Sneaker flipping involves buying limited-edition or high-demand sneakers and reselling them at a higher price, leveraging market trends and brand collaborations for profit. Cryptocurrency investing focuses on purchasing digital assets like Bitcoin or Ethereum, capitalizing on price volatility and blockchain technology innovations to generate returns. Explore the advantages and risks of both investment strategies to determine which aligns best with your financial goals.

Why it is important

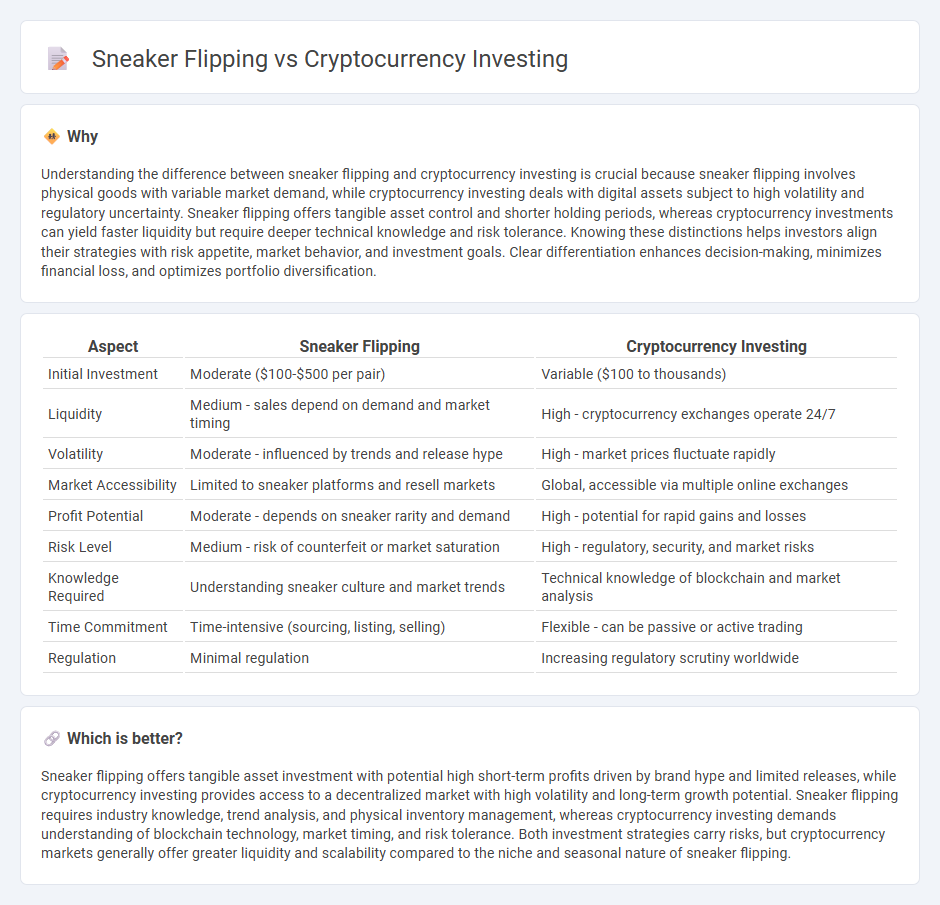

Understanding the difference between sneaker flipping and cryptocurrency investing is crucial because sneaker flipping involves physical goods with variable market demand, while cryptocurrency investing deals with digital assets subject to high volatility and regulatory uncertainty. Sneaker flipping offers tangible asset control and shorter holding periods, whereas cryptocurrency investments can yield faster liquidity but require deeper technical knowledge and risk tolerance. Knowing these distinctions helps investors align their strategies with risk appetite, market behavior, and investment goals. Clear differentiation enhances decision-making, minimizes financial loss, and optimizes portfolio diversification.

Comparison Table

| Aspect | Sneaker Flipping | Cryptocurrency Investing |

|---|---|---|

| Initial Investment | Moderate ($100-$500 per pair) | Variable ($100 to thousands) |

| Liquidity | Medium - sales depend on demand and market timing | High - cryptocurrency exchanges operate 24/7 |

| Volatility | Moderate - influenced by trends and release hype | High - market prices fluctuate rapidly |

| Market Accessibility | Limited to sneaker platforms and resell markets | Global, accessible via multiple online exchanges |

| Profit Potential | Moderate - depends on sneaker rarity and demand | High - potential for rapid gains and losses |

| Risk Level | Medium - risk of counterfeit or market saturation | High - regulatory, security, and market risks |

| Knowledge Required | Understanding sneaker culture and market trends | Technical knowledge of blockchain and market analysis |

| Time Commitment | Time-intensive (sourcing, listing, selling) | Flexible - can be passive or active trading |

| Regulation | Minimal regulation | Increasing regulatory scrutiny worldwide |

Which is better?

Sneaker flipping offers tangible asset investment with potential high short-term profits driven by brand hype and limited releases, while cryptocurrency investing provides access to a decentralized market with high volatility and long-term growth potential. Sneaker flipping requires industry knowledge, trend analysis, and physical inventory management, whereas cryptocurrency investing demands understanding of blockchain technology, market timing, and risk tolerance. Both investment strategies carry risks, but cryptocurrency markets generally offer greater liquidity and scalability compared to the niche and seasonal nature of sneaker flipping.

Connection

Sneaker flipping and cryptocurrency investing both rely on market trends and demand volatility, where buyers capitalize on scarce assets to gain profit. Both markets utilize digital platforms for transactions, emphasizing timing and knowledge of asset valuation to maximize returns. Expertise in spotting undervalued sneakers or cryptocurrencies is crucial, with social media and online communities driving price fluctuations and investment opportunities.

Key Terms

Cryptocurrency investing:

Cryptocurrency investing offers high liquidity and 24/7 market access, enabling rapid portfolio adjustments compared to the slower turnover in sneaker flipping. The crypto market's volatility provides significant profit potential through assets like Bitcoin and Ethereum, whereas sneaker flipping depends heavily on limited releases and brand desirability. Explore detailed strategies and market insights to maximize your returns in cryptocurrency investing.

Blockchain

Cryptocurrency investing leverages blockchain technology to ensure transparent, secure, and decentralized transactions, creating value through digital assets like Bitcoin and Ethereum. Sneaker flipping relies on limited-edition releases and market demand but lacks the trustless verification and immutable records inherent in blockchain systems. Explore how blockchain transforms asset ownership and investment strategies beyond traditional markets.

Volatility

Cryptocurrency investing exhibits high volatility with price swings often exceeding 10% daily, driven by market speculation and regulatory news, whereas sneaker flipping experiences more predictable fluctuations based on limited releases and brand collaborations. The crypto market's 24/7 trading environment contrasts with sneaker resale cycles influenced by seasonal drops and consumer trends. Explore more to understand how volatility impacts profitability in both markets.

Source and External Links

What is Cryptocurrency and How Does it Work? - Kaspersky - Cryptocurrency investing involves significant risks; experts suggest researching exchanges, choosing secure wallets, diversifying investments, and preparing for market volatility to invest safely in this highly speculative asset class.

Cryptocurrency Investments: ETFs, Stocks & Futures | E*TRADE - Investors can gain exposure to cryptocurrencies indirectly via ETFs, ETPs, coin trusts, and futures on brokerage platforms without holding the actual digital assets or wallets.

Cryptocurrency Investment Types - Charles Schwab - Crypto investing options include spot bitcoin and ether funds, crypto-related stocks, ETFs, mutual funds, futures, and coin trusts all available through a traditional brokerage account with no wallet required.

dowidth.com

dowidth.com