Song catalog purchases offer investors tangible assets with steady royalty income and proven track records, contrasting sharply with the high volatility and speculative nature of cryptocurrencies. While music rights provide predictable cash flows backed by intellectual property, cryptocurrencies rely on decentralized networks and market demand, resulting in fluctuating valuations. Explore the benefits and risks of each investment type to determine which aligns best with your financial goals.

Why it is important

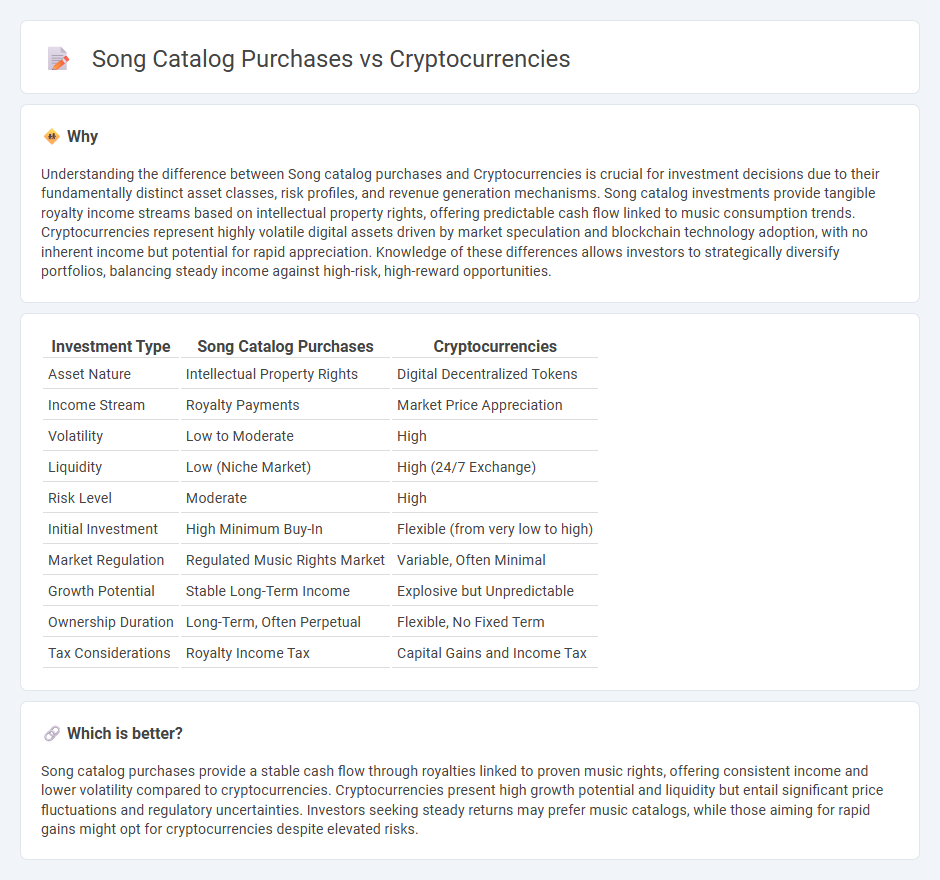

Understanding the difference between Song catalog purchases and Cryptocurrencies is crucial for investment decisions due to their fundamentally distinct asset classes, risk profiles, and revenue generation mechanisms. Song catalog investments provide tangible royalty income streams based on intellectual property rights, offering predictable cash flow linked to music consumption trends. Cryptocurrencies represent highly volatile digital assets driven by market speculation and blockchain technology adoption, with no inherent income but potential for rapid appreciation. Knowledge of these differences allows investors to strategically diversify portfolios, balancing steady income against high-risk, high-reward opportunities.

Comparison Table

| Investment Type | Song Catalog Purchases | Cryptocurrencies |

|---|---|---|

| Asset Nature | Intellectual Property Rights | Digital Decentralized Tokens |

| Income Stream | Royalty Payments | Market Price Appreciation |

| Volatility | Low to Moderate | High |

| Liquidity | Low (Niche Market) | High (24/7 Exchange) |

| Risk Level | Moderate | High |

| Initial Investment | High Minimum Buy-In | Flexible (from very low to high) |

| Market Regulation | Regulated Music Rights Market | Variable, Often Minimal |

| Growth Potential | Stable Long-Term Income | Explosive but Unpredictable |

| Ownership Duration | Long-Term, Often Perpetual | Flexible, No Fixed Term |

| Tax Considerations | Royalty Income Tax | Capital Gains and Income Tax |

Which is better?

Song catalog purchases provide a stable cash flow through royalties linked to proven music rights, offering consistent income and lower volatility compared to cryptocurrencies. Cryptocurrencies present high growth potential and liquidity but entail significant price fluctuations and regulatory uncertainties. Investors seeking steady returns may prefer music catalogs, while those aiming for rapid gains might opt for cryptocurrencies despite elevated risks.

Connection

Investment in song catalogs and cryptocurrencies reflects a growing trend toward alternative asset diversification, where intellectual property rights and digital currencies offer unique revenue streams and market opportunities. Song catalog purchases provide investors with steady royalty income linked to music consumption trends, while cryptocurrencies present high volatility but potential for substantial returns through blockchain innovation. Both asset classes attract investors seeking non-traditional growth avenues and the chance to capitalize on emerging digital economies.

Key Terms

Volatility

Cryptocurrencies exhibit extreme volatility with price swings often exceeding 10% daily, driven by market sentiment, regulatory news, and technological advancements. In contrast, song catalog purchases offer more stable, long-term revenue streams linked to royalties and licensing fees, making them less susceptible to short-term market fluctuations. Explore further to understand how these asset classes compare in risk and investment strategy.

Intellectual Property Rights

Cryptocurrencies offer decentralized ownership and secure transaction verification through blockchain technology, which contrasts with traditional song catalog purchases that involve acquiring intellectual property rights under established copyright laws. Song catalog acquisitions grant buyers legal control over royalties and licensing, providing a tangible asset with predictable revenue streams, unlike the volatility seen in cryptocurrency markets. Discover how these distinct approaches shape investment strategies and intellectual property management.

Liquidity

Cryptocurrencies offer high liquidity through 24/7 decentralized exchanges, enabling rapid buying and selling compared to song catalog purchases, which are typically less liquid and involve lengthy negotiations or contractual transfers. Song catalogs provide stable, long-term royalty income but require considerable time and transaction costs to liquidate, limiting immediate cash flow. Explore deeper insights into liquidity dynamics between digital assets and music rights investments.

Source and External Links

What is Cryptocurrency and How Does it Work? - Kaspersky - Cryptocurrency is a digital payment system that uses cryptography to secure transactions and operates on a decentralized network, eliminating the need for banks to verify exchanges.

Cryptocurrency - Wikipedia - Cryptocurrency is a digital currency that operates independently of any central authority, using a blockchain ledger to record transactions, with thousands of distinct coins existing since Bitcoin's 2009 debut.

Cryptocurrencies: What Are They? - Charles Schwab - Cryptocurrency is a digital currency that functions as a medium for internet-based payments or a store of value, built on blockchain technology to maintain a secure, unalterable public ledger of transactions.

dowidth.com

dowidth.com