Investment in the space economy is rapidly expanding, driven by advancements in satellite technology, space exploration, and commercial applications, attracting billions in venture capital and government funding. Meanwhile, the automotive industry continues to see significant investment focused on electric vehicles, autonomous driving systems, and sustainability innovations. Explore detailed comparisons and future trends to understand where strategic investment opportunities lie.

Why it is important

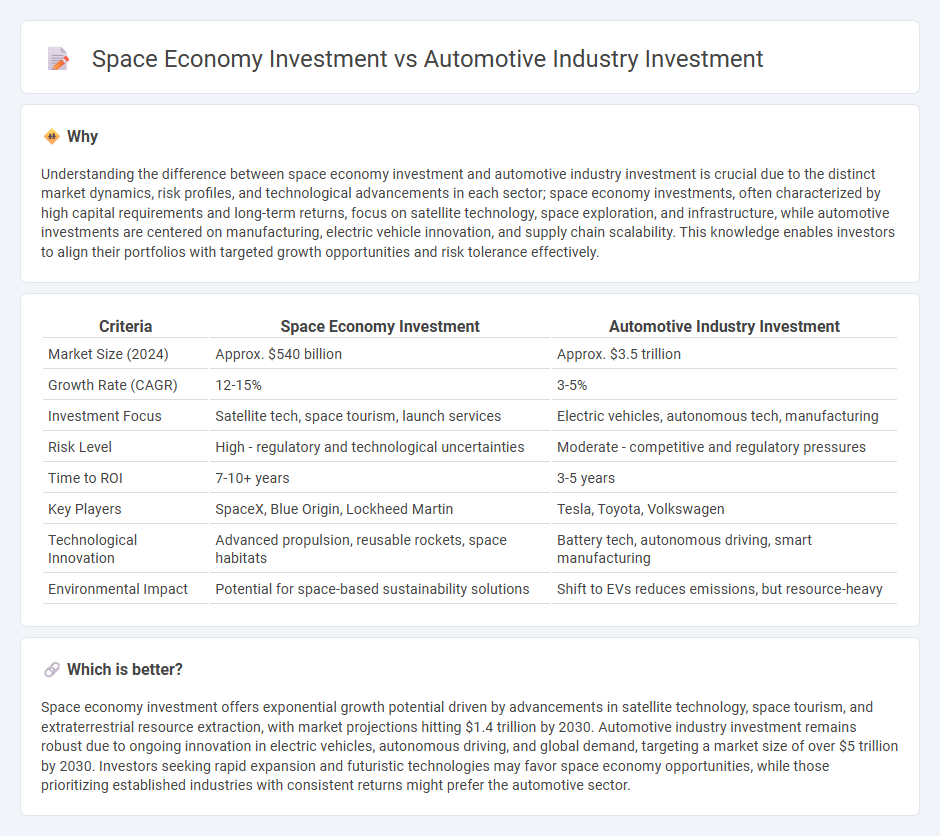

Understanding the difference between space economy investment and automotive industry investment is crucial due to the distinct market dynamics, risk profiles, and technological advancements in each sector; space economy investments, often characterized by high capital requirements and long-term returns, focus on satellite technology, space exploration, and infrastructure, while automotive investments are centered on manufacturing, electric vehicle innovation, and supply chain scalability. This knowledge enables investors to align their portfolios with targeted growth opportunities and risk tolerance effectively.

Comparison Table

| Criteria | Space Economy Investment | Automotive Industry Investment |

|---|---|---|

| Market Size (2024) | Approx. $540 billion | Approx. $3.5 trillion |

| Growth Rate (CAGR) | 12-15% | 3-5% |

| Investment Focus | Satellite tech, space tourism, launch services | Electric vehicles, autonomous tech, manufacturing |

| Risk Level | High - regulatory and technological uncertainties | Moderate - competitive and regulatory pressures |

| Time to ROI | 7-10+ years | 3-5 years |

| Key Players | SpaceX, Blue Origin, Lockheed Martin | Tesla, Toyota, Volkswagen |

| Technological Innovation | Advanced propulsion, reusable rockets, space habitats | Battery tech, autonomous driving, smart manufacturing |

| Environmental Impact | Potential for space-based sustainability solutions | Shift to EVs reduces emissions, but resource-heavy |

Which is better?

Space economy investment offers exponential growth potential driven by advancements in satellite technology, space tourism, and extraterrestrial resource extraction, with market projections hitting $1.4 trillion by 2030. Automotive industry investment remains robust due to ongoing innovation in electric vehicles, autonomous driving, and global demand, targeting a market size of over $5 trillion by 2030. Investors seeking rapid expansion and futuristic technologies may favor space economy opportunities, while those prioritizing established industries with consistent returns might prefer the automotive sector.

Connection

Investment in the space economy and the automotive industry are interconnected through advancements in technology and materials science, where innovations like lightweight composites and autonomous systems developed for spacecraft are adapted to enhance vehicle performance and safety. Both sectors benefit from shared funding in research and development, particularly in propulsion technologies and artificial intelligence, driving growth and efficiency in electric and self-driving cars. Cross-industry collaboration capitalizes on space economy investments to accelerate automotive innovation, creating synergies that boost economic returns and technological progress.

Key Terms

**Automotive Industry Investment:**

Investment in the automotive industry saw a global expenditure exceeding $400 billion in 2023, driven by the shift toward electric vehicles (EVs) and autonomous driving technologies. Leading automakers and tech giants are channeling funds into research and development to enhance battery efficiency, AI-driven navigation systems, and sustainable manufacturing processes. Explore the latest trends and detailed analysis on automotive industry investment to understand its impact on market dynamics.

Supply Chain Integration

Investment in the automotive industry heavily emphasizes supply chain integration to optimize manufacturing processes, enhance component sourcing, and reduce lead times, supporting the sector's scale and efficiency. In contrast, space economy investment prioritizes supply chain resilience and innovation to manage complex logistics, ensure mission-critical deliveries, and adapt to emerging space technologies. Explore further to understand how tailored supply chain strategies drive growth and sustainability in these distinct industries.

Regulatory Compliance

Automotive industry investment in regulatory compliance primarily targets emissions standards, safety protocols, and evolving electric vehicle mandates to meet stringent government policies worldwide. In contrast, space economy investment emphasizes compliance with international space law, licensing for satellite launches, and cybersecurity measures critical to protecting orbital assets and telecommunications infrastructure. Explore the nuances of regulatory compliance in these sectors to better understand investment priorities and risk management strategies.

Source and External Links

Automotive R&D investment, by world region - ACEA - Europe is the world's largest investor in automotive R&D, with investment reaching EUR72.8 billion per year in 2022, surpassing Japan, the U.S., and China.

Alliance for Automotive Innovation Releases NEW Economic Data - In the U.S., the auto industry invested over $32.8 billion in R&D in 2022, with $125 billion committed to EV and battery projects across 18 states, supporting over 113,000 jobs.

Automotive Ventures - A venture capital firm focused on funding innovations in transportation technology, emphasizing AI, new energy sources, digital transformation, and interconnected urban mobility.

dowidth.com

dowidth.com