NFT domain names represent a digital asset class leveraging blockchain technology to provide unique, tradable web addresses with potential for high appreciation. Commodities like gold, oil, and agricultural products serve as tangible investment vehicles with established market liquidity and intrinsic value. Explore how these contrasting investment opportunities can diversify your portfolio and enhance returns.

Why it is important

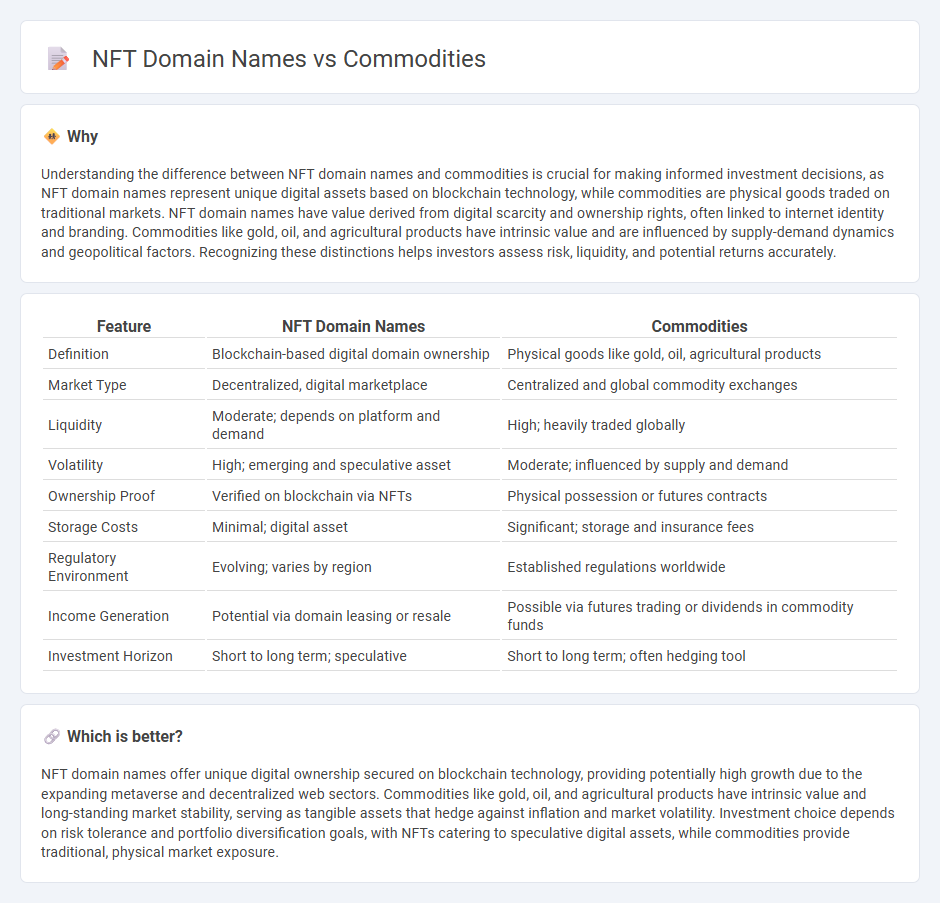

Understanding the difference between NFT domain names and commodities is crucial for making informed investment decisions, as NFT domain names represent unique digital assets based on blockchain technology, while commodities are physical goods traded on traditional markets. NFT domain names have value derived from digital scarcity and ownership rights, often linked to internet identity and branding. Commodities like gold, oil, and agricultural products have intrinsic value and are influenced by supply-demand dynamics and geopolitical factors. Recognizing these distinctions helps investors assess risk, liquidity, and potential returns accurately.

Comparison Table

| Feature | NFT Domain Names | Commodities |

|---|---|---|

| Definition | Blockchain-based digital domain ownership | Physical goods like gold, oil, agricultural products |

| Market Type | Decentralized, digital marketplace | Centralized and global commodity exchanges |

| Liquidity | Moderate; depends on platform and demand | High; heavily traded globally |

| Volatility | High; emerging and speculative asset | Moderate; influenced by supply and demand |

| Ownership Proof | Verified on blockchain via NFTs | Physical possession or futures contracts |

| Storage Costs | Minimal; digital asset | Significant; storage and insurance fees |

| Regulatory Environment | Evolving; varies by region | Established regulations worldwide |

| Income Generation | Potential via domain leasing or resale | Possible via futures trading or dividends in commodity funds |

| Investment Horizon | Short to long term; speculative | Short to long term; often hedging tool |

Which is better?

NFT domain names offer unique digital ownership secured on blockchain technology, providing potentially high growth due to the expanding metaverse and decentralized web sectors. Commodities like gold, oil, and agricultural products have intrinsic value and long-standing market stability, serving as tangible assets that hedge against inflation and market volatility. Investment choice depends on risk tolerance and portfolio diversification goals, with NFTs catering to speculative digital assets, while commodities provide traditional, physical market exposure.

Connection

NFT domain names represent unique digital assets traded as commodities on blockchain marketplaces, allowing investors to speculate on their future value. These digital domains function similarly to traditional commodities by being scarce, tradable, and subject to market demand fluctuations. The convergence of NFTs and commodities markets creates new investment opportunities by combining blockchain technology with asset liquidity and value appreciation potential.

Key Terms

Tangibility

Commodities represent tangible assets like gold, oil, and agricultural products that have intrinsic value derived from physical properties and established market demand. NFT domain names, by contrast, are digital assets secured on blockchain technology, offering unique, verifiable ownership of virtual real estate without physical form. Explore the distinctions between these asset classes to understand their impact on investment portfolios and digital economies.

Liquidity

Commodity markets offer high liquidity with standardized assets traded on established exchanges, ensuring rapid buying and selling. NFT domain names, while unique digital assets secured on blockchain, typically exhibit lower liquidity due to niche demand and less frequent transactions. Explore deeper to understand how liquidity dynamics impact investment strategies in these distinct asset classes.

Volatility

Commodities like gold and oil exhibit price volatility driven by geopolitical tensions, supply-demand imbalances, and macroeconomic factors, often resulting in rapid market fluctuations. NFT domain names experience volatility influenced by digital trends, platform popularity, and speculative investor behavior, leading to unpredictable valuation swings. Explore further to understand how volatility impacts investment strategies in these distinct asset classes.

Source and External Links

Understanding Commodities - PIMCO - Commodities are raw materials used in creating consumer products, including agricultural products, energy, and metals.

Commodities Versus Differentiated Products - Commodities are identical and interchangeable, often traded on futures markets, while differentiated products are unique and diverse.

Commodities - Commodity futures contracts involve buying or selling commodities at a specified price on a future date, regulated by the CFTC.

dowidth.com

dowidth.com