The secondaries market offers investors liquidity and diversified exposure by trading existing private equity stakes, contrasting with real estate investments that focus on tangible asset ownership and potential income generation from property holdings. Secondary market investments often provide faster entry and exit opportunities with reduced risk through established portfolio assets, while real estate demands active management and faces market volatility tied to location and economic factors. Explore deeper insights to understand which investment aligns best with your financial goals.

Why it is important

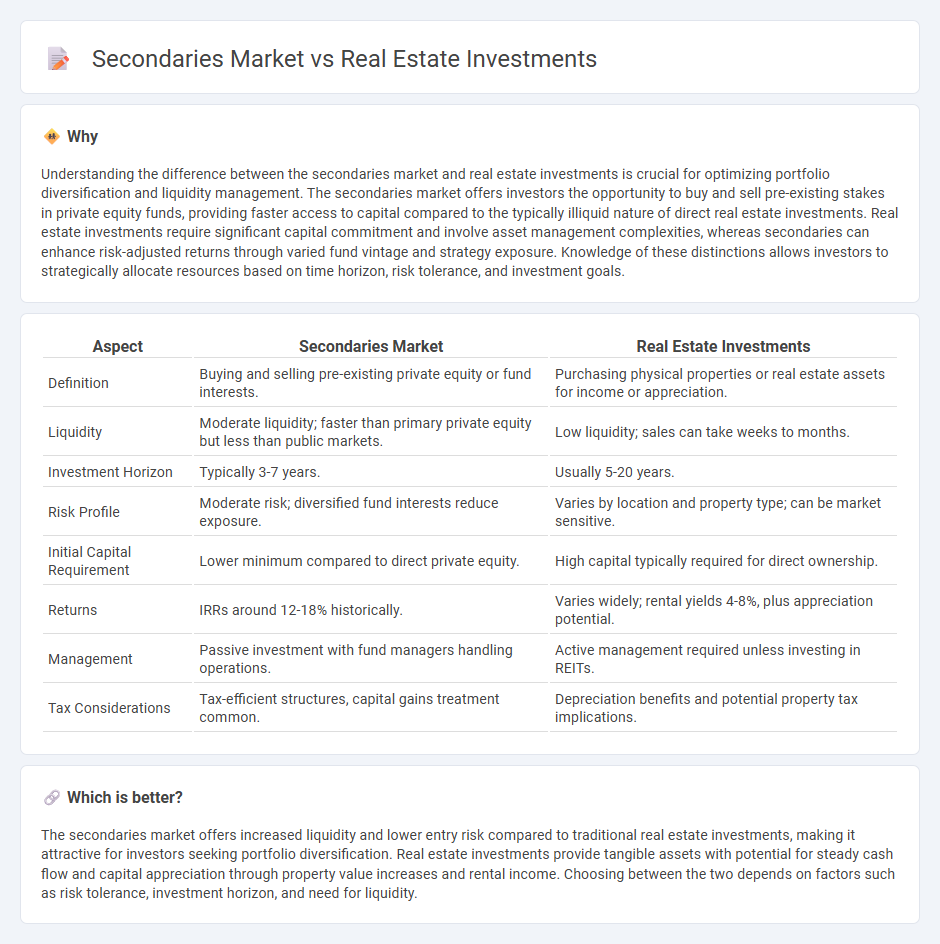

Understanding the difference between the secondaries market and real estate investments is crucial for optimizing portfolio diversification and liquidity management. The secondaries market offers investors the opportunity to buy and sell pre-existing stakes in private equity funds, providing faster access to capital compared to the typically illiquid nature of direct real estate investments. Real estate investments require significant capital commitment and involve asset management complexities, whereas secondaries can enhance risk-adjusted returns through varied fund vintage and strategy exposure. Knowledge of these distinctions allows investors to strategically allocate resources based on time horizon, risk tolerance, and investment goals.

Comparison Table

| Aspect | Secondaries Market | Real Estate Investments |

|---|---|---|

| Definition | Buying and selling pre-existing private equity or fund interests. | Purchasing physical properties or real estate assets for income or appreciation. |

| Liquidity | Moderate liquidity; faster than primary private equity but less than public markets. | Low liquidity; sales can take weeks to months. |

| Investment Horizon | Typically 3-7 years. | Usually 5-20 years. |

| Risk Profile | Moderate risk; diversified fund interests reduce exposure. | Varies by location and property type; can be market sensitive. |

| Initial Capital Requirement | Lower minimum compared to direct private equity. | High capital typically required for direct ownership. |

| Returns | IRRs around 12-18% historically. | Varies widely; rental yields 4-8%, plus appreciation potential. |

| Management | Passive investment with fund managers handling operations. | Active management required unless investing in REITs. |

| Tax Considerations | Tax-efficient structures, capital gains treatment common. | Depreciation benefits and potential property tax implications. |

Which is better?

The secondaries market offers increased liquidity and lower entry risk compared to traditional real estate investments, making it attractive for investors seeking portfolio diversification. Real estate investments provide tangible assets with potential for steady cash flow and capital appreciation through property value increases and rental income. Choosing between the two depends on factors such as risk tolerance, investment horizon, and need for liquidity.

Connection

The secondaries market enhances real estate investments by providing liquidity options for investors seeking to buy or sell existing stakes in real estate funds or portfolios. This market facilitates price discovery and portfolio diversification, enabling more efficient capital allocation within the real estate sector. By offering a platform for trading secondary interests, it contributes to increased market transparency and investment flexibility.

Key Terms

Appreciation

Real estate investments traditionally offer steady appreciation through tangible asset growth and rental income, often benefiting from market stability and inflation hedging. The secondaries market provides liquidity and access to mature fund interests, enabling investors to capitalize on discounted asset values and potentially accelerated returns. Explore deeper insights into how these investment strategies compare for maximizing appreciation.

Liquidity

Real estate investments typically offer lower liquidity due to longer holding periods and complex transaction processes, whereas the secondaries market provides enhanced liquidity by enabling faster asset transfers and access to mature investment positions. Institutional investors leverage secondaries to rebalance portfolios, manage risk, and achieve quicker capital deployment compared to traditional real estate holdings. Explore in-depth analyses to understand liquidity advantages between real estate investments and the secondaries market.

Valuation

Real estate investments often involve direct asset valuation based on property location, market conditions, and cash flow projections, leading to tangible, long-term value appreciation. The secondaries market values portfolios or limited partnership interests using discounted cash flow models, recent transaction comparables, and fund performance metrics, impacting liquidity and pricing flexibility. Explore further to understand how valuation methods influence investment decisions and risk profiles in both markets.

Source and External Links

Real estate investing - Real estate investing involves purchasing, owning, managing, renting, or selling real estate to generate profit or long-term wealth, with valuation and financing playing key roles in maximizing returns and minimizing risk.

Real Estate Investing: 5 Ways to Get Started - NerdWallet - Common ways to invest in real estate include buying REITs, online platforms, rental properties, flipping houses, or leasing for income, with REITs offering dividends and diversification benefits.

4 ways to invest in real estate - Fidelity - Starting points for real estate investment often include purchasing a home, investing in REITs, mutual funds or ETFs, and becoming a landlord to build equity and potentially hedge against inflation.

dowidth.com

dowidth.com