Fractional real estate investments involve multiple investors owning a share of a property, providing access to high-value assets with lower capital requirements, while vacation rental investments focus on generating income through short-term property leases in popular tourist destinations. Fractional ownership typically offers long-term appreciation and shared maintenance costs, whereas vacation rentals can yield higher immediate cash flow but require active management. Explore the advantages and challenges of each to determine which investment suits your financial goals best.

Why it is important

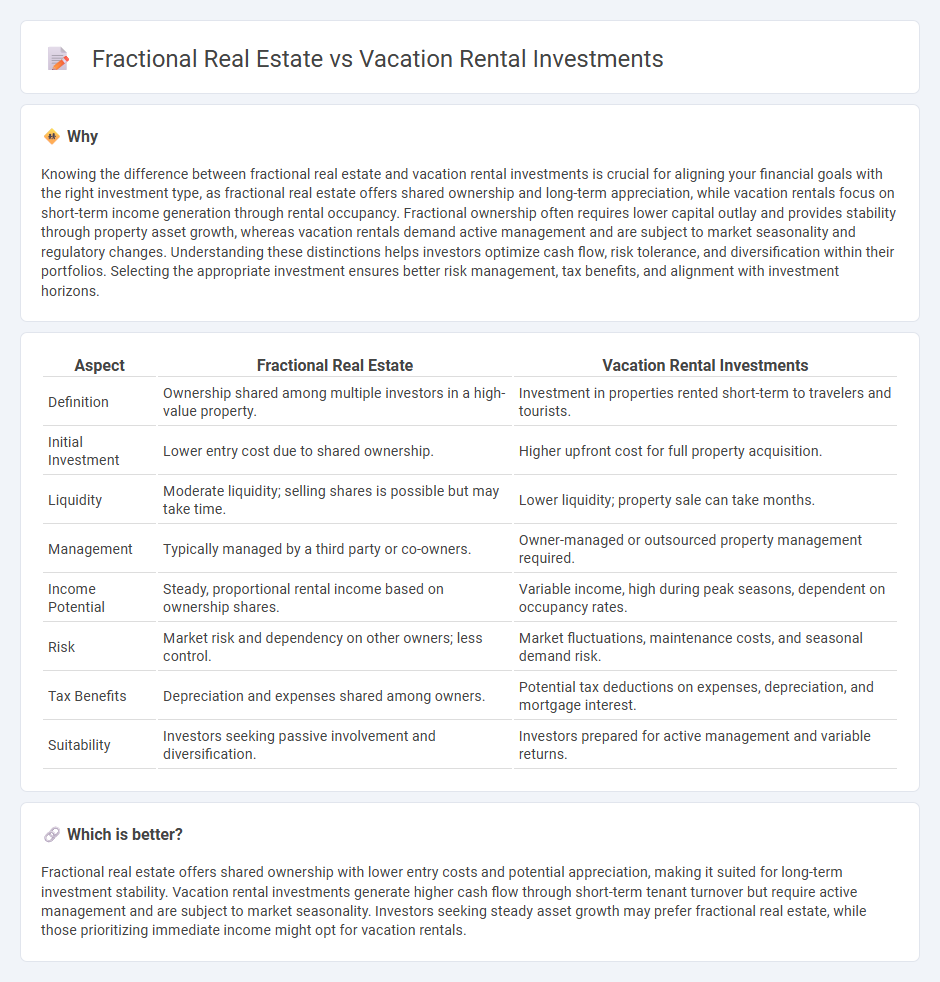

Knowing the difference between fractional real estate and vacation rental investments is crucial for aligning your financial goals with the right investment type, as fractional real estate offers shared ownership and long-term appreciation, while vacation rentals focus on short-term income generation through rental occupancy. Fractional ownership often requires lower capital outlay and provides stability through property asset growth, whereas vacation rentals demand active management and are subject to market seasonality and regulatory changes. Understanding these distinctions helps investors optimize cash flow, risk tolerance, and diversification within their portfolios. Selecting the appropriate investment ensures better risk management, tax benefits, and alignment with investment horizons.

Comparison Table

| Aspect | Fractional Real Estate | Vacation Rental Investments |

|---|---|---|

| Definition | Ownership shared among multiple investors in a high-value property. | Investment in properties rented short-term to travelers and tourists. |

| Initial Investment | Lower entry cost due to shared ownership. | Higher upfront cost for full property acquisition. |

| Liquidity | Moderate liquidity; selling shares is possible but may take time. | Lower liquidity; property sale can take months. |

| Management | Typically managed by a third party or co-owners. | Owner-managed or outsourced property management required. |

| Income Potential | Steady, proportional rental income based on ownership shares. | Variable income, high during peak seasons, dependent on occupancy rates. |

| Risk | Market risk and dependency on other owners; less control. | Market fluctuations, maintenance costs, and seasonal demand risk. |

| Tax Benefits | Depreciation and expenses shared among owners. | Potential tax deductions on expenses, depreciation, and mortgage interest. |

| Suitability | Investors seeking passive involvement and diversification. | Investors prepared for active management and variable returns. |

Which is better?

Fractional real estate offers shared ownership with lower entry costs and potential appreciation, making it suited for long-term investment stability. Vacation rental investments generate higher cash flow through short-term tenant turnover but require active management and are subject to market seasonality. Investors seeking steady asset growth may prefer fractional real estate, while those prioritizing immediate income might opt for vacation rentals.

Connection

Fractional real estate and vacation rental investments both capitalize on the growing demand for flexible property ownership and short-term lodging options. Fractional real estate allows multiple investors to own a share of a vacation property, distributing costs and increasing accessibility, while vacation rentals generate income through short-term tenant stays, maximizing property utilization. This synergy enhances cash flow potential and diversifies investment portfolios in the real estate market.

Key Terms

Ownership structure

Vacation rental investments typically involve full ownership of a property, allowing investors complete control over management and potential rental income. Fractional real estate divides ownership into shares, enabling investors to own a percentage of a high-value property with shared responsibilities and benefits. Explore how different ownership structures impact investment returns and flexibility to determine the best fit for your portfolio.

Rental income

Vacation rental investments generate rental income based on short-term stays, often yielding higher nightly rates but requiring active management and fluctuating occupancy. Fractional real estate offers stable rental income through shared ownership of high-value properties, with income distributed among co-owners and less hands-on involvement. Discover detailed comparisons to determine which investment aligns with your rental income goals.

Liquidity

Vacation rental investments often provide quicker liquidity due to direct property ownership allowing potential full sales or rentals at market value, though market conditions can affect timing. Fractional real estate offers enhanced liquidity options through shared ownership models, enabling investors to buy or sell portions of properties more easily without the need for full asset disposal. Explore our detailed comparison to understand which option aligns best with your liquidity needs.

Source and External Links

Why Should You Invest in Vacation Rentals? | Arrived - Vacation rentals offer an excellent real estate investment opportunity with relatively low barriers to entry, tax benefits, and growing demand as more travelers prefer unique, short-term stays over hotels, making them both a source of income and personal use for owners.

Investing in Vacation Rental Properties: Guide for Beginners - Vacation rental investments can provide good returns through property appreciation and lower operating costs, although they demand active management and strong marketing efforts to maintain occupancy and profitability.

Investing in Vacation Rental Property: The Proven Strategy - Hostfully - Vacation rentals are a lucrative investment with rising revenues and longer bookings driven by remote work trends, but success requires careful market research, management of expenses, and strategic advertising to optimize income and occupancy.

dowidth.com

dowidth.com