Vintage sneaker portfolios offer high-growth potential through limited-edition releases and cultural relevance, appealing to younger investors seeking diversification outside traditional markets. Rare whisky casks provide long-term value appreciation driven by aging processes, scarcity, and global demand from collectors and connoisseurs. Explore the unique benefits and risks of each asset class to determine which aligns better with your investment strategy.

Why it is important

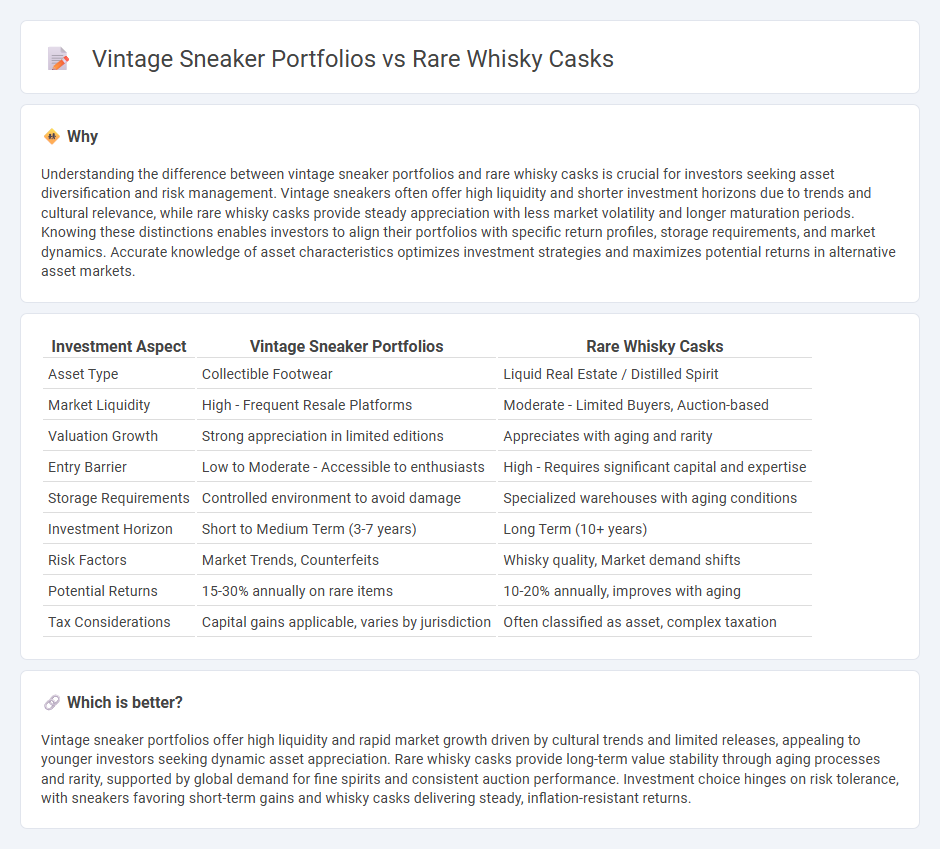

Understanding the difference between vintage sneaker portfolios and rare whisky casks is crucial for investors seeking asset diversification and risk management. Vintage sneakers often offer high liquidity and shorter investment horizons due to trends and cultural relevance, while rare whisky casks provide steady appreciation with less market volatility and longer maturation periods. Knowing these distinctions enables investors to align their portfolios with specific return profiles, storage requirements, and market dynamics. Accurate knowledge of asset characteristics optimizes investment strategies and maximizes potential returns in alternative asset markets.

Comparison Table

| Investment Aspect | Vintage Sneaker Portfolios | Rare Whisky Casks |

|---|---|---|

| Asset Type | Collectible Footwear | Liquid Real Estate / Distilled Spirit |

| Market Liquidity | High - Frequent Resale Platforms | Moderate - Limited Buyers, Auction-based |

| Valuation Growth | Strong appreciation in limited editions | Appreciates with aging and rarity |

| Entry Barrier | Low to Moderate - Accessible to enthusiasts | High - Requires significant capital and expertise |

| Storage Requirements | Controlled environment to avoid damage | Specialized warehouses with aging conditions |

| Investment Horizon | Short to Medium Term (3-7 years) | Long Term (10+ years) |

| Risk Factors | Market Trends, Counterfeits | Whisky quality, Market demand shifts |

| Potential Returns | 15-30% annually on rare items | 10-20% annually, improves with aging |

| Tax Considerations | Capital gains applicable, varies by jurisdiction | Often classified as asset, complex taxation |

Which is better?

Vintage sneaker portfolios offer high liquidity and rapid market growth driven by cultural trends and limited releases, appealing to younger investors seeking dynamic asset appreciation. Rare whisky casks provide long-term value stability through aging processes and rarity, supported by global demand for fine spirits and consistent auction performance. Investment choice hinges on risk tolerance, with sneakers favoring short-term gains and whisky casks delivering steady, inflation-resistant returns.

Connection

Vintage sneaker portfolios and rare whisky casks both serve as alternative investment assets attracting collectors and investors seeking diversification and high returns. These tangible assets appreciate over time due to scarcity, cultural significance, and growing demand in niche markets globally. Investors benefit from portfolio balance by including such non-correlated, inflation-resistant commodities alongside traditional financial instruments.

Key Terms

Asset Authenticity

Rare whisky casks and vintage sneaker portfolios both rely heavily on asset authenticity to maintain and increase their market value, with provenance and expert verification playing crucial roles in preventing counterfeiting. Blockchain technology and tamper-proof labels are increasingly used to ensure transparency and traceability in these alternative investments. Explore how cutting-edge authentication methods secure your valuable assets and enhance investment confidence.

Market Liquidity

Rare whisky casks offer unique investment opportunities characterized by limited supply, strong cultural appeal, and increasing collector demand, yet they often present lower market liquidity compared to vintage sneaker portfolios, which benefit from a broader buyer base and more frequent trading activity. Vintage sneakers, driven by brand collaborations, scarcity, and hype cycles, enjoy higher turnover rates and easier market access, enhancing liquidity for investors seeking quicker asset conversion. Explore detailed market dynamics and strategies to balance liquidity with long-term value in alternative asset investments.

Provenance

Provenance plays a crucial role in determining value for both rare whisky casks and vintage sneaker portfolios, as authenticity and historical ownership significantly impact market demand. Detailed documentation tracing the origin, production year, and previous ownership enhances the credibility and desirability of these collectible assets. Explore deeper insights on how provenance influences investment strategies and asset valuation in niche luxury markets.

Source and External Links

Rare Whisky Barrel Brokerage - Rare Whisky 101 provides a bespoke cask brokerage service for rare whisky casks from iconic distilleries like Ardbeg, Laphroaig, Macallan, and Highland Park, with some casks valued over PS1 million and an average price of PS132,000 per cask.

Buy Rare Whiskies Online - Rare whiskies are often single cask, small batch, or limited-edition releases with unique flavor profiles tied to individual casks, and bottles can be highly collectible, especially if from distilleries no longer in operation.

Rare Cask Single Malt Triple Cask Whisky - The Glenlivet Rare Cask is a triple cask matured single malt with a high proportion of ex-sherry casks, released in uniquely numbered small batches featuring complex notes such as spice, vanilla, and ginger.

dowidth.com

dowidth.com