Secondaries in venture capital involve purchasing pre-existing stakes in startup companies, offering liquidity to early investors without impacting the company's operations, while buyouts focus on acquiring majority control of established firms to implement strategic changes. Venture capital secondaries typically emphasize growth potential and portfolio diversification, whereas buyouts center on operational improvements and value creation through restructuring. Explore how these distinct investment strategies can optimize your portfolio and risk management.

Why it is important

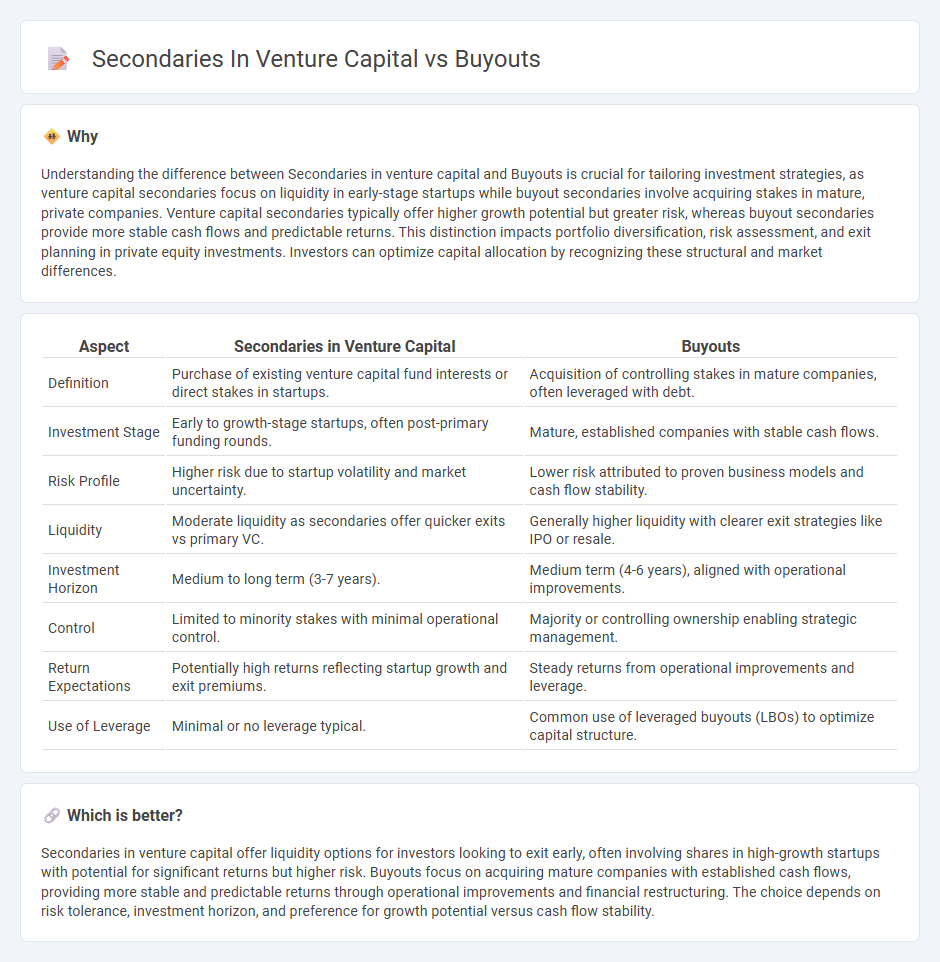

Understanding the difference between Secondaries in venture capital and Buyouts is crucial for tailoring investment strategies, as venture capital secondaries focus on liquidity in early-stage startups while buyout secondaries involve acquiring stakes in mature, private companies. Venture capital secondaries typically offer higher growth potential but greater risk, whereas buyout secondaries provide more stable cash flows and predictable returns. This distinction impacts portfolio diversification, risk assessment, and exit planning in private equity investments. Investors can optimize capital allocation by recognizing these structural and market differences.

Comparison Table

| Aspect | Secondaries in Venture Capital | Buyouts |

|---|---|---|

| Definition | Purchase of existing venture capital fund interests or direct stakes in startups. | Acquisition of controlling stakes in mature companies, often leveraged with debt. |

| Investment Stage | Early to growth-stage startups, often post-primary funding rounds. | Mature, established companies with stable cash flows. |

| Risk Profile | Higher risk due to startup volatility and market uncertainty. | Lower risk attributed to proven business models and cash flow stability. |

| Liquidity | Moderate liquidity as secondaries offer quicker exits vs primary VC. | Generally higher liquidity with clearer exit strategies like IPO or resale. |

| Investment Horizon | Medium to long term (3-7 years). | Medium term (4-6 years), aligned with operational improvements. |

| Control | Limited to minority stakes with minimal operational control. | Majority or controlling ownership enabling strategic management. |

| Return Expectations | Potentially high returns reflecting startup growth and exit premiums. | Steady returns from operational improvements and leverage. |

| Use of Leverage | Minimal or no leverage typical. | Common use of leveraged buyouts (LBOs) to optimize capital structure. |

Which is better?

Secondaries in venture capital offer liquidity options for investors looking to exit early, often involving shares in high-growth startups with potential for significant returns but higher risk. Buyouts focus on acquiring mature companies with established cash flows, providing more stable and predictable returns through operational improvements and financial restructuring. The choice depends on risk tolerance, investment horizon, and preference for growth potential versus cash flow stability.

Connection

Secondaries in venture capital and buyouts provide liquidity options by enabling the transfer of existing equity stakes from early investors to new buyers, facilitating portfolio management and risk diversification. These transactions often occur in buyout funds where mature assets are acquired, allowing investors to exit positions without waiting for a full exit event such as an IPO or acquisition. The connection lies in the common goal of optimizing capital allocation and delivering returns through efficient secondary market solutions in both investment strategies.

Key Terms

Control

Buyouts in venture capital involve acquiring controlling stakes in mature companies, enabling investors to directly steer management decisions and strategic direction. Secondaries typically refer to the purchase of existing stakes in venture funds or portfolios, often without full control, providing liquidity to early investors but limited influence over company operations. Explore the nuances of control dynamics in buyouts versus secondaries to optimize your investment strategy.

Liquidity

Buyouts provide significant liquidity events by allowing investors to sell controlling stakes in matured companies, often generating substantial returns through IPOs or acquisitions. Secondaries offer liquidity by enabling early investors and employees to exit positions in existing venture capital funds or private companies without waiting for a full exit. Explore more about how buyouts and secondaries impact liquidity and investment strategies in venture capital.

Valuation

Buyouts in venture capital typically involve acquiring controlling stakes in mature companies, often leading to higher valuations due to stable cash flows and proven business models. Secondaries, which involve purchasing existing venture fund interests or shares in private companies, usually present valuation discounts reflecting illiquidity and market timing factors. Explore further to understand how valuation dynamics differ between buyouts and secondaries in VC investing.

Source and External Links

Buyout - Definition, Types, Pros, Cons, Process - A buyout is an investment transaction where one party acquires control of a company by purchasing a majority of its shares, often including its debt, aiming to improve its operations and financial performance under new ownership.

Buyout: What are the different types? | Swoop US - A buyout involves acquiring a majority stake in a company, allowing the buyer to control strategic decisions and potentially restructure management and operations post-purchase.

Management buyout - A management buyout (MBO) is a type of buyout where a company's existing management team acquires a significant or full ownership interest, often sometimes with seller financing arrangements.

dowidth.com

dowidth.com