Sneaker flipping involves buying limited-edition sneakers at retail prices and reselling them for a profit, capitalizing on high demand and scarcity. Angel investing requires providing capital to early-stage startups, often in exchange for equity and potential long-term returns. Explore the benefits and risks of sneaker flipping versus angel investing to determine which investment strategy suits your financial goals.

Why it is important

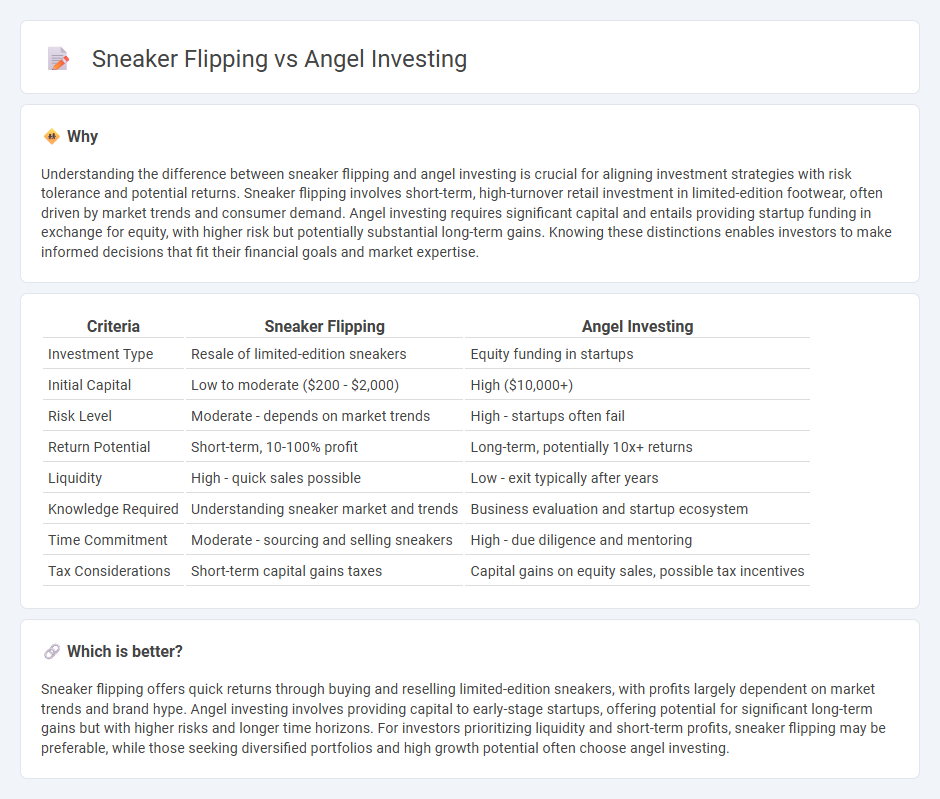

Understanding the difference between sneaker flipping and angel investing is crucial for aligning investment strategies with risk tolerance and potential returns. Sneaker flipping involves short-term, high-turnover retail investment in limited-edition footwear, often driven by market trends and consumer demand. Angel investing requires significant capital and entails providing startup funding in exchange for equity, with higher risk but potentially substantial long-term gains. Knowing these distinctions enables investors to make informed decisions that fit their financial goals and market expertise.

Comparison Table

| Criteria | Sneaker Flipping | Angel Investing |

|---|---|---|

| Investment Type | Resale of limited-edition sneakers | Equity funding in startups |

| Initial Capital | Low to moderate ($200 - $2,000) | High ($10,000+) |

| Risk Level | Moderate - depends on market trends | High - startups often fail |

| Return Potential | Short-term, 10-100% profit | Long-term, potentially 10x+ returns |

| Liquidity | High - quick sales possible | Low - exit typically after years |

| Knowledge Required | Understanding sneaker market and trends | Business evaluation and startup ecosystem |

| Time Commitment | Moderate - sourcing and selling sneakers | High - due diligence and mentoring |

| Tax Considerations | Short-term capital gains taxes | Capital gains on equity sales, possible tax incentives |

Which is better?

Sneaker flipping offers quick returns through buying and reselling limited-edition sneakers, with profits largely dependent on market trends and brand hype. Angel investing involves providing capital to early-stage startups, offering potential for significant long-term gains but with higher risks and longer time horizons. For investors prioritizing liquidity and short-term profits, sneaker flipping may be preferable, while those seeking diversified portfolios and high growth potential often choose angel investing.

Connection

Sneaker flipping and angel investing both involve spotting undervalued assets with high potential for appreciation and require deep market knowledge to capitalize on niche opportunities. Successful sneaker flippers analyze trends, scarcity, and demand patterns, paralleling how angel investors evaluate startup potential, market viability, and growth trajectories. Both investment strategies rely heavily on timing, foresight, and risk assessment to maximize returns in dynamic, fast-paced markets.

Key Terms

Angel Investing:

Angel investing involves providing early-stage capital to startups in exchange for equity, targeting high-growth potential companies often in technology, healthcare, or renewable energy sectors. This form of investment carries significant risks but offers substantial returns and opportunities to influence business development. Discover how angel investing can diversify your portfolio and foster innovation in emerging industries.

Equity

Angel investing involves providing capital to early-stage startups in exchange for equity shares, offering the potential for substantial long-term returns as the company grows. Sneaker flipping, in contrast, is primarily a short-term, profit-driven activity centered on buying limited-edition sneakers at retail and reselling them at higher prices with no equity stake involved. Discover the key distinctions in ownership and financial benefits by exploring how equity impacts these investment strategies.

Valuation

Angel investing typically involves assessing startups with high growth potential, emphasizing factors like market size, revenue projections, and founder expertise to determine valuation. Sneaker flipping relies on limited edition releases, brand popularity, and resale demand to set prices, often driven by online marketplace trends. Explore deeper insights into how valuation strategies differ between these two investment approaches.

Source and External Links

Understanding angel financing and investing - J.P. Morgan - Angel investors provide early-stage funding to startups in exchange for equity or convertible debt, often helping founders develop prototypes, conduct market research, and attract further investment while mentoring founders with their expertise and networks.

Demystifying Angel Investing - Angel Capital Association - Angel investing allows individuals to invest capital into startups to generate returns and build legacy wealth, with additional benefits like impacting regional economies and accessing favorable tax incentives.

Angel Investors - The Hartford Insurance - Angel investors are wealthy individuals who use personal funds to invest smaller amounts more patiently than venture capitalists, typically in early-stage businesses, and often provide mentorship and management help in exchange for equity.

dowidth.com

dowidth.com