Sneaker flipping involves buying limited-edition sneakers at retail prices and reselling them for profit, capitalizing on trends and brand collaborations in the streetwear market. Art collecting focuses on acquiring valuable artworks with long-term appreciation potential, driven by rarity, artist reputation, and market demand. Explore the key differences and potential returns of sneaker flipping versus art collecting as investment strategies.

Why it is important

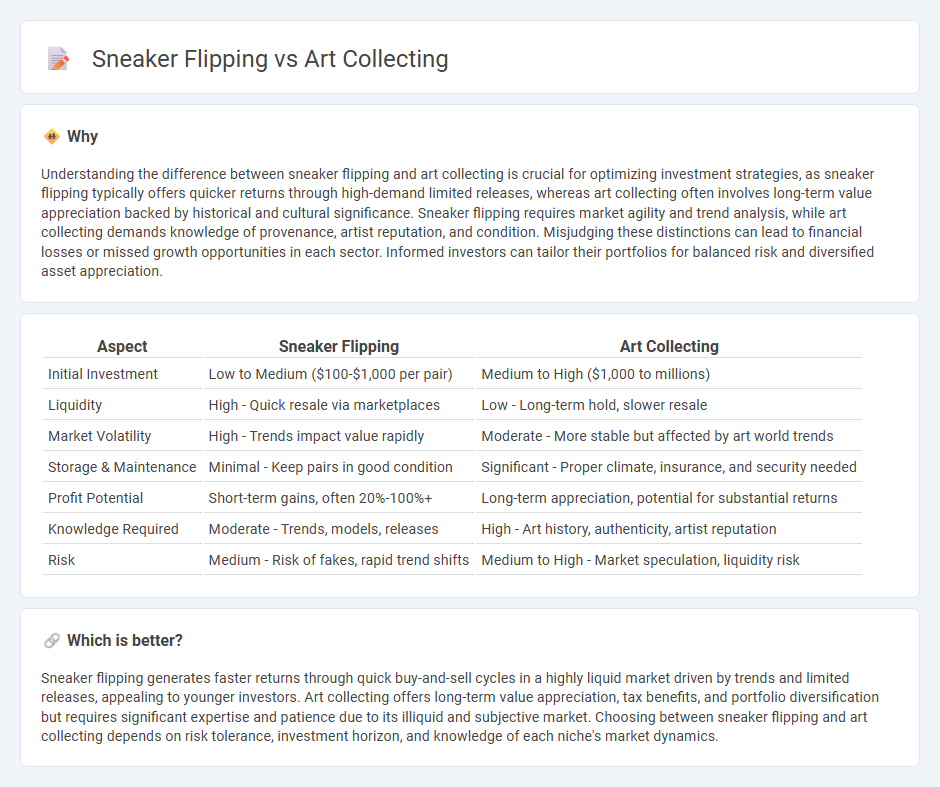

Understanding the difference between sneaker flipping and art collecting is crucial for optimizing investment strategies, as sneaker flipping typically offers quicker returns through high-demand limited releases, whereas art collecting often involves long-term value appreciation backed by historical and cultural significance. Sneaker flipping requires market agility and trend analysis, while art collecting demands knowledge of provenance, artist reputation, and condition. Misjudging these distinctions can lead to financial losses or missed growth opportunities in each sector. Informed investors can tailor their portfolios for balanced risk and diversified asset appreciation.

Comparison Table

| Aspect | Sneaker Flipping | Art Collecting |

|---|---|---|

| Initial Investment | Low to Medium ($100-$1,000 per pair) | Medium to High ($1,000 to millions) |

| Liquidity | High - Quick resale via marketplaces | Low - Long-term hold, slower resale |

| Market Volatility | High - Trends impact value rapidly | Moderate - More stable but affected by art world trends |

| Storage & Maintenance | Minimal - Keep pairs in good condition | Significant - Proper climate, insurance, and security needed |

| Profit Potential | Short-term gains, often 20%-100%+ | Long-term appreciation, potential for substantial returns |

| Knowledge Required | Moderate - Trends, models, releases | High - Art history, authenticity, artist reputation |

| Risk | Medium - Risk of fakes, rapid trend shifts | Medium to High - Market speculation, liquidity risk |

Which is better?

Sneaker flipping generates faster returns through quick buy-and-sell cycles in a highly liquid market driven by trends and limited releases, appealing to younger investors. Art collecting offers long-term value appreciation, tax benefits, and portfolio diversification but requires significant expertise and patience due to its illiquid and subjective market. Choosing between sneaker flipping and art collecting depends on risk tolerance, investment horizon, and knowledge of each niche's market dynamics.

Connection

Sneaker flipping and art collecting both represent alternative investment strategies that capitalize on scarcity and cultural trends to generate substantial returns. These markets leverage exclusivity, limited releases, and high demand, creating valuable asset classes outside traditional investments like stocks or real estate. Investor interest in sneaker reselling and art acquisition reflects growing recognition of tangible assets with appreciation potential driven by collectors and enthusiasts worldwide.

Key Terms

Provenance

Art collecting emphasizes provenance as a critical factor in verifying authenticity and historical value, with detailed documentation tracing ownership and exhibition history. Sneaker flipping relies on provenance primarily through limited releases, serial numbers, and packaging to establish rarity and originality. Explore the nuances of provenance in both markets to understand their impact on value and trust.

Limited Edition

Limited edition art pieces and exclusive sneaker releases both attract collectors seeking rarity and value appreciation. Limited edition artworks often come from renowned artists, emphasizing cultural significance and long-term investment potential, while limited sneakers focus on brand hype and resale profitability driven by scarcity. Discover the unique dynamics and strategies behind limited edition collecting in both markets.

Market Liquidity

Art collecting involves high-value assets with lower market liquidity due to lengthy authentication and seasonal auction cycles, while sneaker flipping offers rapid turnover with smaller profit margins in a highly liquid resale market driven by limited editions and hype culture. The art market's liquidity is influenced by factors such as provenance, artist reputation, and global economic conditions, contrasting with the sneaker market's reliance on trends, social media, and online marketplaces like StockX and GOAT. Explore the dynamics of these investment opportunities to understand how liquidity impacts profitability and risk.

Source and External Links

Art Collecting | EBSCO Research Starters - Art collecting is the practice of acquiring artworks for personal enjoyment, investment, or cultural appreciation, with a rich history from prehistoric times through today's diverse, accessible art market.

How To Start Collecting Art Without Breaking The Bank - Starting art collecting can begin affordably by purchasing prints, editions, exhibition posters, or art books to develop one's taste and connection to art.

5 Tips for First-Time Art Collectors - Artsy - First-time collectors are advised to see as much art as possible in galleries, museums, and fairs, research thoroughly, and focus on personal connection rather than trends.

dowidth.com

dowidth.com