Royalty streaming involves investors providing capital to artists or companies in exchange for a percentage of future revenues, offering a predictable income stream tied to the success of the asset. Crowdfunding pools small investments from a large audience to finance projects, typically without direct financial returns but with rewards or early access incentives. Explore how these diverse investment methods can align with your financial goals.

Why it is important

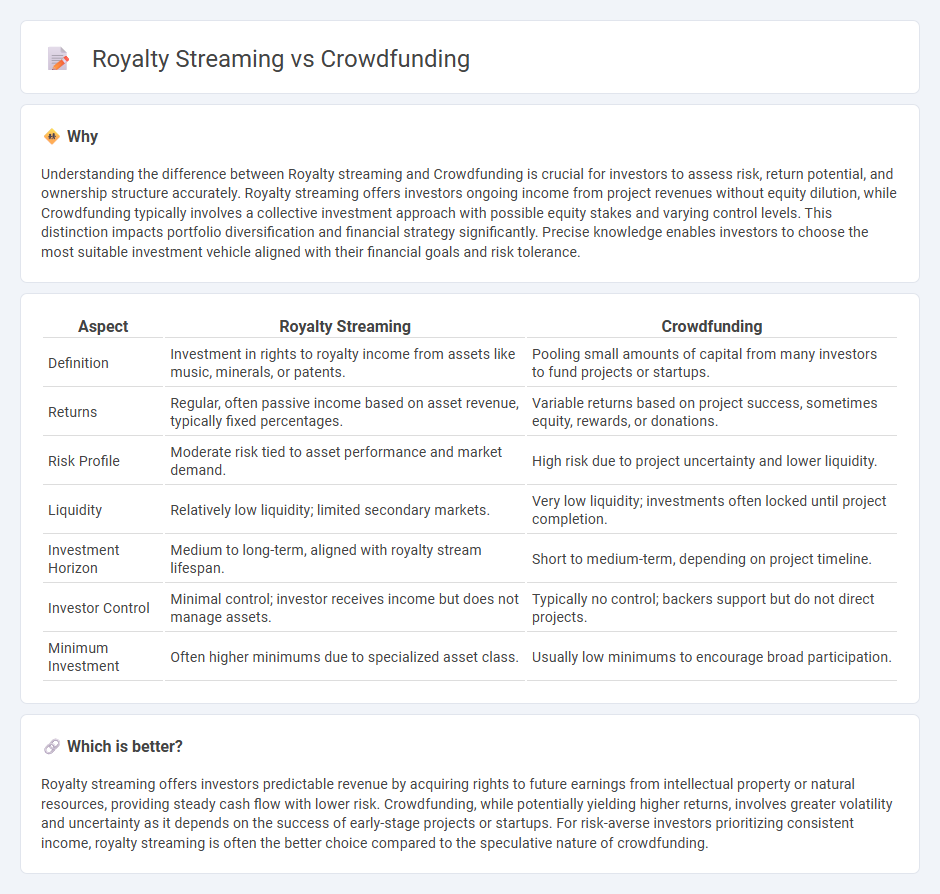

Understanding the difference between Royalty streaming and Crowdfunding is crucial for investors to assess risk, return potential, and ownership structure accurately. Royalty streaming offers investors ongoing income from project revenues without equity dilution, while Crowdfunding typically involves a collective investment approach with possible equity stakes and varying control levels. This distinction impacts portfolio diversification and financial strategy significantly. Precise knowledge enables investors to choose the most suitable investment vehicle aligned with their financial goals and risk tolerance.

Comparison Table

| Aspect | Royalty Streaming | Crowdfunding |

|---|---|---|

| Definition | Investment in rights to royalty income from assets like music, minerals, or patents. | Pooling small amounts of capital from many investors to fund projects or startups. |

| Returns | Regular, often passive income based on asset revenue, typically fixed percentages. | Variable returns based on project success, sometimes equity, rewards, or donations. |

| Risk Profile | Moderate risk tied to asset performance and market demand. | High risk due to project uncertainty and lower liquidity. |

| Liquidity | Relatively low liquidity; limited secondary markets. | Very low liquidity; investments often locked until project completion. |

| Investment Horizon | Medium to long-term, aligned with royalty stream lifespan. | Short to medium-term, depending on project timeline. |

| Investor Control | Minimal control; investor receives income but does not manage assets. | Typically no control; backers support but do not direct projects. |

| Minimum Investment | Often higher minimums due to specialized asset class. | Usually low minimums to encourage broad participation. |

Which is better?

Royalty streaming offers investors predictable revenue by acquiring rights to future earnings from intellectual property or natural resources, providing steady cash flow with lower risk. Crowdfunding, while potentially yielding higher returns, involves greater volatility and uncertainty as it depends on the success of early-stage projects or startups. For risk-averse investors prioritizing consistent income, royalty streaming is often the better choice compared to the speculative nature of crowdfunding.

Connection

Royalty streaming and crowdfunding are connected through their roles in alternative investment strategies, allowing investors to fund projects while receiving revenue shares or equity in return. Royalty streaming offers predictable cash flows by granting rights to a percentage of future revenues, often in industries like mining or entertainment. Crowdfunding leverages a large pool of small investors to finance ventures, creating opportunities for diversified portfolios that include royalty-based returns.

Key Terms

Equity

Crowdfunding enables investors to acquire equity stakes by pooling capital in startups, offering direct ownership and potential dividends tied to company performance. Royalty streaming provides investors with revenue-based returns from intellectual property or future sales without transferring equity or voting rights. Explore these financial models to determine the best strategy for equity participation and investment goals.

Revenue Share

Revenue share models in crowdfunding allow backers to receive a percentage of profits proportional to their investment, aligning investor and project success. Royalty streaming provides investors with ongoing income based on a fixed percentage of revenue generated by a project or asset, ensuring continuous cash flow. Explore detailed comparisons of revenue share dynamics to optimize your investment strategy.

Platform

Crowdfunding platforms enable creators to raise funds directly from supporters by offering rewards or equity, fostering community engagement and upfront capital generation. Royalty streaming platforms provide investors with ongoing revenue shares from future earnings of artists or ventures, emphasizing passive income and long-term financial returns. Explore the strengths and unique features of each platform to determine the best fit for your investment or funding goals.

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet, bypassing traditional financial intermediaries.

What is crowdfunding? Here are four types for startups to know - Stripe - Crowdfunding allows entrepreneurs to raise money from a broad network of individuals online, offering an alternative to traditional financing by pooling small contributions from many supporters.

Crowdfunding - Small Business Financing: A Resource Guide - Crowdfunding uses online platforms to collect small amounts from many people, with models including donation-based, reward-based, and equity-based funding, each offering different incentives for contributors.

dowidth.com

dowidth.com