Crypto staking offers a way to earn rewards by locking digital assets on blockchain networks, often providing higher returns compared to traditional investments like Certificates of Deposit (CDs), which offer fixed interest rates backed by banks and insured by the FDIC. While CDs guarantee principal security and predictable income, staking involves market volatility and varying annual percentage yields (APYs) depending on the cryptocurrency and platform used. Explore the differences in risk, liquidity, and potential gains to determine the best investment strategy for your financial goals.

Why it is important

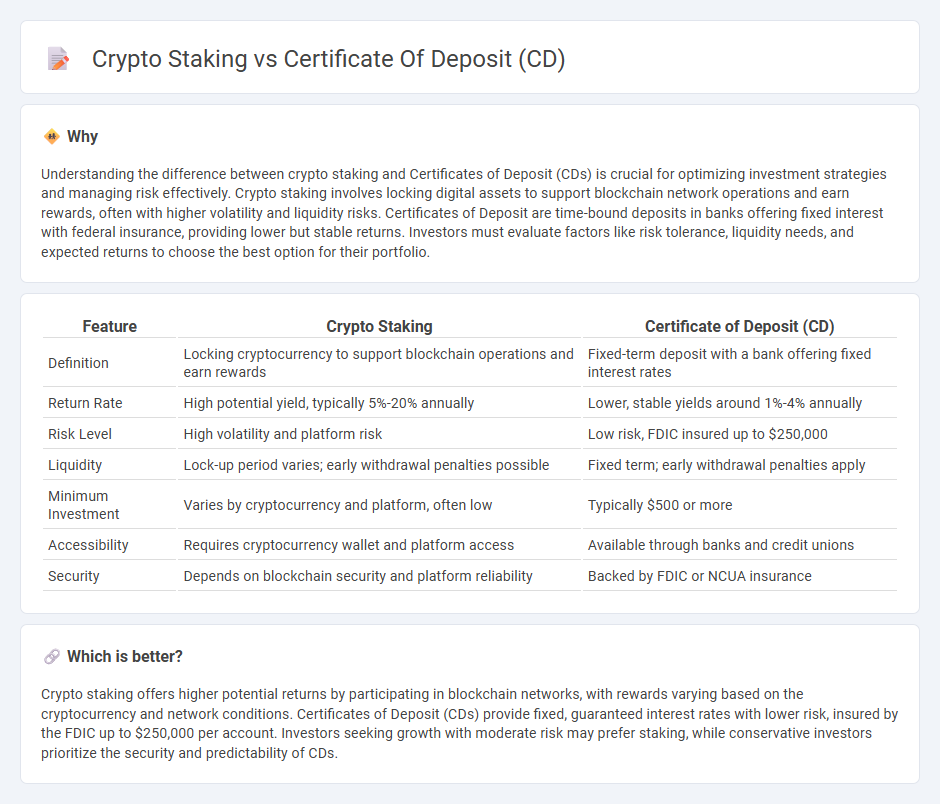

Understanding the difference between crypto staking and Certificates of Deposit (CDs) is crucial for optimizing investment strategies and managing risk effectively. Crypto staking involves locking digital assets to support blockchain network operations and earn rewards, often with higher volatility and liquidity risks. Certificates of Deposit are time-bound deposits in banks offering fixed interest with federal insurance, providing lower but stable returns. Investors must evaluate factors like risk tolerance, liquidity needs, and expected returns to choose the best option for their portfolio.

Comparison Table

| Feature | Crypto Staking | Certificate of Deposit (CD) |

|---|---|---|

| Definition | Locking cryptocurrency to support blockchain operations and earn rewards | Fixed-term deposit with a bank offering fixed interest rates |

| Return Rate | High potential yield, typically 5%-20% annually | Lower, stable yields around 1%-4% annually |

| Risk Level | High volatility and platform risk | Low risk, FDIC insured up to $250,000 |

| Liquidity | Lock-up period varies; early withdrawal penalties possible | Fixed term; early withdrawal penalties apply |

| Minimum Investment | Varies by cryptocurrency and platform, often low | Typically $500 or more |

| Accessibility | Requires cryptocurrency wallet and platform access | Available through banks and credit unions |

| Security | Depends on blockchain security and platform reliability | Backed by FDIC or NCUA insurance |

Which is better?

Crypto staking offers higher potential returns by participating in blockchain networks, with rewards varying based on the cryptocurrency and network conditions. Certificates of Deposit (CDs) provide fixed, guaranteed interest rates with lower risk, insured by the FDIC up to $250,000 per account. Investors seeking growth with moderate risk may prefer staking, while conservative investors prioritize the security and predictability of CDs.

Connection

Crypto staking and Certificates of Deposit (CDs) are connected through their shared function as investment strategies that generate passive income by locking assets for a fixed period. Both methods provide predictable returns--staking rewards crypto holders with interest or new tokens, while CDs offer fixed interest rates on deposited funds. These investment options appeal to risk-averse investors seeking stable income streams with varying degrees of liquidity and market exposure.

Key Terms

Fixed Interest Rate

Certificates of deposit (CDs) offer a fixed interest rate guaranteed by banks, providing predictable returns over a set term with minimal risk. In contrast, crypto staking rewards vary based on network protocols and token demand, often resulting in fluctuating returns without a guaranteed fixed rate. Explore the benefits and risks of both options to determine the best fixed income strategy for your investment portfolio.

Lock-up Period

Certificate of deposit (CD) lock-up periods typically range from a few months to several years, offering fixed interest rates and guaranteed returns under FDIC insurance protections. Crypto staking lock-up periods vary widely depending on the blockchain protocol, often ranging from days to months, with potential rewards influenced by network inflation and token value fluctuations. Explore more to understand the trade-offs between fixed certainty and dynamic yield opportunities in these investment options.

Risk Level

Certificates of deposit (CDs) offer low-risk returns backed by FDIC insurance, making them a secure choice for conservative investors. Crypto staking involves higher risk due to market volatility and potential regulatory changes, but it can yield significantly greater rewards. Explore detailed comparisons to understand which investment aligns better with your risk tolerance.

Source and External Links

What is a certificate of deposit (CD)? | Consumer Financial Protection Bureau - A certificate of deposit (CD) is a type of savings account offered by banks and credit unions where you agree to keep your money deposited for a set period in exchange for a fixed interest rate, but you must pay a penalty for early withdrawal.

Certificate of Deposit - Fixed Income Products | Charles Schwab - CDs are bank deposits that pay a stated amount of interest over a specified period and return your money plus interest at maturity, offering steady, predictable returns and FDIC insurance up to $250,000 per depositor.

Open a Certificate of Deposit (CD) Account Online | Wells Fargo - CDs provide a secure way to grow savings with a fixed interest rate for a chosen term, FDIC insurance, and are a useful tool for achieving short-to-medium-term financial goals by reducing the temptation to spend impulsively.

dowidth.com

dowidth.com