Song catalog purchases provide a steady stream of royalty income, with examples like Bob Dylan's catalog fetching hundreds of millions, attracting investors seeking long-term revenue. Antique instruments, such as Stradivarius violins, appreciate over time and combine cultural value with investment potential, often exceeding auction prices for rare collectibles. Explore the benefits and risks of these unique investment opportunities to determine which aligns best with your portfolio goals.

Why it is important

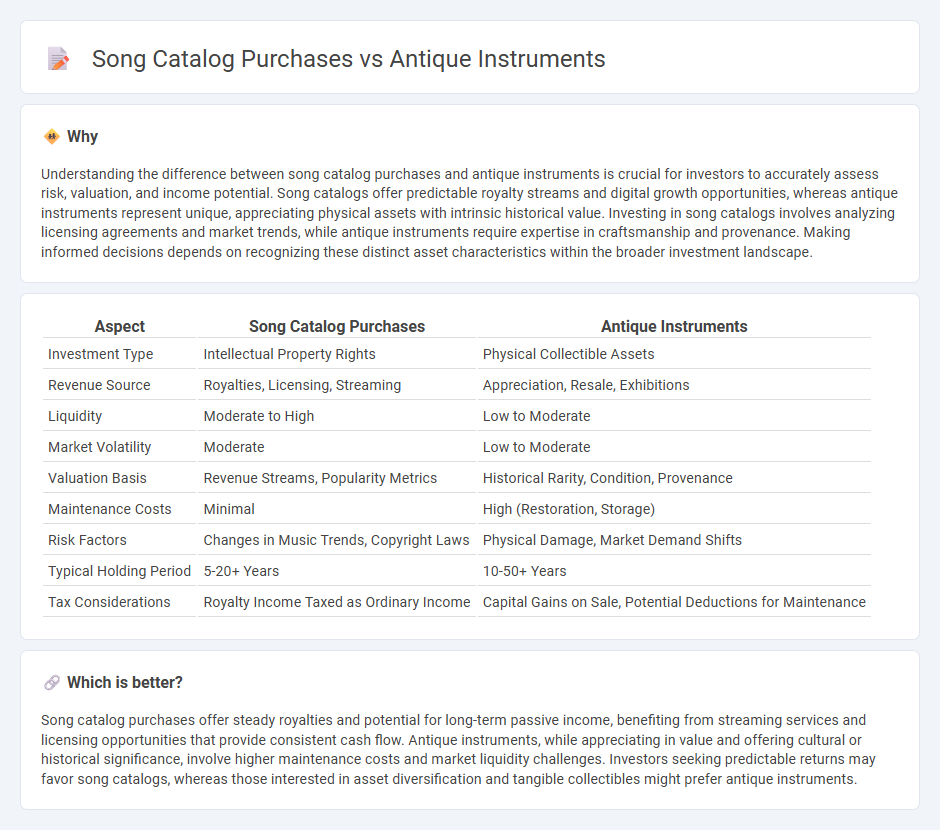

Understanding the difference between song catalog purchases and antique instruments is crucial for investors to accurately assess risk, valuation, and income potential. Song catalogs offer predictable royalty streams and digital growth opportunities, whereas antique instruments represent unique, appreciating physical assets with intrinsic historical value. Investing in song catalogs involves analyzing licensing agreements and market trends, while antique instruments require expertise in craftsmanship and provenance. Making informed decisions depends on recognizing these distinct asset characteristics within the broader investment landscape.

Comparison Table

| Aspect | Song Catalog Purchases | Antique Instruments |

|---|---|---|

| Investment Type | Intellectual Property Rights | Physical Collectible Assets |

| Revenue Source | Royalties, Licensing, Streaming | Appreciation, Resale, Exhibitions |

| Liquidity | Moderate to High | Low to Moderate |

| Market Volatility | Moderate | Low to Moderate |

| Valuation Basis | Revenue Streams, Popularity Metrics | Historical Rarity, Condition, Provenance |

| Maintenance Costs | Minimal | High (Restoration, Storage) |

| Risk Factors | Changes in Music Trends, Copyright Laws | Physical Damage, Market Demand Shifts |

| Typical Holding Period | 5-20+ Years | 10-50+ Years |

| Tax Considerations | Royalty Income Taxed as Ordinary Income | Capital Gains on Sale, Potential Deductions for Maintenance |

Which is better?

Song catalog purchases offer steady royalties and potential for long-term passive income, benefiting from streaming services and licensing opportunities that provide consistent cash flow. Antique instruments, while appreciating in value and offering cultural or historical significance, involve higher maintenance costs and market liquidity challenges. Investors seeking predictable returns may favor song catalogs, whereas those interested in asset diversification and tangible collectibles might prefer antique instruments.

Connection

Song catalog purchases and antique instruments both represent alternative investment opportunities that offer long-term value appreciation through cultural asset ownership. Investing in song catalogs generates revenue from royalties and streaming, while antique instruments appreciate due to rarity, craftsmanship, and historical significance. These assets diversify portfolios by combining income-generating music rights with tangible, collectible musical instruments.

Key Terms

Asset Valuation

Antique instrument valuation hinges on rarity, historical significance, and physical condition, often appreciating due to unique craftsmanship and provenance. In contrast, song catalog purchases derive value from consistent royalty streams, licensing potential, and market trends in music consumption. Explore the intricacies of asset valuation strategies in both markets to optimize investment decisions.

Provenance

Provenance plays a crucial role in the valuation of antique instruments, as documented history and past ownership significantly enhance authenticity and market value. In song catalog purchases, provenance involves assessing original rights documentation and previous royalty streams to confirm legitimacy and expected returns. Explore how verified provenance impacts strategic acquisitions in music assets by learning more.

Royalties

Antique instruments often appreciate in value over time, serving as tangible assets, whereas song catalog purchases generate steady revenue through ongoing royalty payments from various media usages. Investing in song catalogs offers predictable cash flow linked to performance, mechanical, and synchronization royalties, making them attractive for income-driven portfolios. Explore the nuances of royalty streams and asset appreciation to determine the best strategy for your investment goals.

Source and External Links

List of period instruments - Comprehensive overview of historical European instruments used in Renaissance and Baroque music, including strings like the viol and theorbo, woodwinds such as the chalumeau and recorder, and early brass and keyboard instruments.

Antique Musical Instruments - Features a curated collection of rare, historic European and American instruments, including 19th-century flutes, 17th-century viols by Tielke, and miniature harps from the 18th and 19th centuries.

Vintage Band Instruments - Offers a wide selection of antique and vintage band instruments such as saxophones, clarinets, trumpets, trombones, and percussion, with decades of expertise in restoration and sales.

dowidth.com

dowidth.com