Art flipping involves buying traditional artworks at lower prices and quickly reselling them for profit, capitalizing on market trends and the artists' growing reputations. NFT flipping leverages digital tokens representing unique assets, like digital art or collectibles, which are traded on blockchain platforms for rapid gains amid volatile cryptocurrency markets. Explore the distinct advantages and risks of art flipping versus NFT flipping to make informed investment decisions.

Why it is important

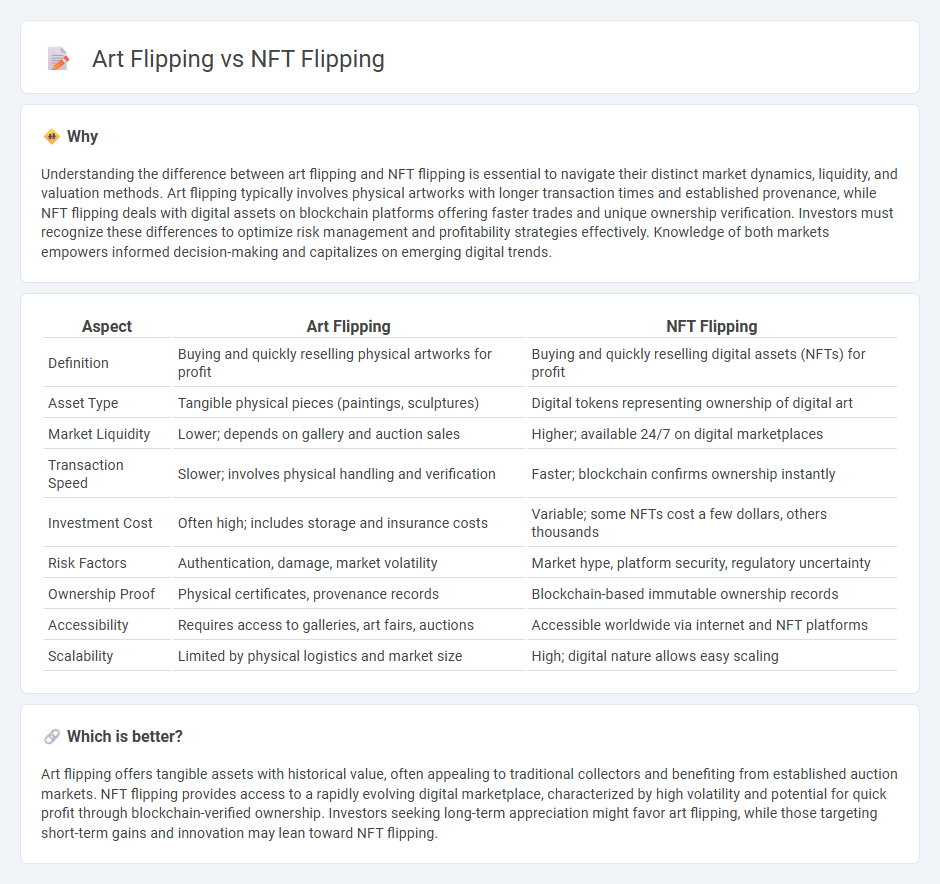

Understanding the difference between art flipping and NFT flipping is essential to navigate their distinct market dynamics, liquidity, and valuation methods. Art flipping typically involves physical artworks with longer transaction times and established provenance, while NFT flipping deals with digital assets on blockchain platforms offering faster trades and unique ownership verification. Investors must recognize these differences to optimize risk management and profitability strategies effectively. Knowledge of both markets empowers informed decision-making and capitalizes on emerging digital trends.

Comparison Table

| Aspect | Art Flipping | NFT Flipping |

|---|---|---|

| Definition | Buying and quickly reselling physical artworks for profit | Buying and quickly reselling digital assets (NFTs) for profit |

| Asset Type | Tangible physical pieces (paintings, sculptures) | Digital tokens representing ownership of digital art |

| Market Liquidity | Lower; depends on gallery and auction sales | Higher; available 24/7 on digital marketplaces |

| Transaction Speed | Slower; involves physical handling and verification | Faster; blockchain confirms ownership instantly |

| Investment Cost | Often high; includes storage and insurance costs | Variable; some NFTs cost a few dollars, others thousands |

| Risk Factors | Authentication, damage, market volatility | Market hype, platform security, regulatory uncertainty |

| Ownership Proof | Physical certificates, provenance records | Blockchain-based immutable ownership records |

| Accessibility | Requires access to galleries, art fairs, auctions | Accessible worldwide via internet and NFT platforms |

| Scalability | Limited by physical logistics and market size | High; digital nature allows easy scaling |

Which is better?

Art flipping offers tangible assets with historical value, often appealing to traditional collectors and benefiting from established auction markets. NFT flipping provides access to a rapidly evolving digital marketplace, characterized by high volatility and potential for quick profit through blockchain-verified ownership. Investors seeking long-term appreciation might favor art flipping, while those targeting short-term gains and innovation may lean toward NFT flipping.

Connection

Art flipping and NFT flipping are connected through their shared strategy of buying and selling assets quickly for profit, capitalizing on market trends and scarcity. Both rely on speculative demand, digital or physical provenance, and the art market's volatility to generate gains. The rise of blockchain technology enhances transparency and ownership verification, bridging traditional art flipping with the digital NFT ecosystem.

Key Terms

**NFT Flipping:**

NFT flipping involves buying digital assets at lower prices and selling them quickly for profit, leveraging market trends and rarity factors such as limited editions and popular collections. Successful NFT flippers analyze blockchain data, social media hype, and creator reputations to predict asset appreciation. Explore more about strategies and tools to maximize gains in the fast-evolving NFT marketplace.

Smart Contracts

NFT flipping leverages blockchain technology and smart contracts to enable transparent, automated transfers of ownership and royalties in digital assets. Art flipping traditionally involves physical pieces with manual transactions, lacking the instantaneous and programmable features that smart contracts provide. Explore how smart contracts revolutionize asset trading by securing and streamlining NFT flips beyond conventional art dealings.

Blockchain

NFT flipping leverages blockchain technology by enabling quick buying and selling of unique digital assets with transparent, immutable ownership records. Art flipping, traditionally based on physical artworks, lacks the instant verification and global accessibility provided by blockchain, limiting its market fluidity compared to NFTs. Explore how blockchain transforms asset trading and investment strategies by diving deeper into NFT and art flipping dynamics.

Source and External Links

How to Buy and Flip NFTs Like an Expert in 5 Simple Steps - NFT flipping involves buying digital assets low on secondary platforms like OpenSea and selling them high for profit, ideally timing purchases near market bottoms and sales during rising trends for best results.

How To Flip NFTs Profit - The Complete Guide - Wagmi.tips - Success in NFT flipping relies on finding early, promising projects (alpha), entering during bull markets, and continuously analyzing market trends across platforms beyond just the largest marketplaces.

How To Flip NFTs [Updated in 2024] - Nansen - Flipping NFTs is a short-term investment strategy focused on buying and quickly reselling for profit, requiring up-to-date data, market knowledge, and often leveraging onchain analytics to overcome information gaps.

dowidth.com

dowidth.com