Sports memorabilia funds offer investors exposure to rare collectibles linked to iconic athletes, often benefiting from growing fan engagement and historical significance. Art investment funds focus on acquiring and managing high-value artworks, leveraging market trends and expert curation to enhance asset appreciation. Explore the unique dynamics and potential returns of these alternative investment options to diversify your portfolio.

Why it is important

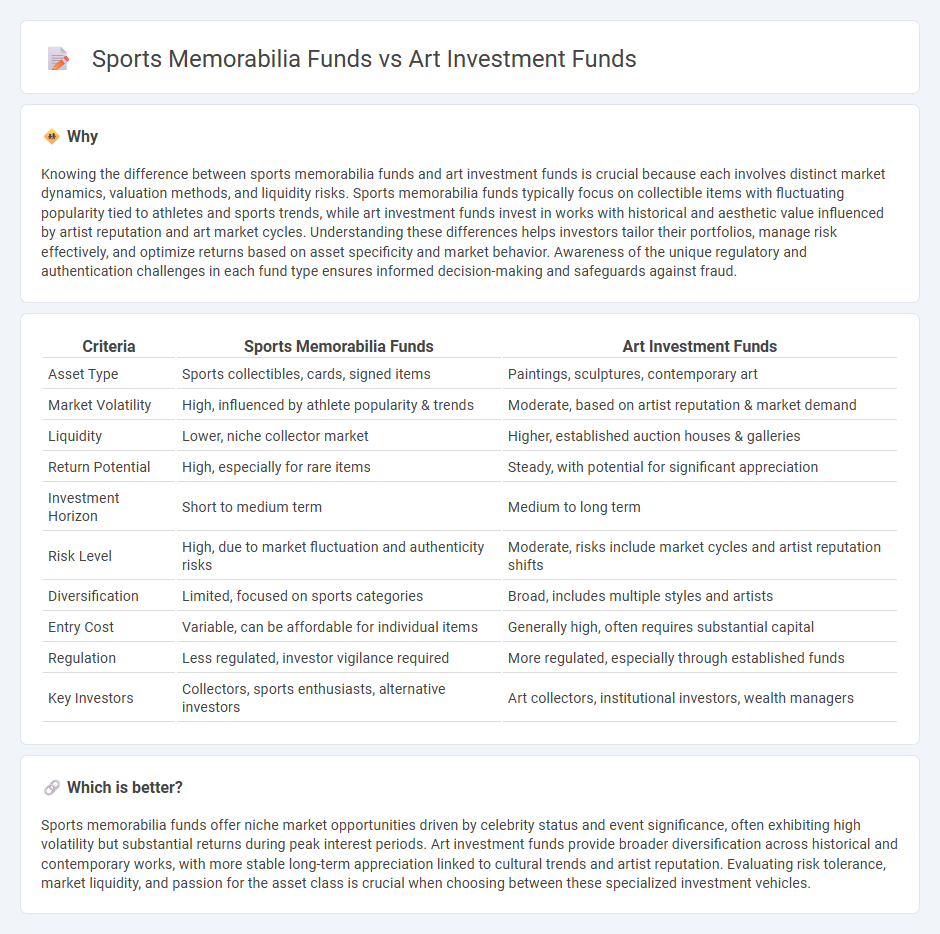

Knowing the difference between sports memorabilia funds and art investment funds is crucial because each involves distinct market dynamics, valuation methods, and liquidity risks. Sports memorabilia funds typically focus on collectible items with fluctuating popularity tied to athletes and sports trends, while art investment funds invest in works with historical and aesthetic value influenced by artist reputation and art market cycles. Understanding these differences helps investors tailor their portfolios, manage risk effectively, and optimize returns based on asset specificity and market behavior. Awareness of the unique regulatory and authentication challenges in each fund type ensures informed decision-making and safeguards against fraud.

Comparison Table

| Criteria | Sports Memorabilia Funds | Art Investment Funds |

|---|---|---|

| Asset Type | Sports collectibles, cards, signed items | Paintings, sculptures, contemporary art |

| Market Volatility | High, influenced by athlete popularity & trends | Moderate, based on artist reputation & market demand |

| Liquidity | Lower, niche collector market | Higher, established auction houses & galleries |

| Return Potential | High, especially for rare items | Steady, with potential for significant appreciation |

| Investment Horizon | Short to medium term | Medium to long term |

| Risk Level | High, due to market fluctuation and authenticity risks | Moderate, risks include market cycles and artist reputation shifts |

| Diversification | Limited, focused on sports categories | Broad, includes multiple styles and artists |

| Entry Cost | Variable, can be affordable for individual items | Generally high, often requires substantial capital |

| Regulation | Less regulated, investor vigilance required | More regulated, especially through established funds |

| Key Investors | Collectors, sports enthusiasts, alternative investors | Art collectors, institutional investors, wealth managers |

Which is better?

Sports memorabilia funds offer niche market opportunities driven by celebrity status and event significance, often exhibiting high volatility but substantial returns during peak interest periods. Art investment funds provide broader diversification across historical and contemporary works, with more stable long-term appreciation linked to cultural trends and artist reputation. Evaluating risk tolerance, market liquidity, and passion for the asset class is crucial when choosing between these specialized investment vehicles.

Connection

Sports memorabilia funds and art investment funds both capitalize on the growing market of tangible collectibles, leveraging rarity and cultural significance to drive asset appreciation. They attract investors seeking alternative assets with potential for high returns outside traditional stocks and bonds, emphasizing provenance and authenticity to establish value. The connection lies in their shared focus on niche markets where expert appraisal and market trends heavily influence investment performance.

Key Terms

**Art Investment Funds:**

Art investment funds pool capital to acquire valuable artworks, offering portfolio diversification and potential for high returns driven by the art market's appreciation. These funds often include works by established artists, providing both aesthetic and monetary value, with valuations influenced by provenance, rarity, and market trends. Discover more about how art investment funds can enhance your asset allocation strategy.

Provenance

Art investment funds prioritize provenance through detailed documentation and historical ownership records, ensuring authenticity and value retention in high-value artworks. Sports memorabilia funds emphasize provenance by verifying signed items, game-used artifacts, and reliable chain of custody to prevent counterfeits and maintain market trust. Discover more about how provenance impacts the financial and collectible value in these niche investment arenas.

Valuation

Art investment funds rely on expert appraisals, auction results, and provenance to determine the value of artworks, often reflecting market trends and artist reputation. Sports memorabilia funds assess valuation based on rarity, athlete significance, authentication, and historical context, with prices influenced by memorabilia condition and recent sales of comparable items. Explore deeper insights into valuation techniques and market dynamics by learning more about these specialized investment funds.

Source and External Links

Basics of Art Funds and their Managers - Provides an overview of art investment funds, including strategies like "buy and hold," geographic arbitrage, and emerging artists.

Art Investment Opportunities: A Guide - Discusses art funds as a traditional investment method where multiple investors pool resources to manage a collection of artworks.

Strategic or Speculative? - Examines the rise of art investment funds, highlighting strategies by funds like Fine Art Group and Arte Collectum.

dowidth.com

dowidth.com