Investment communities, including retail investors and online forums, often focus on shared knowledge, diverse strategies, and real-time market sentiment, driving collective decision-making and grassroots trends. Institutional investors wield significant capital, sophisticated analytics, and long-term strategic planning, influencing market stability and major asset movements. Explore the dynamics between these groups to understand how their interactions shape investment landscapes.

Why it is important

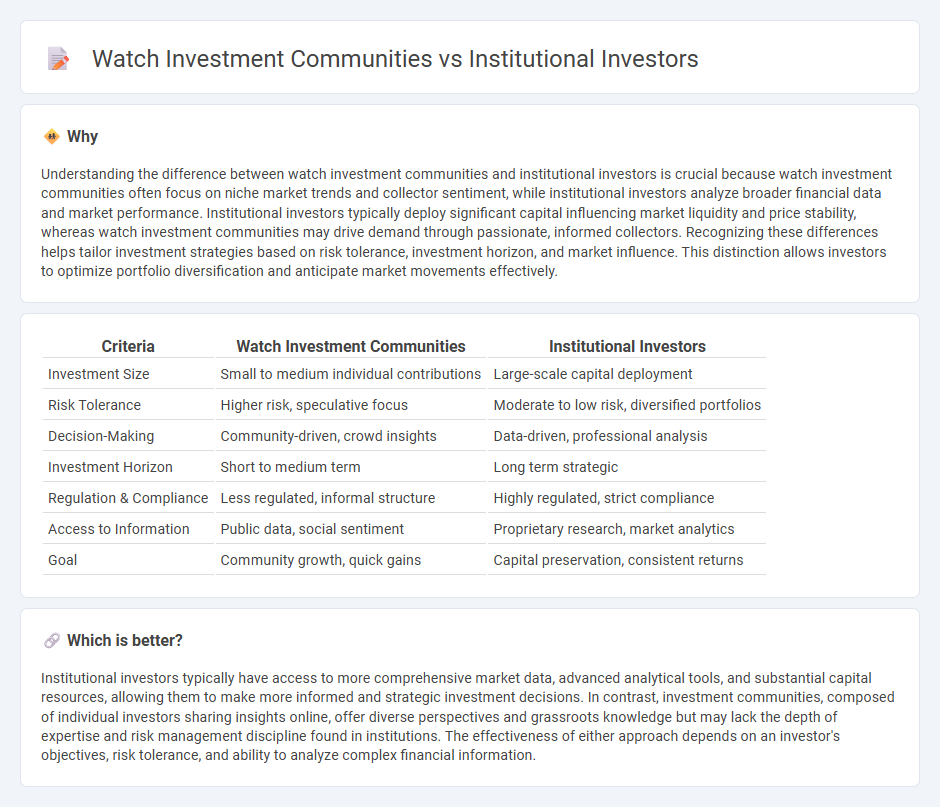

Understanding the difference between watch investment communities and institutional investors is crucial because watch investment communities often focus on niche market trends and collector sentiment, while institutional investors analyze broader financial data and market performance. Institutional investors typically deploy significant capital influencing market liquidity and price stability, whereas watch investment communities may drive demand through passionate, informed collectors. Recognizing these differences helps tailor investment strategies based on risk tolerance, investment horizon, and market influence. This distinction allows investors to optimize portfolio diversification and anticipate market movements effectively.

Comparison Table

| Criteria | Watch Investment Communities | Institutional Investors |

|---|---|---|

| Investment Size | Small to medium individual contributions | Large-scale capital deployment |

| Risk Tolerance | Higher risk, speculative focus | Moderate to low risk, diversified portfolios |

| Decision-Making | Community-driven, crowd insights | Data-driven, professional analysis |

| Investment Horizon | Short to medium term | Long term strategic |

| Regulation & Compliance | Less regulated, informal structure | Highly regulated, strict compliance |

| Access to Information | Public data, social sentiment | Proprietary research, market analytics |

| Goal | Community growth, quick gains | Capital preservation, consistent returns |

Which is better?

Institutional investors typically have access to more comprehensive market data, advanced analytical tools, and substantial capital resources, allowing them to make more informed and strategic investment decisions. In contrast, investment communities, composed of individual investors sharing insights online, offer diverse perspectives and grassroots knowledge but may lack the depth of expertise and risk management discipline found in institutions. The effectiveness of either approach depends on an investor's objectives, risk tolerance, and ability to analyze complex financial information.

Connection

Investment communities and institutional investors are interconnected through shared market analysis, portfolio strategies, and real-time data exchange, enhancing decision-making and market efficiency. Institutional investors influence community sentiments by providing large-scale capital flows and strategic insights that individual investors monitor closely. This symbiotic connection drives liquidity and price discovery in financial markets, fostering a dynamic investment environment.

Key Terms

Asset Allocation

Institutional investors, such as pension funds and insurance companies, strategically allocate assets to optimize long-term returns while managing risk through diversified portfolios emphasizing equities, fixed income, and alternative investments. Watch investment communities, often composed of retail investors and online forums, increasingly influence market trends by sharing timely insights and crowd-sourced strategies but typically exhibit higher volatility in asset allocation decisions. Explore how different asset allocation approaches impact investment performance and market dynamics.

Due Diligence

Institutional investors employ rigorous due diligence processes involving comprehensive financial analysis, risk assessment, and compliance checks to ensure substantial capital protection and long-term growth. Watch investment communities rely heavily on market trends, brand prestige, and limited edition rarities, often accompanied by enthusiast-driven insights rather than formal analytics. Explore the distinct due diligence methodologies to understand how investment strategies diverge in these two sectors.

Collective Influence

Institutional investors wield significant financial power and strategic influence, often shaping market trends through large-scale asset management and long-term investment strategies. Watch investment communities, comprising smaller, individual investors, leverage collective intelligence and social collaboration to identify emerging opportunities and influence market sentiment. Explore further to understand how these groups drive collective influence in today's dynamic financial landscape.

Source and External Links

Institutional investor - An institutional investor is an entity that pools money to purchase securities, real property, and other investment assets or originate loans, including banks, pension funds, insurance companies, and mutual funds, managing trillions in assets and often influencing corporate governance through voting rights.

Institutional Investor - Institutional investors are legal entities that accumulate funds from multiple investors to invest in financial instruments, benefiting from lower fees, fewer regulations, and access to assets unavailable to private investors while typically focusing on long-term investing strategies.

Institutional Investors and 'Smart Money' - Institutional investors are professional entities pooling capital for large, sophisticated investments, often called "smart money," whose trades significantly affect stock prices and market trends, although their expertise does not guarantee better outcomes than retail investors.

dowidth.com

dowidth.com