's market demand. Explore how each investment strategy leverages property appreciation to maximize wealth potential.

Passive Income

Real estate investing generates passive income through rental yields and property appreciation, offering tangible asset growth and tax benefits. Royalty rights investing provides income via ongoing payments from intellectual property or natural resource extraction, often requiring minimal management effort. Explore the nuances of these investment options to maximize your passive income strategy.

Asset Liquidity

Real estate investing typically offers lower asset liquidity due to the physical nature of properties and the time-consuming sale processes, often requiring weeks or months to complete transactions. In contrast, royalty rights investing provides higher liquidity since these financial assets can be traded more easily in specialized markets or through private sales, allowing quicker access to cash. Explore the nuances of asset liquidity across these investment types to optimize your portfolio strategy.

Source and External Links

Real Estate Investing: 5 Ways to Get Started - Real estate investing options include REITs, online platforms, rental properties, flipping homes, and buying to rent, each with different risk and return profiles suitable for various investor goals.

Arrived | Easily Invest in Real Estate - Arrived offers a platform to invest in pre-vetted rental properties starting as low as $100, enabling passive income and property appreciation with property management handled for investors.

Real Estate Investing for Beginners: 5 Skills of Successful Investors - Real estate is a large, diverse asset class including residential, commercial, and land properties, each with specific zoning and investment considerations critical for beginner investors to understand.

dowidth.com

dowidth.com