Music royalties provide investors with a steady stream of income generated from the ongoing use of copyrighted songs, while bonds offer fixed interest payments based on debt issued by corporations or governments. Unlike bonds, which carry interest rate and credit risks, music royalties are influenced by factors such as song popularity and licensing agreements, making them a form of alternative asset with different risk-return profiles. Explore the benefits and drawbacks of each investment type to determine which aligns best with your financial goals.

Why it is important

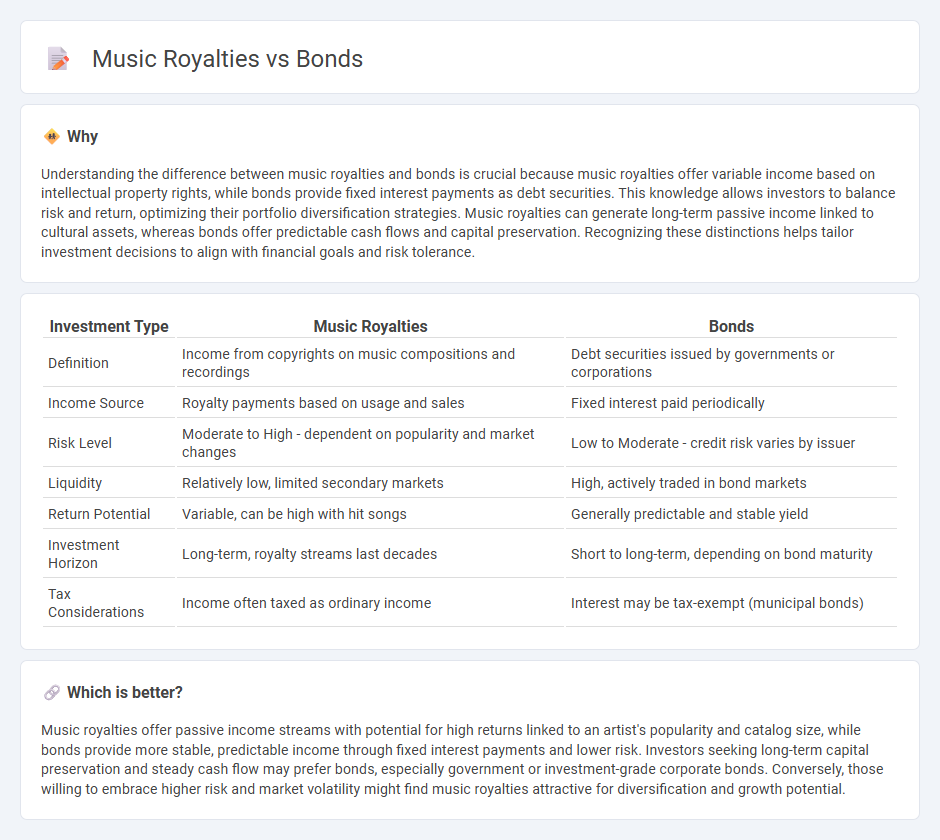

Understanding the difference between music royalties and bonds is crucial because music royalties offer variable income based on intellectual property rights, while bonds provide fixed interest payments as debt securities. This knowledge allows investors to balance risk and return, optimizing their portfolio diversification strategies. Music royalties can generate long-term passive income linked to cultural assets, whereas bonds offer predictable cash flows and capital preservation. Recognizing these distinctions helps tailor investment decisions to align with financial goals and risk tolerance.

Comparison Table

| Investment Type | Music Royalties | Bonds |

|---|---|---|

| Definition | Income from copyrights on music compositions and recordings | Debt securities issued by governments or corporations |

| Income Source | Royalty payments based on usage and sales | Fixed interest paid periodically |

| Risk Level | Moderate to High - dependent on popularity and market changes | Low to Moderate - credit risk varies by issuer |

| Liquidity | Relatively low, limited secondary markets | High, actively traded in bond markets |

| Return Potential | Variable, can be high with hit songs | Generally predictable and stable yield |

| Investment Horizon | Long-term, royalty streams last decades | Short to long-term, depending on bond maturity |

| Tax Considerations | Income often taxed as ordinary income | Interest may be tax-exempt (municipal bonds) |

Which is better?

Music royalties offer passive income streams with potential for high returns linked to an artist's popularity and catalog size, while bonds provide more stable, predictable income through fixed interest payments and lower risk. Investors seeking long-term capital preservation and steady cash flow may prefer bonds, especially government or investment-grade corporate bonds. Conversely, those willing to embrace higher risk and market volatility might find music royalties attractive for diversification and growth potential.

Connection

Music royalties and bonds are connected through their roles as alternative investment vehicles that provide regular income streams to investors. Music royalties generate consistent cash flow from licensing and streaming revenues, similar to bond interest payments that offer fixed returns over time. Both investments diversify portfolios by combining steady income with varying risk profiles depending on factors like artist popularity or bond credit ratings.

Key Terms

Yield

Bonds typically offer a fixed yield based on interest payments, providing predictable income streams, while music royalties generate variable yields influenced by factors such as song popularity, licensing agreements, and market trends. Yield from music royalties can potentially outperform traditional bonds but involves higher risk and less liquidity due to fluctuating revenue and rights management complexities. Explore detailed comparisons to understand how yield dynamics impact your investment portfolio.

Rights ownership

Bonds represent fixed-income investments with no direct link to rights ownership, while music royalties are income streams generated from owning rights to compositions or recordings. Rights ownership in music royalties entails control over usage, licensing, and distribution, leading to potential long-term revenue growth tied to intellectual property value. Explore the nuances of rights ownership in bonds versus music royalties to optimize your investment portfolio.

Income stream

Bonds generate income through fixed interest payments, providing a predictable and steady cash flow ideal for risk-averse investors. Music royalties deliver income based on the usage and popularity of songs, offering variable cash flow with potential for growth tied to copyright ownership. Explore the benefits and risks of each income stream to optimize your investment portfolio.

Source and External Links

Bonds | Investor.gov - Bonds are debt securities issued by governments, municipalities, or corporations to raise money, promising to pay fixed interest and repay principal at maturity, offering predictable income and capital preservation.

Bond (finance) - Wikipedia - Bonds provide external funding for long-term investments and are generally less volatile than stocks; they are primarily held by institutions but also accessible to individuals via bond funds.

What is a Bond and How do they Work? - Vanguard - Bonds are loans to issuers like companies or governments that pay investors periodic interest and return principal at maturity, providing income and helping reduce portfolio volatility.

dowidth.com

dowidth.com