Fractional ownership allows investors to buy a portion of a high-value asset, such as real estate or collectibles, providing direct equity and potential capital appreciation. Mutual funds pool money from multiple investors to invest in a diversified portfolio managed by professionals, offering liquidity and reduced individual risk. Explore the key differences and benefits to determine which investment approach suits your financial goals best.

Why it is important

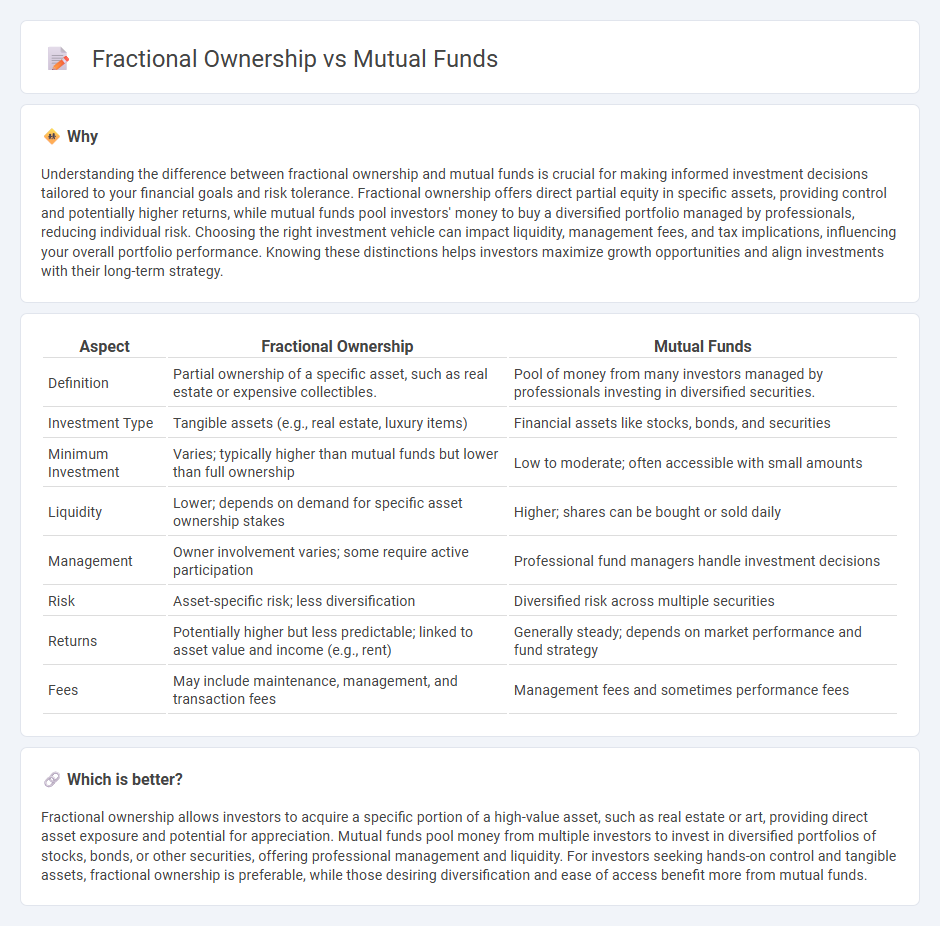

Understanding the difference between fractional ownership and mutual funds is crucial for making informed investment decisions tailored to your financial goals and risk tolerance. Fractional ownership offers direct partial equity in specific assets, providing control and potentially higher returns, while mutual funds pool investors' money to buy a diversified portfolio managed by professionals, reducing individual risk. Choosing the right investment vehicle can impact liquidity, management fees, and tax implications, influencing your overall portfolio performance. Knowing these distinctions helps investors maximize growth opportunities and align investments with their long-term strategy.

Comparison Table

| Aspect | Fractional Ownership | Mutual Funds |

|---|---|---|

| Definition | Partial ownership of a specific asset, such as real estate or expensive collectibles. | Pool of money from many investors managed by professionals investing in diversified securities. |

| Investment Type | Tangible assets (e.g., real estate, luxury items) | Financial assets like stocks, bonds, and securities |

| Minimum Investment | Varies; typically higher than mutual funds but lower than full ownership | Low to moderate; often accessible with small amounts |

| Liquidity | Lower; depends on demand for specific asset ownership stakes | Higher; shares can be bought or sold daily |

| Management | Owner involvement varies; some require active participation | Professional fund managers handle investment decisions |

| Risk | Asset-specific risk; less diversification | Diversified risk across multiple securities |

| Returns | Potentially higher but less predictable; linked to asset value and income (e.g., rent) | Generally steady; depends on market performance and fund strategy |

| Fees | May include maintenance, management, and transaction fees | Management fees and sometimes performance fees |

Which is better?

Fractional ownership allows investors to acquire a specific portion of a high-value asset, such as real estate or art, providing direct asset exposure and potential for appreciation. Mutual funds pool money from multiple investors to invest in diversified portfolios of stocks, bonds, or other securities, offering professional management and liquidity. For investors seeking hands-on control and tangible assets, fractional ownership is preferable, while those desiring diversification and ease of access benefit more from mutual funds.

Connection

Fractional ownership allows investors to buy partial shares of expensive assets, similar to how mutual funds pool money from multiple investors to purchase a diversified portfolio of securities. Both investment methods lower entry barriers, providing access to high-value markets and enhancing diversification. Mutual funds distribute earnings proportionally, mirroring the fractional ownership model of shared returns based on investment size.

Key Terms

Diversification

Mutual funds offer diversification by pooling investors' money to buy a broad portfolio of stocks, bonds, or other securities, spreading risk across various asset classes. Fractional ownership allows investors to hold a portion of a specific asset, such as real estate or collectibles, but often lacks the built-in diversification found in mutual funds. Discover how these investment options balance risk and diversification to suit your financial goals.

Liquidity

Mutual funds offer high liquidity as investors can buy or sell shares at the end of each trading day based on the net asset value (NAV), ensuring quick access to their investment capital. Fractional ownership, particularly in real estate or luxury assets, often entails lower liquidity due to longer holding periods and limited secondary markets, making asset liquidation more time-consuming. Explore detailed comparisons to understand which investment suits your liquidity needs best.

Minimum Investment

Mutual funds typically require a minimum investment amount, which can range from $500 to $3,000 depending on the fund, whereas fractional ownership often allows investors to start with significantly lower amounts, sometimes as little as $100. This accessibility makes fractional ownership an attractive option for new investors seeking real estate or high-value asset exposure without substantial capital. Explore more to understand which investment model aligns best with your financial goals and risk tolerance.

Source and External Links

Mutual Funds | Investor.gov - A mutual fund is an SEC-registered investment company pooling money from many investors to invest in a diversified portfolio managed by professionals, offering liquidity and low minimum investments.

Mutual fund - Wikipedia - Mutual funds pool money to purchase securities, classified by investment type or management style, offering benefits like diversification, professional management, and liquidity, but also involve fees and expenses.

Understanding mutual funds - Charles Schwab - Mutual funds pool money to buy diversified investments managed by professionals, providing convenience, low costs, and access to various asset classes and investment strategies.

dowidth.com

dowidth.com